🌍 Frontier Markets News, October 24th 2025

A weekly review of key news from global growth markets

Africa

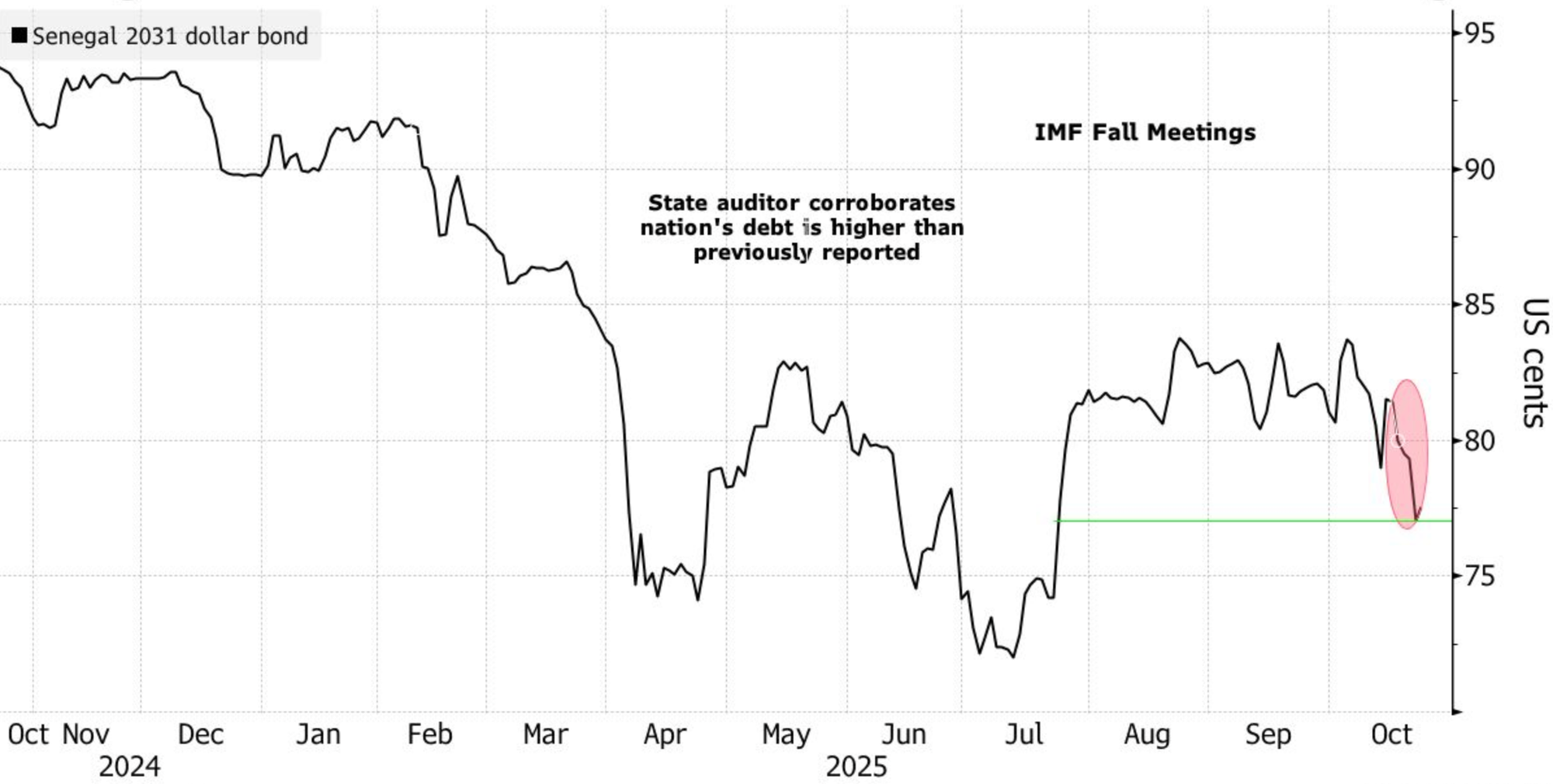

Concerns over Senegal’s debts intensify

Senegal’s bonds slumped to a three-month low this week as investor concerns over the country’s debt levels intensified, Bloomberg reports. As a delegation from the IMF arrived in Dakar to continue negotiations with the Senegalese government regarding its dire fiscal predicament, doubts over the multilateral’s ability to gather timely and accurate information on the West African nation’s fiscal and external accounts continued to grow.

