🌍 Frontier Markets News, October 3rd 2025

A weekly review of key news from global growth markets

Africa

Youth-led protests sweep across Morocco and Madagascar

Scores of people were injured in Morocco this week after online protests over corruption and inequality spilled onto the streets, AP reports. The youth-driven uprising appeared to crystallize around Gen-Z frustrations over governance, services and opportunity in the North African country.

The demonstrations were initially peaceful, but reportedly turned violent in a number of cities after aggressive moves by authorities to contain them. Hundreds of people have been arrested and two people were killed in clashes with security forces, Al Jazeera reports.

The demonstrations mirror a movement in Madagascar, where protests that began on September 25 over crushing water and electricity shortages rapidly scaled into a nationwide youth movement pressing for President Andry Rajoelina’s resignation. The president responded by dissolving his government, but demonstrators remained in the streets with local leaders showing support.

Exporters face uncertain future after AGOA expiry

African exporters are bracing for a sharp rise in costs after the US pact easing import duties, The African Growth and Opportunity Act (AGOA), expired this week, CNN reports.

The lapsing of the agreement brings to an immediate end duty-free access to the US market for 32 sub-Saharan exporters, Ecofin Agency reports. The hit lands on top of sweeping 10-30% US tariff hikes announced in April, further eroding price competitiveness with Asian competitors.

With the demise of AGOA looming, many African nations had already been deepening their trading relationships with other nations, DW reports. And, according to a report by UNCTAD, the real impact on exporters might be less severe than first feared. Exporters of mined commodities, fuels, and raw materials, such as Senegal and Angola will face the smallest impacts, the report said. Exporters in countries such as Kenya and Madagascar, which are further up the value chain in textiles, apparel, and light manufacturing, will face more severe disruption.

The White House has signaled it’s open to a one-year stopgap renewal, but extending AGOA would require Congress to reauthorize the program, Reuters reports.

Ethiopia moves to restructure last of defaulted debt

Nearly two years after it failed to pay a coupon on a $1 billion Eurobond, Ethiopia has opened restructuring talks with private bondholders, Addis Insight reports. The move follows a July agreement with bilateral lenders including China and France to restructure $8.4 billion in international debt. That deal provided more than $3.5 billion in debt relief.

The private bondholders previously refused to accept Ethiopia’s proposal of an 18-20% haircut, arguing that the official debt restructuring undervalued the country’s exports, and therefore underestimated Ethiopia’s ability to pay its debts.

Ethiopia’s economic picture is mixed. Inflation has eased to 13.6% from 17.5% a year ago and policy remains restrictive, but foreign-exchange reserves are still thin at roughly 1.6 months of import cover. The country is also pushing for more investment, most recently signing an agreement with Russia’s Rosatom for a new nuclear plant.

Asia

Vietnam boosts incentives for domestic manufacturers

Vietnam is helping domestic suppliers finance the cost of equipment and training as it seeks to become less dependent on inputs or components from China, Nikkei reports. To help strengthen local supply chains, the government is offering to cover half of a company’s research and software costs and 70% of set-up costs such as brand registration and consulting, as long as firms commit to producing inputs for other goods, Nikkei reports.

The subsidies are also part of a growing national self-sufficiency push, which included this week an effort by the government to encourage Vietnamese people to buy Vietnam-made products. The country’s Prime Minister Phạm Minh Chính also urged the hospitality sector to work harder to promote domestic tourism.

Kyrgyzstan sees investment boom

Investment in Kyrgyzstan has been rising strongly this year, in part driven by strategic funding from government ministries, The Times of Central Asia reports. The hospitality, food service and manufacturing industries each saw domestic investment double between January and July.

While the economy grew more than 11% year-on-year over the same timespan, investment surged by some 30%, according to the Eurasian Development Bank. The Central Asian country is seeking to grow its industrial and transportation sectors.

Kyrgyzstan is also increasingly becoming a hotbed for Chinese investment. China now contributes a quarter of foreign investment into Kyrgyzstan, in addition to owning more than a third of its debt.

Some officials are beginning to show frustration with the arrangement. In a recent social media post, Duishenbek Kamchibekov, chairman of the Kyrgyz Association of Geologists and Mining Engineers, suggested the country had given China too much from a recent discovery of a rare-earths deposit, bne IntelliNews reports.

