🌍 Frontier Markets News, September 19th 2025

A weekly review of key news from global growth markets

Africa

Leading candidates both claim victory in Malawi election

Both main candidates in Malawi’s presidential election have claimed victory, despite the official results not having been announced, Semafor reports. This week’s election took place at a critical time for the southern African country, which is dealing with a weakening currency, food shortages, corruption scandals and power cuts that have left many citizens disillusioned with political promises.

Incumbent President Lazarus Chakwera of the ruling Malawi Congress Party is seeking a renewed mandate, but faced a strong challenge from former president Peter Mutharika’s Democratic Progressive Party and other smaller parties hoping to capture disaffected youth and urban voters. With nearly half the electorate under 35, the youth vote could prove decisive.

The Malawi Electoral Commission pledged a transparent process and said on Friday that it was resisting pressure to prematurely release the results. The commission was widely derided after the previous election in 2019 in which the initial result was overturned because of concerns over the vote’s integrity.

Islamists block key Mali transport route

Al-Qaeda affiliate JNIM has imposed a fuel blockade on Mali’s western corridor, disrupting fuel deliveries on a crucial supply route for the landlocked country, the BBC reports. Militants have reportedly been setting fire to convoys in the gold-rich Kayes region, marking an escalation from hit-and-run raids to coordinated economic warfare.

According to Reuters and AP up to 100 fuel trucks have been destroyed in recent days.

The blockade poses an existential threat to Mali’s military government, whose legitimacy depends on maintaining basic services. The junta claims it has launched successful airstrikes against the militants, but an FMN source said field reports suggest Malian forces withdrew from a confrontation on Monday, suggesting the militants might be getting the upper hand.

Regionally, JNIM’s blockade tactics heighten risks across the new Alliance of Sahel States after Mali’s exit from ECOWAS. Fellow Alliance member Burkina Faso remains overstretched by relentless insurgent pressure and mass casualties. Senegal, while threatened by the spread of insurgent activity, has not offered military assistance outside of its borders.

Asia

Social media play key role in selecting Nepal’s leader

Less than a week after Nepal’s former leader resigned, the Himalayan nation has a new acting prime minister. Sushila Karki took office on Friday with the mandate to bring order to a country whose halls of power lie in ruin after mass protests gave way to looting.

Karki, a 73-year old former chief justice on Nepal’s Supreme Court, emerged as a favorite of the mostly young protesters, who forced out former Prime Minister K.P. Sharma Oli. In a 145,000 person chatroom on the online message board Discord, activists debated who should lead the country before settling on Karki, NDTV reports.

Karki will now face the tough task of uniting the country. More than 70 people died in the protests, Reuters reports, and issues that sparked the demonstrations—including widespread corruption—will take time to resolve. The country is set to hold elections in March.

Laos turns to crypto mining to fund dam build-out

Laos has a new plan to finance the debts it has taken on building dozens of dams over the past two decades: cryptocurrency mining.

The construction has transformed Laos into a clean-energy powerhouse, but it now has more electricity than it can sell, SCMP reports. Meanwhile, the country’s debt is now larger than its total economy. At a recent meeting, officials in Vientiane touted the ability of digital-asset mining to transform the country’s “surplus power into economic value.”

Policymakers—perhaps inspired by Bhutan’s use of crypto mining to bolster its government budget—believe they can solve both the excess capacity and debt problems at once. With the surplus electricity generated by the dams, the country can power notoriously energy-guzzling cryptocurrency mines, and use the revenue they generate to pay down the country’s debt.

Vietnam ‘confident’ of EM upgrade

Vietnamese finance minister Nguyen Van Thang said on Tuesday he is “pretty confident” that the country will be upgraded to emerging market status by index provider FTSE Russell next month. Analysts project that the upgrade would trigger up to $7 billion in inflows to Vietnam’s stock market, Reuters reports.

- Vietnam surpasses Thailand as top destination for Chinese tourists (Bloomberg)

Vietnam has made several recent moves aimed at achieving the upgrade, which it has been seeking for seven years.

