🌍 Frontier Markets News, October 17th 2025

A weekly review of key news from global growth markets

Africa

Cameroon opposition candidate claims victory

Tensions are rising in Cameroon after Issa Tchiroma Bakary declared victory over 92-year-old President Paul Biya in last Sunday’s election, Semafor reports. The government quickly pushed back, reiterating that only the Constitutional Council can proclaim a winner. Meanwhile, anger sparked by allegations of vote-rigging in Biya’s favor spilled into the streets of Douala on Wednesday, where police forcibly dispersed pro-Tchiroma protests.

Official results are expected by October 26.

Cameroon’s is the latest in a flurry of elections across the continent. In Seychelles, opposition leader Patrick Herminie won the presidential run-off with 52.7%, unseating Wavel Ramkalawan. In Côte d’Ivoire, police dispersed rallies and arrested hundreds ahead of the October 25 poll, drawing criticism from rights groups. In Gabon, Brice Oligui Nguema, who took power after a coup over Ali Bongo in 2023, cemented control of parliament, with his UDB party winning 70% of seats this week following his victory in a presidential election in April.

Protests continue to grow across the continent

Protests over a long-running pollution crisis in the Tunisian coastal city of Gabes intensified this week, after dozens of people suffered breathing difficulties caused by toxic gases from a nearby phosphate plant, Middle East Eye reports. The country’s President Kais Saied, who blames the problems at the factory on poor political decisions in the past, promised to mobilize a team to repair the plant, which administrators said in 2017 should be replaced with one that meets modern pollution standards.

The cash-strapped Tunisian government views phosphate as an important revenue driver and hopes to increase production fivefold by 2030, Reuters reports.

In Morocco, protests prompted by lavish government World Cup spending in the face of unemployment and economic instability for many young Moroccans, are meeting repressive crackdowns even as political leaders publicly acknowledge the validity of the protestors’ complaints, Sada News reports. The North African nation’s finance minister Nadia Fettah Alaoui said the protests were a “wake-up call.”

Similar protests in Madagascar have triggered a change of government after parliament impeached President Andry Rajoelina, NPR reports. Rajoelina has since fled the country, and the military, led by the elite CAPSAT unit, seized power. The government will be led by Colonel Michael Randrianirina, who has promised elections will be held “quickly”.

Ethiopia sees strong trade growth

Ethiopia’s first-quarter exports this year more than doubled from 2024, reaching almost $2.5 billion, according to the country’s trade ministry. The increase, largely driven by gold and agricultural products, is helping boost the East African nation’s GDP, which the IMF projects will grow 7.2% this year.

Coffee exports, bolstered by high prices and improved supply chains, are also providing momentum. The government said exports over the past two months reached 80,000 metric tonnes, earning $576 million—more than a quarter of total coffee export earnings for 2024.

Ethiopia’s rapidly growing export revenues have become a key point of contention causing a breakdown in debt restructuring negotiations with private creditors following its default on a $1 billion private bond in 2024. The government and creditors agreed to a principal haircut and extension of terms, but creditors want to tie the scale of the debt reduction and the size and schedule of repayments to export earnings.

While the next rounds of debt negotiations might involve IMF brokers, Ethiopia is continuing to expand its exports. This week, the country officially started exporting goods under the African Continental Free Trade Area framework.

Asia

Bangladesh arrests army officers for crimes under Hasina

Bangladesh’s army announced on Saturday that it had arrested at least 15 officers accused of crimes under ousted Prime Minister Sheikh Hasina, NDTV reports. The detentions are part of a crackdown on people who the country’s courts say abetted Hasina’s regime, which came to an end last year after clashes between police and protesters left 1,400 dead.

Hasina herself is sheltering from several arrest warrants in India, which is unlikely to extradite her.

The country has been struggling to right its export-reliant economy after the turmoil of last year, but has run into the headwinds of American tariffs. Sales abroad in turn hinge on the garments and textile sector, which contributes 85% of export revenue, according to the Foreign Investors’ Chamber Of Commerce & Industry in Bangladesh. The industry took a non-tariff blow on Tuesday, when a fire at a garment and chemicals factory in the capital, Dhaka, killed at least 16 people, the New York Times reports.