Georgia’s ruling party faces test of power in local vote

Georgians will take to the polls in local elections tomorrow for the first time since a contentious parliamentary vote last year led to mass protests, France24 reports. The ruling Georgian Dream party has consolidated power over the past decade. Observers say since 2022 it has pushed the small Caucasus country closer to Russia, and rights groups add it has jailed dozens of activists and journalists.

The ruling party’s current approval rating is around 35%.

Analysts expect Georgian Dream to maintain its sway over the country, however, in part because the local elected bodies have only limited power. There is also concern that the election will not be free, as independent watchdogs have been silenced, opposition parties are divided, and oversight has been left to the Georgian Dream itself, the Organized Crime and Corruption Reporting Project reports.

Middle East

Investors cheer Kuwait’s return to sovereign bond market

Kuwait this week made a long-anticipated return to international capital markets, raising $11.25 billion from dollar denominated bonds issued in tranches of three, five and 10 year increments, Bloomberg reports. Kuwait’s first international bond issuance since 2017 saw strong investor demand, with orders topping $27.7 billion, helping the bonds achieve a price 35 basis points below initial expectations. They are widely expected to be rated in the A+/AA range.

The deal was initially discussed earlier this summer, with reports that Kuwait had tapped advisors for a potential $6 billion sale. The higher size suggests market confidence in Kuwait’s growth potential as it puts into action a plan to diversify its economy away from overreliance on oil exports.

- Bahrain joins sovereign debt rush to ease pain from low oil prices (Zawya)

A dramatic political reshuffle in 2024, which saw the country’s Emir dissolve parliament and suspend parts of the constitution to overcome a budgetary impasse, likely made the deal possible. The new government passed a landmark “Financing and Liquidity Law” in March.

Lebanon pushes to grow renewable energy capacity

Lebanon this week launched a national plan to boost renewable energy with support from the UK government, as part of a series of steps to secure its energy supply and improve its power grid. Under the new strategy, which aims to increase renewables to 55% of Lebanon’s energy mix, the UK will provide financial and technical support to Lebanon mirroring an agreement signed in April with the World Bank for a $250 million loan and assistance package.

- Lebanon signs contracts for 15MW in solar capacity (Attaqa)

Solving Lebanon’s energy sector woes is a critical component of the broader effort underway to reconstruct its damaged economy, as it has for years relied on costly imports from historically unreliable partners such as Syria and Russia.

The formal energy mix in Lebanon has been overwhelmingly dominated by fossil fuel, but the economic crisis since 2020 has seen a remarkable shift in power generation capacity. From 2021-2024 Lebanon saw a tenfold increase in off-grid solar generation to some 1,300 megawatts of capacity, the Century Foundation reports.

Europe

Russian campaign fails to swing Moldova’s parliamentary election

The incumbent Party of Action and Solidarity (PAS) won 55 of 101 seats in Moldova’s parliamentary election despite a widespread Russian influence campaign, which included vote buying and cyberattacks on electoral systems, Politico reports. The pro-Russian Patriot Bloc party won just 25% of parliamentary seats.

The Russian campaign caused concern across the continent, as Moldova is currently in line to join the EU by 2030 and a pro-Russian government would almost certainly have derailed that. Immediately after the election, Deputy Prime Minister Cristina Gherasimov urged the EU to accelerate the accession process, the BBC reports.

Russia’s efforts to sway the election result also included training groups of men to foment violence and to break through police lines, the BBC reports. But fears that the election result would prompt violence across the country have so far proved unfounded.

Bosnian Serb leader steps down ahead of November election

After months of threatening secession of the Republika Srpska from Bosnia and Herzegovina the president of the independent region Milarod Dodik stepped down this week and nominated his close ally Sinisa Karan as his party’s candidate in this November’s presidential election, DW reports.

Dodik has long been dogged by corruption allegations and in February he was charged with disobeying rulings by the body enforcing the Dayton Peace agreement of 1995, which ended the Bosnian war. In August Dodik was stripped of his presidency and banned from office for six years, but refused to step down.