On Sunday the government announced it would prevent public companies from imposing limits on foreign ownership that are lower than those set by Hanoi. In the same fell swoop it shortened the window by which companies must list their shares after receiving approval from the country’s exchange.

The new rules follow a decision last November to eliminate prefunding requirements for equity trades by overseas investors. FTSE has long asked Vietnam to ease access for foreign capital.

Middle East

Gulf states mull future of US ties

Leaders of the Gulf Cooperation Council this week agreed to activate a “regional defense mechanism“ in response to Israel’s airstrike on Doha, Qatar, last week. It is the first such defense pact formed within the GCC, whose members have until now maintained strategic autonomy on foreign and national security policy.

The decision followed an emergency meeting of Arab leaders in Doha, and is the only concrete response to the attack beyond diplomatic condemnation.

US President Donald Trump criticized Israel for the attack and invited Qatar’s Prime Minister Sheikh Mohammed bin Abdulrahman bin Jassim Al-Thani to Washington to shore up their bilateral relationship, Reuters reports.

GCC AI push gains steam with fresh foreign investment partnerships

Saudi Arabia and Oman this week lined up a range of landmark deals with foreign investors to fund startups and data centers to support the region’s AI ambitions. Omani investors agreed a $265 million deal with Egyptian investors to build a new special economic zone in the country with funding for local AI startups.

Saudi Arabia’s national AI champion Humain, which signed deals earlier this month on new data center construction, is fielding interest from US private equity giants BlackRock and Blackstone, among others, for a multibillion dollar injection to fund more AI infrastructure construction in the kingdom, Bloomberg reports.

Jordan’s tourism growth a bright spot in the economy

Jordan this week reported a 7.5% year-on-year increase in tourism revenues to $5.3 billion for the first eight months of the year, Zawya reports. Spending by tourists was also up significantly, providing a much-needed injection of crucial foreign exchange earnings for a country that has pegged its currency to the US dollar.

Visitor numbers also increased by 15% in the period, with spending increases driven primarily by Asian and European tourists, up 38.4% and 30.2% respectively.

The Jordanian economy is heavily dependent on foreign exchange earnings, and must rely on services like tourism or high-level manufacturing to meet that need as it is, unlike most of its neighbors, relatively poor in natural resources such as oil and gas. The kingdom has also begun diversifying into media, with film production, especially from international filmmakers from Hollywood and Bollywood, now reportedly contributing some $500 million annually to the economy, roughly a 1% contribution to GDP.

Europe

Turkish stocks rally as court stays case against opposition leader

Turkish equities rallied more than 5% this week after a court delayed ruling on whether to annul the leadership of opposition party CHP chief Özgür Özel, the FT reports. The case, brought by a former party mayor, alleged vote-rigging at the 2023 party congress and was widely seen as a government-backed effort to fracture the opposition.

The lira strengthened on the news, but it remains down 11% this year after the arrest of Istanbul mayor Ekrem İmamoğlu, a popular challenger to President Recep Tayyip Erdoğan. That arrest triggered Turkey’s largest anti-government protests in a decade and prompted the central bank to burn through $50 billion in reserves to stabilize markets.

For investors, the stay buys time but not certainty. Erdoğan has not ruled out extending his rule beyond 2028, and his nationalist allies are pushing to abolish term limits. With opposition leaders under pressure from courts and activists facing detention, the risk premium on Turkish assets remains high, despite tactical rallies.

Poland floats option for cutting Russian energy imports to EU

Poland is urging EU states to end Russian oil imports by 2026, two years ahead of the bloc’s current deadline. Warsaw argues that imported US liquified natural gas delivered via Poland could replace remaining Russian flows and has already started supplying Ukraine. Energy minister Milosz Motyka framed the proposal as a response to drone incursions and a necessary step for European coherence.

Slovakia and Hungary are pushing back against pressure to stop using Russian gas, warning that an accelerated cutoff risks “seriously damaging” their industries. Both countries still rely heavily on oil delivered from Russia through the Druzhba pipeline and have resisted US calls for the EU to impose tighter sanctions on Russia.