The IMF appears to be working hard to enable Senegal to qualify for a support program. Sources within the multilateral told FMN on the sidelines of last week’s World Bank meetings in DC that the Fund is considering changing the calculation period for achieving debt sustainability from five years to 10, which would give Senegalese officials far more runway.

Senegalese officials are also reportedly seeking waivers from the IMF related to misreporting of government debts and on key debt sustainability thresholds. It’s widely understood that the waiver on the misreporting is forthcoming.

The IMF suspended its $1.8 billion debt program earlier this year after then-newly elected President Diomaye Faye’s government uncovered $7 billion of unreported borrowing.

Zimbabwe looks to extend president’s term

Zimbabwe’s ruling ZANU-PF this week said it was working to amend the constitution to let President Emmerson Mnangagwa stay in office for two years beyond his constitutionally mandated two terms, Al Jazeera reports. If successful, the move would see Mnangagwa retaining power until at least 2030.

Mnangagwa took office after toppling longtime former leader Robert Mugabe in a 2017 coup and won his first five-year term as president in 2018. Despite promising to serve only one term, he stood for reelection in 2023 and won a poll that critics said was neither free nor fair.

- Huayou to start Zimbabwe lithium sulphate production early 2026 (Reuters)

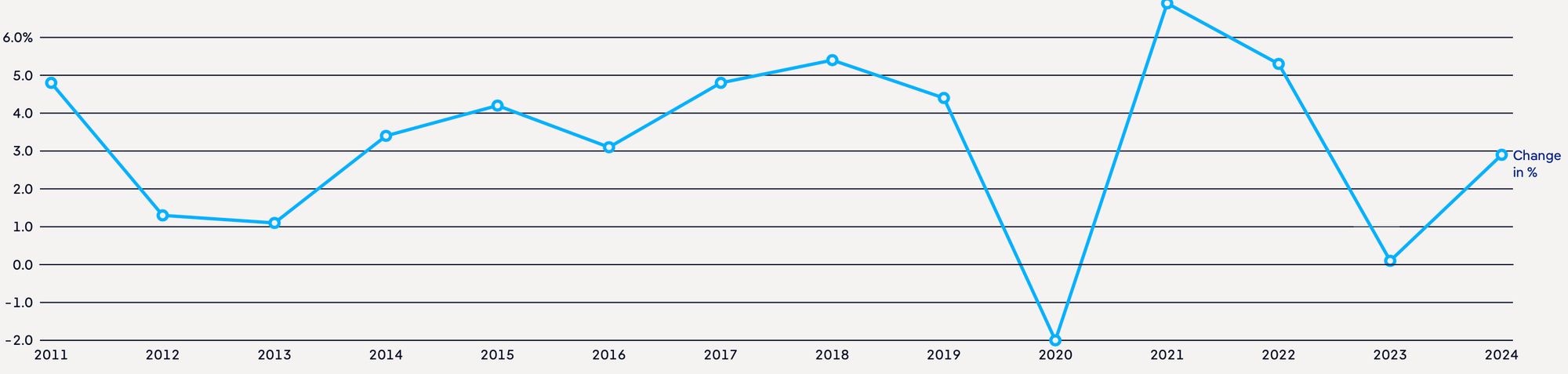

The mineral-rich country’s economy has floundered during Mnangagwa’s time in office, with GDP falling some 5% and GDP per capita plunging by more than 15% according to IMF data. Droughts dragged on 2024 growth but a 6% rebound is forecasted for this year, with output buoyed by a better farm season, record gold prices, and stronger remittances.

Algeria expands oil and gas collaboration across continent

Algeria’s state-owned energy firms this week signed agreements to help Mozambique develop its oil and gas sector, as part of the North African country’s effort to collaborate with other African hydrocarbon producers, Africa News Agency reports.

