🌍 Frontier Markets News, October 31st 2025

A weekly review of key news from global growth markets

Africa

Angola pushes to diversify as global access improves

Angola’s efforts to diversify its oil-dependent economy into mining rare earths, diamonds and copper appear to be bearing fruit. This week, UK-based Pensana, which is developing the Longonjo rare-earth mine in central Angola’s Huambo Province, said it was in advanced discussions with the US Export-Import Bank to finance up to $160 million in project debt.

Last week, the firm signed an MoU for an offtake agreement with Germany’s Vacuumschmelze, to route Longonjo output into a magnet manufacturing plant in South Carolina, as part of a US magnet-manufacturing onshoring effort.

- JPMorgan to resume dollar clearing in Angola (Bloomberg)

Angola is also trying to buy a majority stake in diamond firm De Beers, Reuters reports. The bid represents a change of tack: Angola previously expressed interest in securing a small minority interest. The Botswana government, which holds a 15% stake in De Beers, has right of first refusal to purchase De Beers.

Production is also about to start at Angola’s first major copper mine, Reuters reports. According to officials, the mine will begin commercial operations within a week with output expected to reach 25,000 tons of concentrate per year for the first two years.

African airlines face headwinds

Kenya Airways announced this week it is pausing a plan to create an all-Boeing fleet, as the aircraft manufacturer and parts supplier GE wrestle with delivery delays globally, according to The Africa Report. The airline has been planning to raise $1.5 billion in 2026 to help it buy some 60 planes over the next five years in the hopes of mounting a challenge to dominant regional airline Ethiopian Airlines.

Ethiopian, which is the continent’s largest carrier, is also facing holdups with more than 100 planes on backorder. The carrier is moving to grow its frequency and reach, expanding flights to Nigeria’s capital Abuja and developing a partnership with UAE-based Etihad.

Smaller airlines across Africa were dealt a blow this week by the EU. The bloc’s transport commission banned dozens of carriers— including over 30 from Tanzania, and all airlines from Sierra Leone and Liberia—from EU airspace citing safety concerns.

TotalEnergies to restart giant Mozambique gas project

French oil giant TotalEnergies set the stage this week for construction to restart on its $20 billion natural gas project in Mozambique, Zawya reports. Work on the project was halted four years ago after an attack by Islamist extremists.

In the interim, the estimated cost of the project has surged by $4.5 billion to roughly $20.5 billion and the anticipated start of production has been delayed considerably. First LNG is now targeted for the first half of 2029, compared with an original mid-2024 goal.

Investors cheered the news, pushing up Mozambique’s 2031 eurobonds, trimming yields to near 12.5%. The restart is another bullish sign for Maputo’s LNG outlook following Italian oil firm ENI’s decision earlier this month to go ahead with the Coral North floating project.

Asia

ASEAN signs new trade deal with China

The Association of Southeast Asian Nations upgraded its trade deal with China on Tuesday at a summit the 11-country bloc hosted in Malaysia this week, AP reports. The new arrangement, which Chinese premier Li Qiang characterized as an antidote to US “protectionism”, covers areas including digital trade and the green economy.

Beijing has previously said that the trade deal will expand market access in the agriculture and pharmaceutical sectors, according to Reuters.

China and ASEAN first signed a free-trade agreement in 2010, with bilateral trade increasing four-fold since then. But whether the deal can become more substantive is unclear. China and the Philippines, an ASEAN member, engage in near-weekly confrontations in areas of the South China Sea that both countries claim as their own, and the Philippines’ President Ferdinand Marcos Jr. said “cooperation cannot exist alongside coercion.”

Great powers seek out Central Asian leaders

Donald Trump is set to join the leaders of Russia and China in attempting to tighten ties with Central Asia, Reuters reports. The US president is reportedly planning to meet the leaders of Uzbekistan, Kazakhstan, Kyrgyzstan, Tajikistan and Turkmenistan in Washington next week to discuss deepening trade cooperation.

Russia’s President Vladimir Putin held his own meeting with the leaders of the five nations in Tajikistan earlier this month. In June, Chinese President Xi Jinping met the group in Kazakhstan.

Analysts say the Central Asian leaders are keen to play on Trump’s desire to ink deals to increase the region’s clout. In September Uzbek President Shavkat Mirziyoyev said his country would buy up to $105 billion in US products—even though his country’s entire GDP is $115 billion. Still, the region’s ties to China and Russia could make the US want to return the favor, according to the Atlantic Council.

Bangladesh and Pakistan tighten ties

Bangladesh and Pakistan agreed on Monday to further elevate their trade relationship and to cooperate on defense and investment, Bloomberg reports. The pledge is part of a growing rapprochement between the two nations that began after Bangladesh ousted former Prime Minister Sheikh Hasina—who was friendly with Pakistan’s rival India—last year.