Latin America

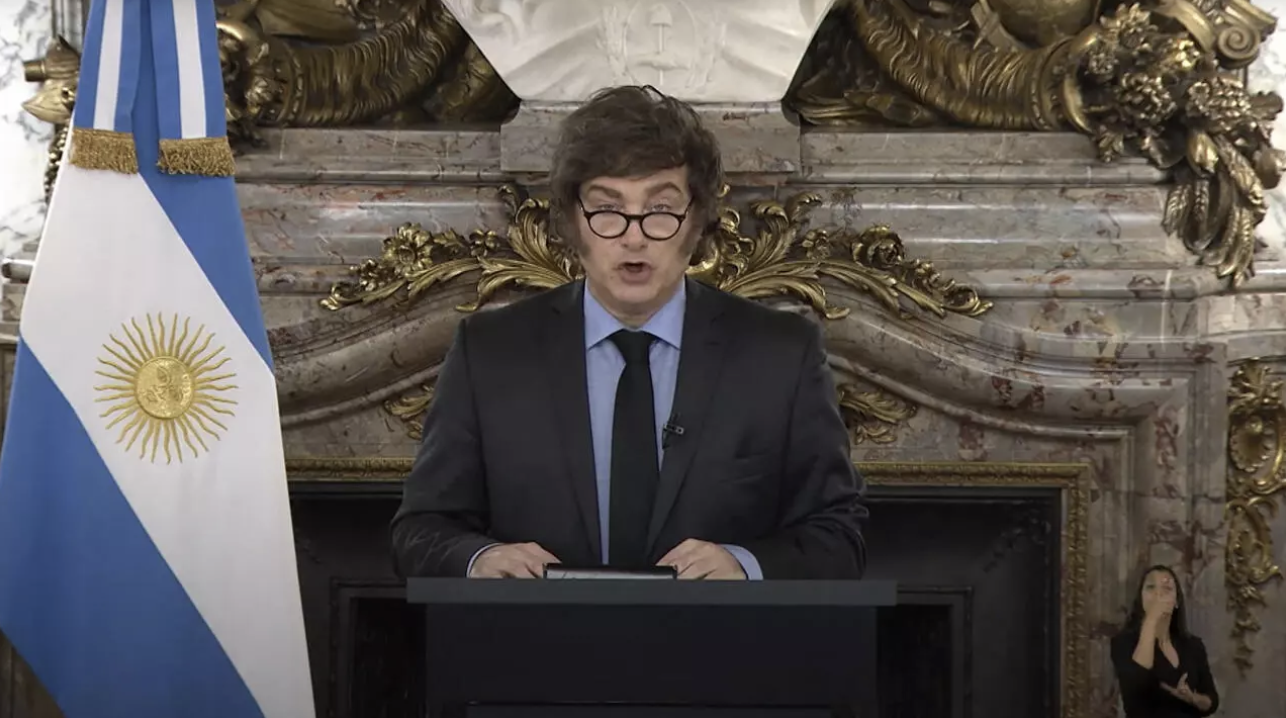

Argentina’s Milei moves to shore up popular support

Argentina’s President Javier Milei has shifted his tone after his party’s stinging defeat last week in Buenos Aires province, unveiling a 2026 budget that boosts pensions, healthcare, and education spending above inflation, France24 reports. The move comes after nearly two years of austerity that cut public jobs and investment but brought headline inflation down from 211% in 2023 to just over 30% today.

Milei framed the increases as temporary relief, insisting fiscal balance remains “non-negotiable.”

Markets remain skeptical. The peso has fallen over 6% this month, and Argentina’s bonds once again rank among emerging markets’ worst performers. The central bank is near legal limits on currency intervention, with dollar futures exposure above $7.5bn and reserves running low. Analysts warn the adjustment buys only weeks of stability, not months.

US strains ties with Colombia over cocaine traffic

The US has for the first time since 1997 “decertified“ Colombia as a partner in anti-narcotics cooperation, citing record cocaine output, the FT reports. President Donald Trump’s designation faults President Gustavo Petro for failing to meet eradication targets, although it also granted waivers to preserve some military programs.