Oil firm Sonatrach inked an MoU to cooperate with Mozambique’s ENH across the oil and gas value chain, including expansion of the gas distribution network and skills training. Electricity and gas supplier Sonelgaz agreed to work with Mozambique’s power utility EDM on power transport and plant upgrades, with officials in Maputo also seeking joint manufacturing of electrical equipment.

The move is part of Algiers’ 2025-29 energy strategy, which is targeting around $60 billion of investment in upstream exploration, refining, petrochemicals and renewables development. Last week, Sonatrach signed a $5.4 billion, 30-year production-sharing deal with Saudi Arabia’s Midad Energy for the Illizi Basin.

Asia

Vietnamese leader to visit London, upgrade ties with UK

Vietnam and Britain will upgrade bilateral ties when Vietnamese leader To Lam visits London next week, Reuters reports. Lam is set to arrive in the UK on Wednesday after visiting Bulgaria and Finland.

- UAE AI firm to build $2bn data center in Vietnam (Nikkei)

The upgrade will see the UK become the 14th country to sign a “comprehensive strategic partnership” with Vietnam, following players such as the US, China and Russia. Hanoi and London are set to sign a business arrangement related to aviation as well as pacts on health and education, according to an agenda viewed by Reuters.

The UK and Vietnam already have a free-trade agreement, and commercial ties are growing rapidly. Bilateral trade grew 17% between 2023 and 2024, the Diplomat reports.

Georgia’s only oil refinery gets first oil shipment from Russia

Russian oil company Russneft has provided a newly built Georgian refinery with its first cargo, Reuters reports. The 105,340 tonne shipment arrived earlier this month, around when the Kulevi refinery opened. It currently has the capacity to refine 1.2 million tons of oil a year but is aiming to ramp up to 4 million by 2028.

Georgia and Russia have been at odds since they fought a short war over contested territory in 2008. In recent years the ruling Georgian Dream party has pushed Tbilisi closer to Moscow, but the shadow of war is still preventing a restoration of diplomatic ties. In April Foreign Minister Maka Botchorishvili, a member of Georgian Dream, said the ongoing occupation of Georgian territory is “the number one obstacle to normalizing relations with Russia.”

ASEAN summit to draw global attention

World leaders are set to gather at the annual summit of the Association of Southeast Asian Nations in Malaysia this week. Beyond the regional heads of state, US President Donald Trump is planning to attend alongside Brazilian President Luiz Inacio Lula da Silva and South African President Cyril Ramaphosa.

- Southeast Asia sees rapid growth in Chinese hotel chains (Nikkei)

The bloc is set to cap the conference by expanding for the first time in almost two decades. On Sunday it will admit Timor-Leste as a full member, finalizing an accession process that began 14 years ago.

The agenda for the summit includes upgrading intra-ASEAN trade agreements as well as a deal the bloc has with China, Business Times reports. But analysts say Trump could steal the show, with leaders in the region jockeying for economic and security arrangements with the US, SCMP reports.

Middle East

Turkey deepens involvement in Syria

The semi-autonomous, US-backed Kurdish forces in Syria reached an agreement in principle this week to integrate with the Damascus government’s national army, AP reports. After months of talks about preserving Kurdish semi-autonomy and protecting minority rights in the new government—led by President Ahmed al-Sharaa’s Sunni-dominated HTS—the two sides reached agreement on merging Kurdish forces as a “cohesive” unit rather than dissolving them.

The deal needs approval by Turkey, which is effectively the new government’s sponsor and security guarantor, and which has called for the full integration of the Kurdish region and the dissolution of its armed forces. Meanwhile, Damascus and Ankara are reportedly considering deepening defense ties, which would give Turkey greater leverage over national security issues in Syria.

- Turkey’s President Recep Tayyip Erdoğan seals agreements in Kuwait, Qatar and Oman (Turkiye Today)

Turkish businesses are hoping to benefit from strengthening ties between the two countries, DW reports. As Syria moves to secure international funding for rebuilding its shattered economy, Turkish firms see rich prospects in the construction and energy sectors, and also in trade, as discussions around reopening border crossings and cooperation with the Kurds on oil exports are ongoing.