While Bosnia and Herzegovina’s economy has been growing, the Republika Srpska’s has struggled, in part because corrupt officials have exploited public utilities and other institutions, DW reports. It has also seen a sharp drop in population, which has plunged from 1.5 million in 1995 to 700,000 today.

Latin America

Argentine assets sell off as US deal looks shaky

Argentina’s peso and bonds slumped again this week as investors doubted the government’s ability to stabilize markets ahead of the October 26 midterms. The peso dropped nearly 7% against the dollar early in the week despite new central bank intervention, while benchmark 2035 bonds dropped to 70 cents on the dollar. Traders say reserves are being drained with little clarity on how long authorities can defend the currency.

- Milei restores ties with Macri after Buenos Aires defeat (Mercopress)

- Poverty in Argentina falls to lowest level since 2018 (Buenos Aires Times)

A $20 billion support plan promised by the Trump administration, which prompted a market revival last week, has run into political headwinds as well. Leaked texts from the US treasury secretary suggest farm officials see Argentina’s tax holiday for exporters and fresh soybean sales to China as undermining American producers, sparking opposition in Congress.

A deal is still likely, but the terms may come with concessions that cut against Milei’s economic program. US negotiators are expected to demand restrictions on agricultural exports and a pullback from Chinese financing, including the $18 billion currency swap line with Beijing, of which $5 billion has already been drawn.

US ends Haiti garments trade deal in blow to last major industry

The US has allowed a trade program that supported Haiti’s largest remaining industry to expire, the WSJ reports. The decision ends nearly two decades of preferential treatment that had helped employ 60,000 workers and underpin 90% of exports from the troubled Caribbean nation.

Haitian business leaders warn the move will accelerate factory closures, deepen poverty and push more young men toward gangs or migration. Apparel brands including Hanes and Calvin Klein are already shifting orders to Asia, while Washington has emphasized its focus on bringing manufacturing back home. For Haiti, the loss of its last major formal employer risks turning economic collapse into humanitarian crisis.

Beyond Haiti, EMs globally are struggling to generate jobs, FMN’s Ken Stibler argues. As foreign direct investment increasingly targets low-employment sectors, the problem could get far worse.

Read more at FrontierMarkets.co.

Caribbean islands launch EU-style migration deal to stem labor outflows

Barbados, Belize, Dominica and St Vincent have signed a landmark free-movement pact, allowing citizens to live and work indefinitely across their borders without permits, the Guardian reports. The move marks the most ambitious step yet by Caricom members to replicate EU-style labor mobility.

Leaders hope the deal will slow the brain drain of skilled professionals to North America and Europe. Supporters say it could deepen integration and ease demographic pressures, while critics fear stretched social services and job competition at home