Petro responded by halting all future US arms purchases and accusing Washington of interfering in Colombia’s sovereignty. Bogotá has already sought alternatives, including a fleet of Swedish fighter jets, although past pledges to cut Israeli imports limit its options.

The rupture underscores how Petro’s “Total Peace” strategy has left drug flows undiminished while straining ties with Washington, long Bogotá’s top security backer.

LatAm rides out tariff shock

Six months into US President Donald Trump’s sweeping tariff regime, Latin America has absorbed the shockbetter than many expected—an outcome this newsletter forecast in April. IMF projections for 2025 growth in Brazil, Mexico, and the region as a whole have been revised upward since April, reflecting resilience and new trade openings.

Countries less exposed to US supply chains are benefiting from diversion of demand away from China and Mexico, America’s Quarterly argues.

- Mercosur, EFTA states Iceland, Liechtenstein, Norway and Switzerland) sign FTA (Mercopress)

Mexico remains the most vulnerable, with its auto sector squeezed by a 25% universal tariff and stricter rules of origin. President Claudia Sheinbaum is negotiating exemptions in exchange for a crackdown on Asian exports rerouting through Mexico.

Brazil has fared better, with exemptions shielding two-thirds of exports, although beef and coffee face higher rates. Across the region, the new trade geography recalls 2018–19, when China’s retaliation against the US boosted South American soy and meat exports.

What We’re Reading

Ghana delivers another larger-than-expected rate cut (MSN)

Ghana invests $1.2bn in infrastructure to boost growth (Semafor)

Ghanaian banks to reduce NPL ratios (Fitch Ratings)

Liberia awards TotalEnergies four offshore exploration permits (Hart Energy)

‘The hungry can’t stay silent.’ Behind deadly protests in Angola (BBC)

Angola surprises with first rate cut since 2023 as CPI cools (Bloomberg)

Zimbabwe signs $455mn deal to rehabilitate Hwange thermal power plant (AfricaMiningMarket)

South African banks’ sovereign exposure continues to grow (Fitch Raitings)

Egypt signs $121mn oil and gas exploration deals (Reuters)

Libya government reaches agreement with armed group (Barron’s)

‘Neoliberal orthodoxy undermines democracy’ in Africa (The Africa Report)

Sub-Saharan Africa’s major economies hit by high finance costs (Reuters)

Sri Lanka gets $500mn boost from China to build highways (Reuters)

Pakistan flooding’s $1bn damage to crops threatens food security (Nikkei)

Saudi Arabia inks defense pact with Pakistan (FT)

EU and Indonesia agree trade deal (FT)

Indonesia hands SOEs to new sovereign wealth fund (Nikkei)

Indonesia announces $1bn stimulus package (Bloomberg)

Japan to aid Papua’s disaster preparedness, countering China influence (Nikkei)

Syria’s quest to build its own Silicon Valley (Rest of World)

Oman fertilizer firm ‘preparing for Muscat IPO’ (Bloomberg)

Saudi bonds to join benchmark index in 2026 (AGBI)

Saudi Aramco sells $3bn in foreign currency Islamic bonds (Reuters)

Saudi and Omani firms invest to boost Iraq’s private sector (Semafor)

TotalEnergies launches final phase of $27bn Iraq energy project (Reuters)

Romanian presidential candidate charged with plotting coup (BBC)

Bolivian presidential hopeful plans $4bn economic rescue plan (Bloomberg)

Argentina to privatize 44% of state nuclear power company (Buenos Aires Herald)

We are committed to providing FMN readers with a free weekly digest of politically unbiased, succinct and clear news and information from frontier and small emerging markets.

Please consider becoming a paid supporter to help cover some of our costs and support our continued development of sharp markets-focused coverage and new informational products. Paid subscribers will also gain exclusive access to our quarterly EM/FM report that aggregates EM insights from 25 major banks, international institutions and consultancies.