Tourism set to power Jordan’s recovery

While doubts persist over the durability of the ceasefire between Israel and Hamas, travel firms are ramping up their investments in Jordan, banking on a revival in tourism that has been growing since earlier this year. Budget airline Ryanair this week said it was sharply increasing the number of direct flights to Jordan, with 18 routes—some 84 weekly flights—now scheduled, and talks underway for a “significant expansion” to 50 flights, Reuters reports.

Royal Jordanian Airlines, the national flag carrier, is also expanding its services, this week inking a deal with Dallas Fort Worth Airport to begin direct flights four times a week starting in May. RJA is also expanding regional flights in a partnership with Morocco on a twice-weekly direct flight connecting Amman and Casablanca.

Tourism is an increasingly important sector of Jordan’s service-oriented economy, driving GDP and capturing crucial foreign currency reserves for the government. Its nascent revival, and fresh bets on air travel, suggest a recovery is underway despite uncertainty over potential instability in the region.

Europe

More EU money earmarked for Trans-Caspian Corridor

The EU this week pledged an additional €3 billion to develop a transport route that bypasses Russia and provides Central European nations better access to global trade, RFE reports. The funding for the so-called Trans-Caspian Corridor comes on top of the €10 billion allotted in 2024.

Also known as the Middle Corridor, the 6,500-kilometer route runs from China to Central Europe through Azerbaijan, Georgia and Turkey, and provides an alternative to trade routes through Russia. The Middle Corridor transported 4.5 million tons of cargo in 2024, up from 2.7 million tons in 2023, according to the Institute of Eurasian Integration.

During a state visit to Kazakhstan this week, Azerbaijan’s President Ilham Aliyev highlighted his own country’s involvement in the Middle Corridor and pledged continued cooperation with Central Asian nations in developing the route. China has also invested in the corridor’s development and aims to establish a deep-water port in Georgia scheduled to begin operating in 2029, although progress on the port has been limited since its announcement more than a decade ago.

Poland shines amid EU economic gloom

After years of solid growth and careful use of development funds, Poland has become a star of the EU, DW reports. The country’s economy, which recently surpassed Switzerland’s to become the world’s 20th largest, has been growing at triple that of the EU’s 1% average, and investors are betting it will become one of the most robust in the region.

A large part of the reason for Poland’s success, according to DW, is its successful integration into the EU. Poland capitalized on EU funding to improve infrastructure and to counter corruption and now plays an increasingly important geopolitical role. Poland’s population size is another factor; at 37 million, it is the fifth most populous in the EU and has recorded an average unemployment rate of just 2.9% over the past five years compared to the broader EU’s 6.4%.

- Polish bank long-term funding gap widens on capital buffer increase (Fitch Ratings)

Clouds are gathering, however. The narrow victory in this year’s presidential election of Euroskeptic Karol Nawrocki could threaten further EU integration, while political tensions and flagging economies across the wider region could undermine Poland’s growth prospects.