Pakistan-Afghanistan call truce after border clash turns deadly

Tensions between Pakistan and Afghanistan turned deadly this week, killing dozens and wounding at least 100 on either side of their shared border, AP reports. The two sides called a 48-hour ceasefire on Wednesday, after Qatar and Saudi Arabia urged restraint, the New York Times reports.

Pakistan, which has nuclear weapons, signed a defense pact with Saudi Arabia last month. The Gulf kingdom is also one of Pakistan’s largest financiers, providing billions in rolled over deposits and giving Pakistan the runway to pitch itself as a critical minerals and digital assets hub to potential investors such as the US.

The South Asian country is still heavily dependent on more traditional forms of development finance, however. This week it reached a deal with the IMF to unlock a $1.2 billion payout under its $7 billion bailout program.

US seizes $15bn in bitcoin from Cambodia-based scam conglomerate

The US has seized $15 billion in bitcoin from a Cambodia-based conglomerate it accused of crypto scamming, the Department of Justice announced on Tuesday. The DOJ called it the largest asset forfeiture in the department’s history.

The US followed up the seizure by imposing sanctions on 146 targets in the conglomerate’s network, the Treasury Department said. The UK said it had frozen more than $150 million worth of the group’s property in London.

- South Korea bans some Cambodia travel due to scam threats (Yonhap)

American and British officials allege that the conglomerate, Prince Group, is a leading perpetrator of so-called pig butchering scams, which seek to defraud investors by taunting them with crypto riches. The FBI estimates that crypto investment scams cost Americans $5.8 billion last year alone. Chen Zhi, Prince Group’s founder and chairman, is still at large.

Middle East

Exclusive: Lebanon’s debt restructuring hopes fade

Concerns over the potential timing and pricing of a debt restructuring for Lebanon are threatening to reverse a dramatic rally in its defaulted dollar-denominated bonds. In April, Lebanese officials said that they were hoping to conclude an IMF arrangement “within months”, which would have paved the way for talks with holders of its defaulted bonds on a debt restructuring.

However, sources with knowledge of meetings held this week between the IMF, bondholders and Lebanese officials told FMN that timeline has proven unrealistic. An audit of the embattled central bank—a precondition for advancing a debt restructuring—has reportedly yet to hit full speed, and officials now expect the audit to be completed sometime around parliamentary elections, which are scheduled for next May.

Bondholders also have unrealistic expectations for recovery values, according to IMF research. Bondholders are reportedly targeting 25-35 cents on the dollar, while the IMF expects just 10-20 cents, based on its assessment of Lebanon’s debt-service capacity, which it estimates will be $200-300 million once an IMF program is granted.

Kuwait joins GCC outbound investment rush

Following a successful return last week to the international bond market, Kuwait is exploring deploying foreign direct investments through bilateral lending arrangements. The government-managed Kuwait Fund is in talks with the Ethiopian government about partnering on large scale infrastructure projects should it successfully complete its long standing sovereign debt restructuring, Fana Broadcasting reports.

At a gathering on the sidelines of this week’s IMF annual meetings in Washington, the two sides discussed funding for a proposed $10 billion airport near the capital, Addis Ababa. The new airport would handle up to 60 million passengers annually once the first phase is completed in 2029, with that number rising to 110 million on final completion of the project.

Kuwait has also this week finalized $13 million in agreements on road infrastructure projects in Belize and St. Lucia, its first foray into direct bilateral lending in the Caribbean region. It’s also looking to expand its footprint in its own neighborhood, this week opening discussions on a bilateral agreement with fellow GCC member Oman on investment and trade partnerships.

Europe

Moldova to ‘benefit from post-election stabilty’

The incumbent pro-EU Party of Action and Solidarity’s victory in Moldova’s recent election should benefit the economy by reducing political uncertainty and supporting further integration with the EU, ratings firm Fitch said this week. The PAS win, in the face of alleged Russian interference campaigns, sets the stage for increased access to the EU as well as more disbursements from the €1.9 billion Reform and Growth Facility, a financial support package set up earlier this year.

