🌍 Frontier Markets News, May 24th 2025

A weekly review of key news from global growth markets

Africa

Morocco in $14bn collaboration with UAE

Morocco and the UAE this week signed a series of deals worth more than $14 billion for energy and water infrastructure projects, AFP reports. Projects include the construction of an 850-mile high-voltage line to carry green electricity from the disputed Western Sahara territory to Casablanca.

Morocco is planning to double its power generation capacity in time for the 2030 football World Cup, with renewable sources making up 80% of the increase, Morocco World News reports.

The UAE deal also includes investment for seawater desalination plants to help the country tackle acute water shortages.

Morocco has been investing heavily in clean energy over the past 15 years, increasingly making deals with other countries, including China in the electric vehicle industry, to build out its infrastructure. The Western Sahara region is also experiencing a surge in investment as more countries, such as the US and France, are recognizing Morocco’s sovereignty over the area.

African nations targeted as criminal networks focus on critical minerals

Criminal networks are seizing on the surge in demand for critical minerals globally to insert themselves in the supply chain, Nigeria’s Premium Times reports.

In a new report on crimes affecting the environment, the UN’s Office on Drugs and Crime said organized crime groups are increasingly embedding themselves in the global supply chain at mining hubs, most of which are in Africa, Latin America, the Caribbean, and Southeast Asia.

Such criminal groups are taking advantage of weak oversight and regulatory loopholes to siphon off capital, and “using corruption, violence and/or coercion to bypass regulations, evade taxation, and manipulate access to resources. In many cases, the US said, local populations as a result face sexual exploitation, forced labor or displacement, and environmental dangers.

Trump team to host White House Africa Summit 2.0

The US administration announced it would hold a summit for African leaders later this year in an apparent show of enthusiasm for engaging with the continent, Semafor reports. The State Department’s senior official for African affairs Troy Fitrell said he wanted the US’ relationship with Africa to focus on “trade, not aid.”

Fitrell last week launched a six-point plan to enhance trade between Africa and the US. Among the key priorities he laid out were insistence that African governments enact investor-friendly reforms to create an environment that would enable US firms to capitalize on “Africa’s extraordinary commercial potential.”

The last time the White House hosted an Africa summit was under the Biden administration in 2022. Africa experts in Washington have been pushing for another summit, but several are wary of the “trade, not aid” approach, citing the fact that the US has suspended its Trade and Development Agency and saying the newly unveiled strategy is set up to prioritize US business over mutual prosperity.

Podcast: Emomotimi Agama, Nigeria’s SEC Director General

Nigeria’s Securities and Exchange Commission is spearheading efforts to create a more transparent, welcoming investment environment. In our latest podcast, we talk to ‘Timi Agama, the SEC Director General and one of the key architects of Nigeria’s new Investments and Securities Act, about building investor confidence in Nigeria’s markets, and potentially unleashing a flood of domestic and international capital.

As well as discussing the progress regulators have made creating a more transparent and consistent investment environment we talked about the importance digital assets and Nigeria’s ambition to be a world leader in cryptocurrency regulation.

Listen to the full episode on Spotify, Apple Music, or wherever you get your podcasts.

Asia

Thailand diverts $4.7bn in consumer stimulus for tariff amelioration

The Thai cabinet approved a measure this week to move $4.7 billion in planned budget spending away from consumer stimulus and toward projects that will help reduce exposure to U.S. tariffs. The government will use the funding to cushion sectors including water management, transport and logistics, Reuters reports, as well as for small business loans.

The money will come from a pot set aside for Thailand’s “digital wallet“ program, which sought to distribute $276 to every Thai citizen. The government planned to spend $4.6 billion on the project this fiscal year and $7.9 billion next year.

The US assigned a 36% tariff to Thailand on April 2 before pausing the duty a week later. The moratorium ends in July.