Latin America

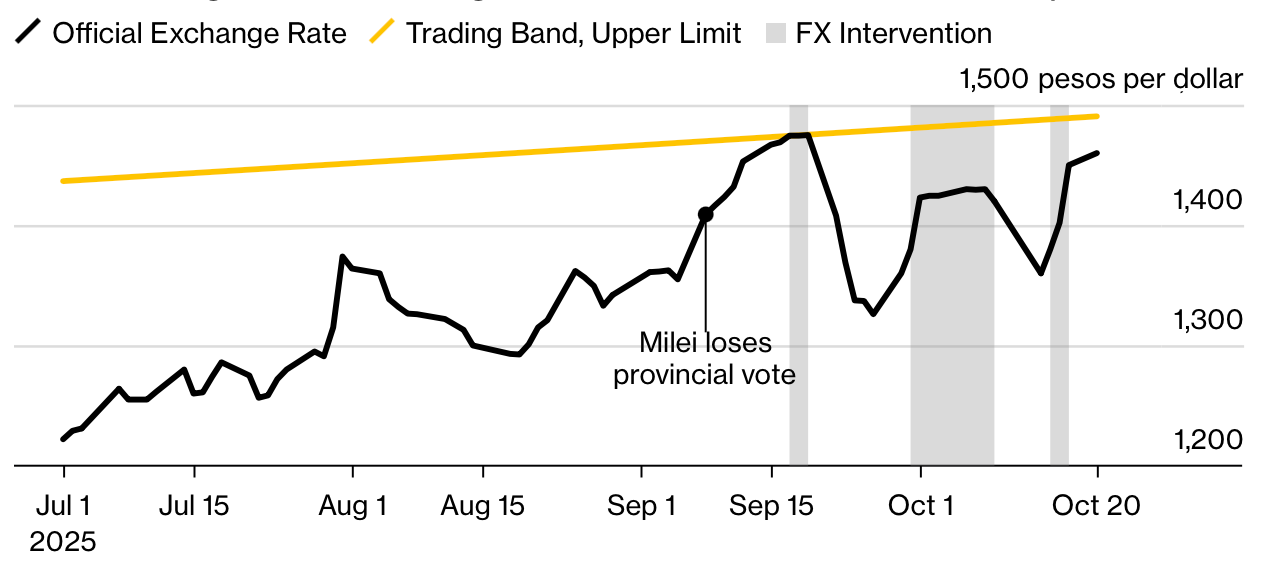

Washington makes Argentina’s peso problems its own

The US Treasury’s efforts to support Argentina’s currency have done little to calm volatility ahead of Sunday’s midterm elections. After two weeks of direct peso purchases, Treasury Secretary Scott Bessent signed a $20 billion swap line with Argentina’s central bank, part of an extraordinary package to shore up President Javier Milei’s reform agenda. The US calls it a stabilization agreement, while markets are interpreting it as a bailout.

The US administration this week laid out the political stakes. Bessent framed the program as essential to prevent “another failed state in Latin America,” while President Donald Trump described Milei as “fighting so hard to survive.” The swap is paired with negotiations for an additional $20 billion in private lending that Washington is urging US banks to assemble, although lenders are wary, seeking guarantees before committing capital.

For all the choreography, the market reaction has been muted. The peso remains the worst-performing emerging-market currency this year, down more than 40%, and bond gains evaporated once investors saw that no terms were disclosed. “They confirmed what investors already knew, but there were no details,” said UBS strategist Pedro Quintanilla-Dieck. Traders in Buenos Aires estimate the US bought more than $200 million in pesos in just one session last Friday, without altering sentiment.