Moldova cleared the bilateral EU and EC screening process last month, the final step before the country can begin formal EU accession negotiations. Moldova’s integration with Europe’s economy, including its energy sector, will reduce exposure to geopolitical risk—largely driven by Russia—which is the primary weakness for Moldova’s sovereign credit rating, Fitch said.

Turkish government expands control with corporate crackdown

A state-owned fund has become one of Turkey’s largest business owners after hundreds of companies were transferred into its hands under an “anti-corruption” campaign, the FT reports. The State Deposit Guarantee Fund (TMSF), which acts as trustee to companies being investigated by Turkey’s judiciary, has nearly doubled in size over the past year and now controls 1,056 businesses.

The recent confiscation of private assets supports President Recep Tayyip Erdoğan’s reputation among voters as ‘tough on corruption’ but some worry company funds will be transferred to Erdoğa loyalists, or directly to the government. More than a dozen people associated with one of the companies placed under TMSF control were detained last week.

Latin America

Trump conditions Argentina support on Milei’s electoral performance

US treasury secretary Scott Bessent this week confirmed plans for an additional $20 billion financing package for Argentina, the FT reports. The new arrangement combines funding from private banks and sovereign funds to stabilize Argentina’s reserves and debt payments, and follows an earlier pledge of a $20 billion currency swap line.

- Milei fields unconventional candidates for midterms (FT)

The US intervention halted a run on the peso and briefly steadied markets, but shortly afterwards, President Donald Trump warned the aid would end if Javier Milei’s party performs poorly in the October 26 midterms, saying “if he doesn’t win, we’re gone.”

The remark triggered a backlash in Buenos Aires and renewed volatility in bond markets, where 2035 notes fell back to 57 cents on the dollar. US officials insist continued support depends on Milei’s maintaining free-market policies, but the episode underscored Argentina’s new dependence on Washington’s political goodwill as much as its dollars.

Peru president’s impeachment raises risk for economy

Peru’s Congress has voted to impeach President Dina Boluarte, citing “permanent moral incapacity” and ending her scandal-plagued government amid a surge in violent crime and collapsing public support, the Washington Post reports. Her removal followed a fatal shooting at a concert in Lima and the defection of right-wing allies who had previously shielded her from removal.

José Jerí, head of Congress, was sworn in as interim president, promising a crackdown on insecurity and an end to what he called “the paralysis of leadership.” Peru now has its seventh president since 2016.

Ratings firm Fitch warned the impeachment raises the risk of fiscal populism ahead of April 2026 elections. The firm said the transitional government’s limited mandate will make it difficult to resist pre-election spending and pension withdrawals that could undermine fiscal consolidation.

While Peru retains strong macro fundamentals and moderate debt levels, recurring leadership crises have eroded reform momentum and investor confidence.