Global Macro

EM assets rally despite trade war gloom

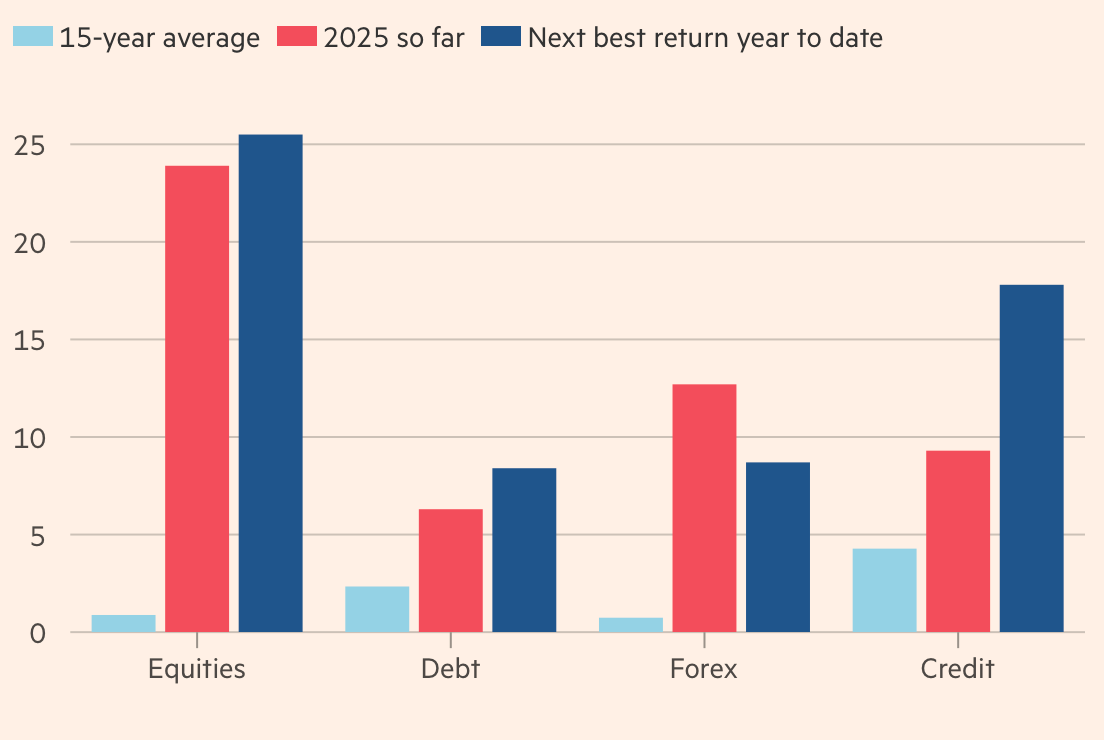

Emerging market assets are outperforming other sectors, despite concerns over the US’ trade war agenda, the FT reports. The MSCI EM equities index is up nearly 24% year-to-date, while Deutsche Bank says EM currencies are enjoying their strongest first three quarters since 2010. High-yield EM debt has returned more than 9%.

The rally reflects a weaker dollar, healthier EM balance sheets and proactive central bank policies. Many EMs raised interest rates earlier and more aggressively than the Fed, giving them room to cut sooner and fueling strong fixed-income returns. Many emerging markets have further bolstered confidence by reining in government spending.

Growth, however, remains the missing ingredient, and much will depend on whether wages catch up to wealthier economies. In the meantime, however, investors are embracing EM assets as a hedge against developed-market fiscal strains and as exposure to commodity-backed growth.

What We’re Reading

Gabon president’s party wins most seats in first legislative elections since 2023 coup (ABC)

Ghana inflation sinks to lowest level since August 2021 (TRT Afrika)

Guinea’s first presidential election after coup set for December 28 (AfricaNews)

Surface-to-air missiles and deadly drones spread on Sudan’s battlefields (WaPo)

China signs new commitment for $1.4bn Tanzania-Zambia railway upgrade (The East African)

Mozambique says work can resume on LNG project (Reuters)

Trump opens trade finance spigot for US deals in Western Sahara (Africa Report)

Bhutan to develop $454mn rail line with India (Bloomberg)

Vingroup builds $6.7bn LNG power plant in northern Vietnam (Nikkei)

Thailand’s soaring currency weighs on businesses (SCMP)

Indonesia promises $2bn Christmas stimulus as economy flags (FT)

Afghanistan goes dark as Taliban imposes nationwide communications blackout (RFE)

Papua New Guinea inks security deal with Australia despite China’s objections (ABC)

Oman approves commercial courts to woo investors (Arabian Gulf Business Insight)

Sanctions reimposed on Iran 10 years after landmark nuclear deal (BBC)

Trump family company expands $1bn project in Saudi Arabia (Bloomberg)

Iraq resumes Kurdish oil exports to Turkey after 2.5-year pause (Reuters)

Tensions rise ahead of Iraqi elections (Al Monitor)

‘Czech Trump’ poised to return as prime minister (NY Times)

Russian economy barely growing after overheating (Fitch)

Moldova launches new stock exchange with support from Bucharest Stock Exchange (Romania Insider)

Bukele’s El Salvador real estate boom is being built by evicting the poorest (El Pais)

As Peru election nears, economic gains ‘at risk’ (Reuters)

We are committed to providing FMN readers with a free weekly digest of politically unbiased, succinct and clear news and information from frontier and small emerging markets.

Please consider becoming a paid supporter to help cover some of our costs and support our continued development of sharp markets-focused coverage and new informational products. Paid subscribers will also gain exclusive access to our quarterly EM/FM report that aggregates EM insights from 25 major banks, international institutions and consultancies.