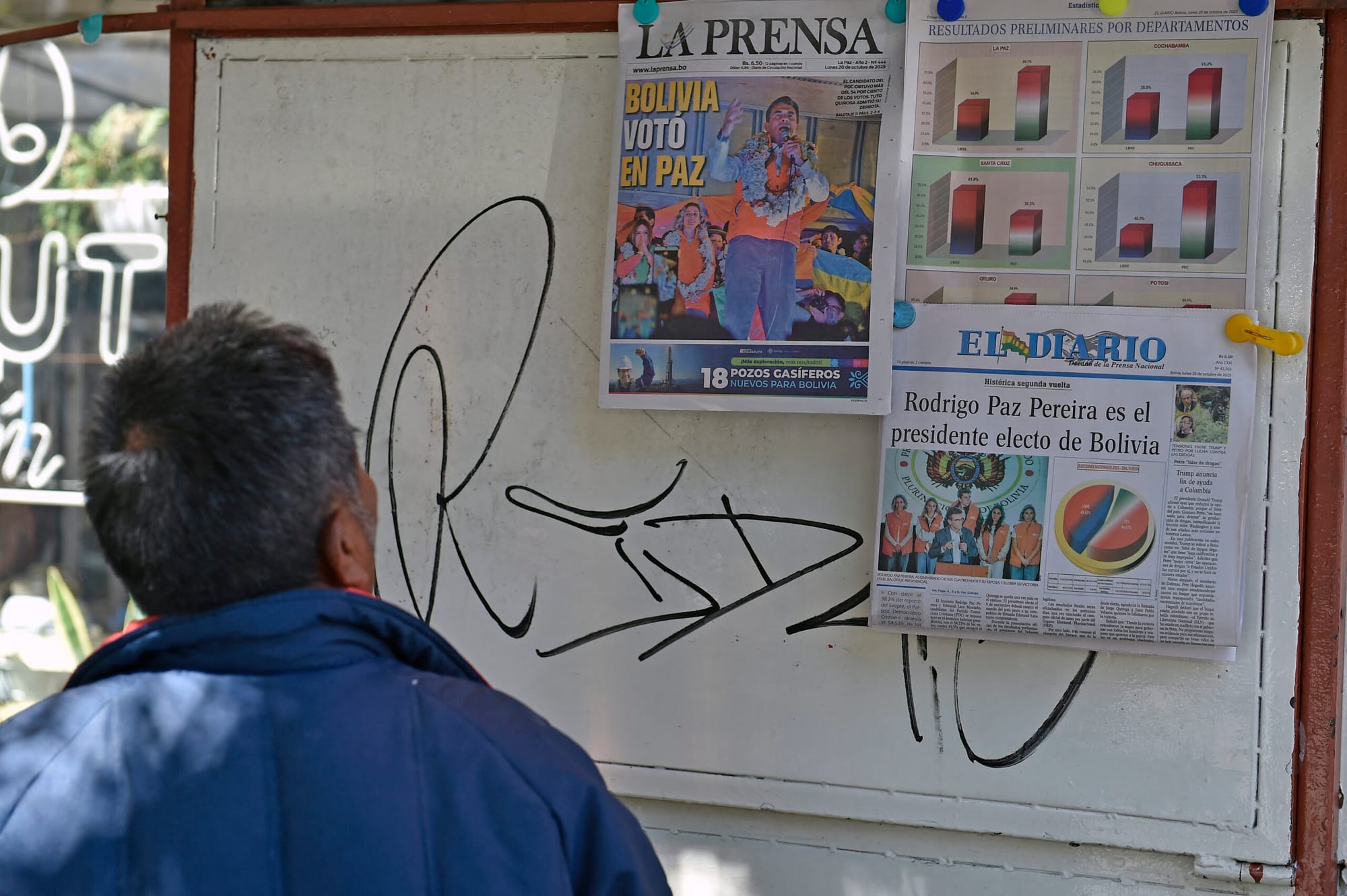

Bolivia’s new president faces challenges enacting reforms

Rodrigo Paz’s victory in Bolivia’s presidential election last Sunday ends two decades of socialist rule but comes amid severe financial stress, Reuters reports. The country’s usable reserves have fallen below $200 million, inflation has surged past 20%, and the fiscal deficit exceeds 10% of GDP.

Paz has pledged gradual fiscal consolidation and new investment in hydrocarbons and mining, but his ability to make meaningful changes will be hindered by the fact that his Christian Democratic Party lacks a congressional majority.

Economists say the new administration will be forced to consider measures it campaigned against, including an IMF program and exchange-rate adjustment. Bolivia’s fixed rate of seven bolivianos per US dollar is no longer credible, with the parallel market trading nearly twice as high. Without external financing or debt restructuring, the government faces a liquidity crunch in early 2026 when $388 million in payments come due.

The early test for Paz will be whether he can impose reforms before reserves run out.

Colombia’s spat with Trump raises economic risks

Tensions between Washington and Bogotá have intensified after US President Donald Trump escalated his criticism of Colombia’s President Gustavo Petro. Trump accused Petro of being an “illegal drug leader,” and announced plans to suspend all US aid and impose new tariffs, jeopardizing one of the hemisphere’s most established security partnerships.

The US has already removed Colombia from its list of reliable counternarcotics allies for the first time since 1997.

The confrontation follows a US military strike on a vessel near Venezuelan waters that Petro claims was Colombian. Bogotá recalled its ambassador and demanded an explanation, while Trump vowed to “close up these killing fields.” With 26% of Colombian exports going to the US, the dispute introduces material risk to trade and investment flows.

Peru’s acting president gets off to rocky start

Just days after taking office, Peru’s acting president, José Jerí, is facing growing nationwide protests against crime and corruption, Democracy Now reports. Driven in part by a youth-led movement of Gen Z demonstrators frustrated by political stagnation and weak institutions, the protests have already left one person dead and dozens injured, RFI reports.