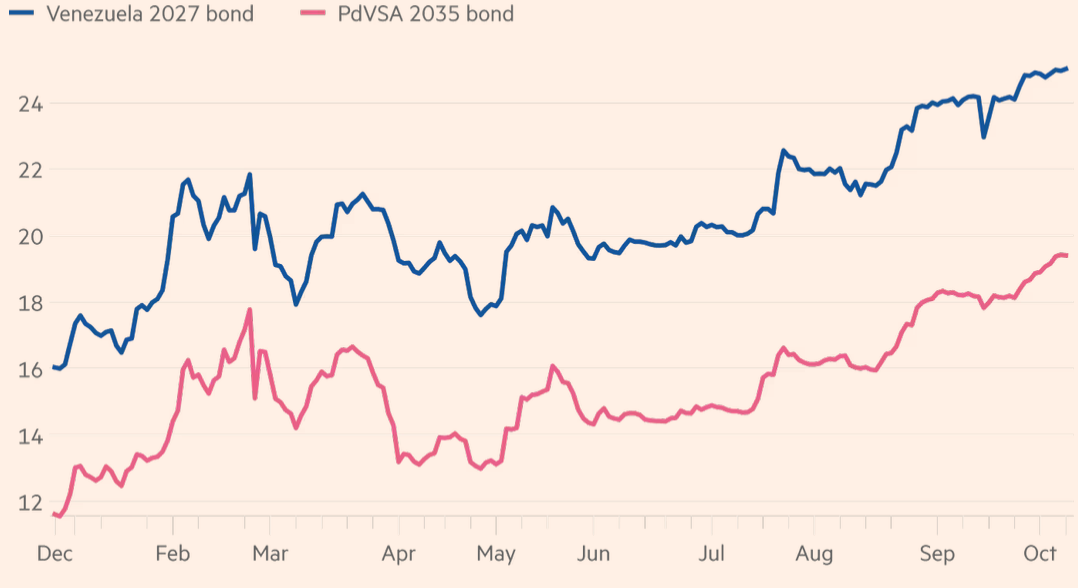

Venezuelan bonds surge on regime-change expectations

Venezuela’s dollar bonds have climbed more than 50% this year to around 25 cents on the dollar as investors bet that growing US pressure on President Nicolás Maduro’s government will lead to regime change, the FT reports.

The Trump administration has intensified military activity in the Caribbean, sinking several suspected drug trafficking boats it said were linked to Venezuela and deploying warships and F-35 jets to the region. Investors interpret the escalation, along with the closure of diplomatic backchannels, as a signal that Washington is serious about forcing political change in Caracas.

The rally also reflects broader inflows into high-yield emerging market assets as the dollar weakens. Funds that once avoided Venezuelan debt are returning after the bonds were re-included in JPMorgan’s EM index, driving volumes to their highest in years. Analysts say markets are pricing in “optionality” on a future restructuring once sanctions are lifted, betting that the country’s vast oil reserves and US policy alignment could eventually unlock double-digit recovery values.

What We’re Reading

Nigeria’s Lagos to begin $3bn Green Line rail construction in December (Business Day Nigeria )

Côte d’Ivoire plans to turbocharge its economy with street-naming campaign (FT)

Why Ethiopia and Kenya have signed a defense pact (The Africa Report)

Kenya tightens rules on crypto market (EcoFin)

Uganda launches continent’s first AI data center (iAfrica)

Zambia signs deals with Chinese lender to revamp some loans (Bloomberg)

DRC and rebels agree to create body to oversee potential ceasefire (AP)

French aerospace giant invests €320mn in Morocco (Business Insider Africa)

Algeria clinches $5.4bn oil and gas deal with Saudi Arabia (Business Insider Africa)

Africa braces for fallout as EU tightens steel rules with 50% tariffs (Business Insider Africa)

Apple expands operation in Vietnam (SCMP)

Indonesia restarts carbon emissions trading (Reuters)

Indonesia looks to negotiate debt with China from high-speed rail project (Jakarta Globe)

Thailand wins $70mn US investment for AI chip components (Nikkei)

Saudi Arabia set to give retail traders bigger IPO roles (Semafor)

IMF ups Saudi Arabia’s 2025 GDP growth forecast as oil output rises (Reuters)

Iraq pledges to end $4bn gas imports from Iran by 2028 (CNBC)

Estonia closes border road due to large number of Russian troops (RFE)

Kosovo to form government after months of deadlock (Bloomberg)

EU raises pressure on Serbia over ‘rule of law’ reforms (Balkan Insight)

Montenegro politicians are deploying Trump’s playbook to squeeze central bank (Bloomberg)

Russia’s coal miners buckle under sanctions, weak prices and war (FT)

Brazil imports Vaca Muerta natural gas from Argentina (Oil and Gas Journal)

Bolivia’s fuel crisis deepens ahead of presidential runoff (Mercopress)

China now receives $3.9 billion more in debt payments than it lends to developing nations (Business Insider Africa)

We are committed to providing FMN readers with a free weekly digest of politically unbiased, succinct and clear news and information from frontier and small emerging markets.

Please consider becoming a paid supporter to help cover some of our costs and support our continued development of sharp markets-focused coverage and new informational products. Paid subscribers will also gain exclusive access to our quarterly EM/FM report that aggregates EM insights from 25 major banks, international institutions and consultancies.