- Exiled Bangladesh PM says millions will boycott election with her party banned (Reuters)

The new arrangement will see Bangladesh gain greater access to Pakistan’s Karachi port, Times of India reports, and potentially establish a direct air connection between the two countries’ capital cities. That could be a boon to the Bangladeshi export sector, which made up more than 10% of GDP last year, according to the World Bank.

Middle East

Saudi SWF shifts from megaprojects to AI

Saudi Arabia’s sovereign wealth fund is preparing a shift in strategy from big-ticket real estate “megaprojects” to developing local “ecosystems” around sectors like tourism, high tech, and logistics, Reuters reports. After a series of delays and reorganizations, the Public Investment Fund booked losses on some of its megaproject investments, revising its average annualized returns since 2017 down to 7.2% from 8.7% the year prior.

Saudi economy minister Faisal Alibrahim this week told CNBC that the kingdom is “reprioritizing” and reorienting its economy around a “structure that is productivity-led” with “technology, innovation, and generative AI” at the heart. That reprioritization was in evidence this week at the Future Investment Initiative conference held in Riyadh, where AI dominated both the conversation on stage and the contracts signed, according to Semafor.

The PIF is expected to announce its new strategy for 2026-2030 in the coming weeks. It is expected to cut spending and lean on the private sector to invest more heavily.

Iran and Pakistan strengthen ties

Iran and Pakistan this week stepped up their relationship, with high-level talks on security and economic cooperation, state-owned PressTV reports. The move highlights Iran’s attempt to pursue a more multilateral, regionally focused foreign policy.

According to the report, the neighbors have agreed on new mechanisms to promote greater bilateral trade, including resolving logistical border issues and developing a barter system for trading goods. Iran has an existing bartering arrangement with China, which facilitates bilateral trade despite international sanctions.

- Iranian oil discounts to China widen on sanctions, quota shortage (Reuters)

Announcing the strategic security partnership with Pakistan, Iran’s top security chief Ali Larijani also lauded a defense pact between Pakistan and Saudi Arabia as a step toward “tangible, coordinated, and comprehensive action” by Muslim countries.

Europe

Turkey looks to strengthen relations with Germany and the UK

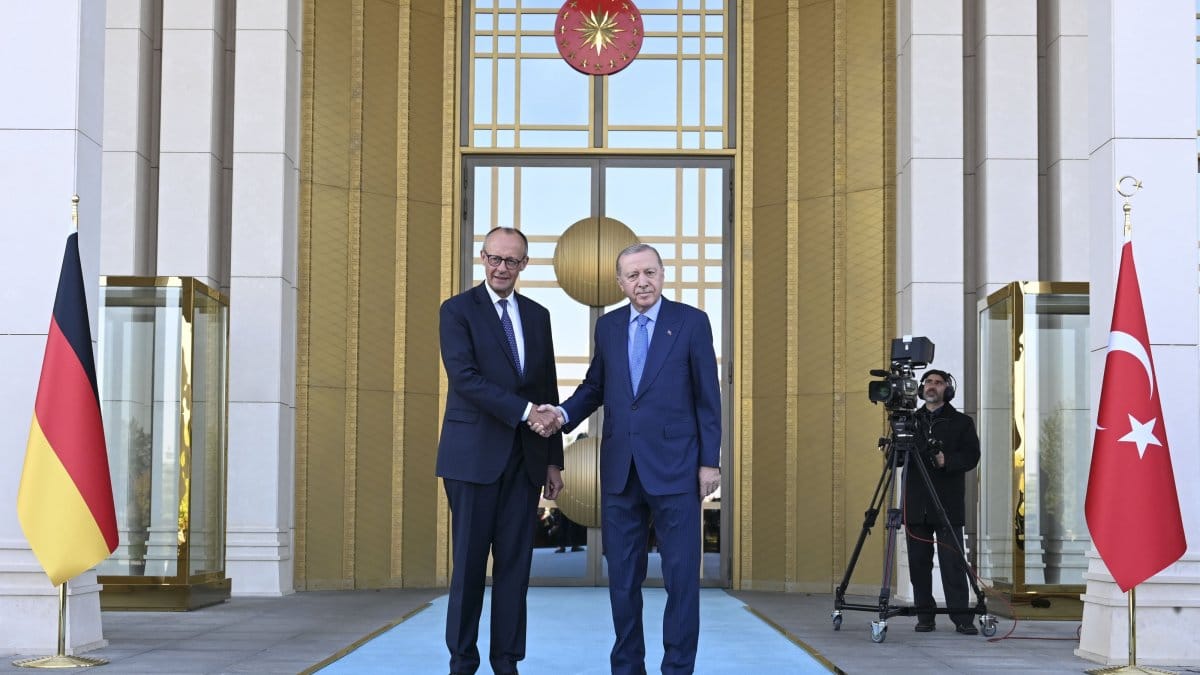

Turkey’s President Recep Tayyip Erdoğan hosted German Chancellor Friedrich Merz in Ankara this week to discuss cooperation on economics, defense and migration, DW reports. Relations between Germany and Turkey have been tense for years, and the visit offers the two countries a chance to reset bilateral conversations and develop new areas of cooperation.