After initially moving to impeach Jerí, who took over as president on October 10 following Dina Boluarte’s snap removal from office, the country’s Congress this week backed his picks for cabinet ministers. Jerí’s approval ratings remain below 10%, however, and allegations of past misconduct have further undermined his legitimacy.

The unrest comes against a background of economic stability. GDP expanded 3.3% in the first eight months of 2025 and inflation remains near 1%. Fitch Ratings cautioned, however, that upcoming 2026 elections and the departure of long-time central bank chief Julio Velarde could unsettle markets.

Global Macro

China steps into foreign aid vacuum

China is gradually expanding development lending after several years of retrenchment, using smaller bilateral programs and local-currency swap lines to regain influence across Asia, Africa and the Middle East, Nikkei reports. New facilities with Argentina, Egypt and Pakistan reflect a shift from large Belt and Road projects toward shorter-term liquidity and infrastructure maintenance.

The strategy emphasizes speed and flexibility. Rather than funding headline-grabbing megaprojects, Beijing is deploying targeted credit that integrates partners into yuan payment systems and digital settlement networks. Analysts view the approach as part of a broader effort to internationalize the currency and deepen long-term dependencies.

With the US and Europe scaling back concessional financing, China’s ability to deliver quick relief is enhancing its relevance among indebted emerging economies. The cumulative effect may prove more enduring than the early Belt and Road surge: smaller in volume but more integrated into the financial systems of its partners.

What We’re Reading

Democracy in Côte d’Ivoire under scrutiny ahead of election (DW)

Côte d’Ivoire warns citizens over surge in election disinformation (FT)

Ethiopia in talks with China to convert dollar loans to yuan (Bloomberg)

Foreign capital will ‘reshape Ethiopia’s financial sector’ (The Africa Report)

Uganda secures $2bn from World Bank after funding freeze (Bloomberg)

DRC seeks $500 million World Bank loan for Lobito Corridor (Ecofin)

China ‘helps Malawi to relax a little bit in debt’ (Malawi Nation Online)

Angola’s first major copper mine to start production (Reuters)

Chinese loans fuel Angola’s future cities (SCMP)

Madagascar coup leader Randrianirina sworn in as president (Reuters)

Morocco’s Gen Z activists renew protests (FT)

Egypt to open Nile Corniche lands to investors to boost revenues (Arab News)

IMF urges Egypt to speed up privatization (Bloomberg)

Inside six industries on the rise in the Africa’s most investable economies (BusinessWeek)

African e-mobility company to raise $100mn in round led by Afreximbank (FT)

Vietnamese stocks fall sharply after regulator points to violations in credit market (FT)

Vietnam to increase income tax relief to boost economy (Nikkei)

AI company from UAE plans $2bn data center in Vietnam (Nikkei)

Indonesia reaches deal with China on railway debt (Nikkei)

Indonesia military seizes palm oil plantations, threatening industry (Reuters)

Thai deputy finance minister resigns over ties to scams (NYT)

Mongolia court blocks parliamentary effort to oust PM (Reuters)

Oman seeks to build a space industry (Rest of World)

Kuwait signs $500 million wastewater treatment plant deal with Turkey’s Kuzu (Reuters)

Kuwait and Bahamas sign deals on boosting political and economic cooperation (Zawya)

Iran’s energy crisis forces government to attempt shift from oil to solar (FT)

Saudi Arabia in talks for US defense pact (FT)

North Macedonia ruling party wins by landslide in local elections (EUalive)

Czech and Polish firms snap up struggling German businesses (Reuters)

Russian attacks prompt surge in Ukraine gas imports (EnergyNow)

Serbia, Hungary dismayed by EU decision to end Russian gas imports (Balkan Insight)

White House weighs fresh Nicaragua tariffs over human rights (Bloomberg)

Global public debt nearing historic high, IMF finds (Mercopress)

Investors return to ‘resilient’ frontier markets (Investment Week)

We are committed to providing FMN readers with a free weekly digest of politically unbiased, succinct and clear news and information from frontier and small emerging markets.

Please consider becoming a paid supporter to help cover some of our costs and support our continued development of sharp markets-focused coverage and new informational products. Paid subscribers will also gain exclusive access to our quarterly EM/FM report that aggregates EM insights from 25 major banks, international institutions and consultancies.