After the meeting, Erdoğan emphasized the need for the two countries to cooperate more closely. “In light of the changing security conditions in Europe, we must leave behind problems in the procurement of defense industry products and focus on joint projects,” he said. Germany has the biggest Turkish community of any European country and is the most important export market for Turkish goods.

Merz’s visit to Ankara came just days after Erdoğan signed an £8 billion deal with the UK to purchase 20 Eurofighter Typhoon fighter jets. Turkey has NATO’s second-largest military. Britain’s defense ministry described the agreement as the “biggest fighter jet deal in a generation.” London will deliver the first batch of jets to Ankara in 2030.

Latin America

Argentine peso and bonds jump after Milei’s surprise midterm win

Argentina’s currency, stock markets and government bonds surged early this week after President Javier Milei’s party scored a decisive midterm win that consolidated his control of Congress and secured US backing for his market-oriented reforms, the WSJ reports. The peso gained nearly 4% against the dollar on Monday while the benchmark Merval stock index jumped 21%, reflecting relief that pro-market policies would continue. Dollar bonds due 2035 rose 12 cents to 69 cents, their highest since 2023, as investors priced out the risk of an imminent devaluation.

On Tuesday, however, investors’ concern that the peso is overvalued resurfaced, and the currency gave up all its gains, the FT reports. A day later the currency strengthened again.

With $40 billion in promised US support, including a $20 billion Treasury swap and $20 billion in private lending, investors expect Milei’s administration to sustain the peso’s trading band and accelerate fiscal consolidation. “The government now has political cover and time to adjust [the currency regime] on its own terms,” Daniel Lansberg-Rodríguez, co-founder of research firm Aurora Macro, said.

Still, Argentina’s fundamentals remain fragile. Reserves net of IMF debt are negative, inflation exceeds 140%, and $18 billion in foreign obligations will fall due within 12 months. The precarious financial background will test Milei’s ability to translate electoral momentum into sustained policy execution.

Fight over AI regulation heats up in Chile

A proposed law that would impose ethical standards on the use of AI in Chile is emerging as a potential bellwether for how developing economies regulate the technology, Bloomberg reports. The bill, which has already been approved by the lower house, classifies AI systems by ethical risk and imposes fines of up to $1.5 million for violations.

The country’s President Gabriel Boric portrays the initiative as part of Chile’s bid to anchor the region’s AI economy while defending cultural autonomy. Tech firms counter that high compliance costs could slow investment just as cloud expansion accelerates.

The debate comes as Amazon, Google, and Microsoft have been investing heavily in data-center projects around Chile’s capital Santiago, drawn by cheap renewable power and strong fiber-optic links. And while lawmakers insist the bill will strengthen trust without stifling innovation, its real impact will depend on how swiftly regulations are written once it passes the Senate.

What We’re Reading

Côte d’Ivoire bonds gain as Ouattara poll win reassures investors (Bloomberg)

At least four killed in protests after Biya declared victor of Cameroon election (Al Jazeera)

Kenya‑IMF talks snag on securitization, arrears and weak revenues (Africa Report)

Protests erupt as Tanzania holds contentious election (AP)

Namibian president sacks deputy prime minister (AA)

African development banks set to expand lending (Reuters)

Cambodia and Thailand sign peace agreement (BBC)

Kyrgyzstan bans biggest independent media outlets ahead of election (OCCRP)

Saudi Arabia rolls out the red carpet for Syria at FII (Semafor)

Goldman Sachs in talks for $10bn private investment mandate from Kuwait (Bloomberg)

Climate fund backs $6bn Jordan water project with its largest deal (Zawya)

Lithuania warns it will shoot down suspicious balloons from Belarus (FT)

European Parliament criticizes ‘state repression’ in Serbia (Balkan Insight)

Azerbaijan and UAE discuss expanding military cooperation (News.az)

US weighs fresh Nicaragua tariffs over human rights (Bloomberg)

Marco Rubio is leading US pressure campaign against Venezuela (WSJ)

Global public debt nearing historic high, IMF finds (Mercopress)

We are committed to providing FMN readers with a free weekly digest of politically unbiased, succinct and clear news and information from frontier and small emerging markets.

Please consider becoming a paid supporter to help cover some of our costs and support our continued development of sharp markets-focused coverage and new informational products. Paid subscribers will also gain exclusive access to our quarterly EM/FM report that aggregates EM insights from 25 major banks, international institutions and consultancies.