ASEAN moves to strengthen regional alliances

The Association of Southeast Asian Nations will host a trilateral summit with China and the six rich oil states of the Gulf Cooperation Council in Malaysia on Tuesday. The summit will take place during the biannual ASEAN summit.

Last year, the Southeast Asian bloc opened the conference up to the Gulf for the first time. This year marks an expansion of those talks to include China. The move reflects ASEAN’s increasing efforts to create a larger bloc that can strike a balance between the US and China as the trade war between the world’s two largest economies plays out.

At their own regional meetings, the ASEAN nations will be focusing on bringing an end to the civil war in Myanmar, with two closed-door dialogues on the subject scheduled before the summit, Nikkei reports.

Kazakhstan oil production rises 2% in continued challenge to OPEC+ caps

Kazakhstan continued to defy OPEC+ oil production quotas in May, with output increasing by 2%, Reuters reports. The country’s oil production also exceeded its OPEC+ quota last month.

The willingness to irk the petrostate alliance comes as Kazakhstan increasingly looks to Europe to diversify its economy. Official Kazakh trade data shows that Italy was the country’s largest export destination last year, followed by China and Russia. Negotiations are currently underway for Italian companies to expand in Kazakhstan and establish joint ventures with Kazakh companies, Kazakhstan’s Ambassador to Italy H.E. Yerbolat Sembayev said in an interview with SpecialEurasia this week.

Europe is already the largest foreign investor in Kazakhstan. At a summit in Uzbekistan last month, the EU pledged to begin a “new chapter” in its relationship with Kazakhstan and other Central Asian countries.

Middle East

US and Iran to convene in Rome for fifth round of nuclear talks

The US and Iran are to meet in Rome this weekend for the fifth round of high-level nuclear talks, ABC news reports. The two sides still disagree over Iran’s claimed right to continue enrichment for civilian energy use, and what to do with its stockpile of near-weapons-grade enriched uranium—and Iran’s supreme leader Ayatollah Ali Khamenei said he didn’t expect results from the negotiations.

- Iran steps up mass deportation of Afghan migrants (FT)

Iranian foreign minister Abbas Aragchi, posting on X ahead of the talks, said a US insistence on zero enrichment would result in no deal, despite US envoy Steve Witkoff, US Secretary of State Marco Rubio, and President Donald Trump stating it is absolutely necessary for any deal.

Failure to reach a deal could be crippling for Iran’s economy, which is struggling under sanctions and hobbled by low oil prices. The IMF projects GDP will stagnate this year and next, even as annual inflation soars above 40%. A deal with the US that ended sanctions could allow Iran to sell more oil, boosting foreign reserves exchange and alleviating inflationary pressures, and unlock access to foreign direct investment necessary for rebuilding its embattled energy infrastructure and boosting job creation.

Europe

Moderate chalks up surprise win in Romanian election rerun

Romanian assets rallied after centrist Bucharest Mayor Nicușor Dan delivered a surprise victory in Romania’s presidential election, defeating far-right nationalist George Simion 54% to 46%, despite trailing by 20 percentage points after the first round. The country’s currency and dollar bonds led emerging market gains as investors celebrated the defeat of a Trump-aligned candidate who promised to halt assistance to Ukraine and shift Romania from EU alignment.

The election marked the culmination of months of political turmoil after Romania’s Constitutional Court annulled a previous vote in December over Russian interference concerns. Fears that Romania might follow other European nations toward populist nationalism seem to have mobilized pro-EU voters, prompting a record 65% turnout.

- Runoff looms after centrist Warsaw mayor narrowly wins Polish presidential vote (Politico)

Dan now faces the immediate challenge of forming a government capable of implementing EU-mandated fiscal reforms. Romania’s 9.3% budget deficit is the largest in the bloc and rating agencies have threatened a downgrade to junk status, the FT reports. Dan’s victory removes a major geopolitical risk for Brussels and NATO.

Serbia joins EU payments system

Serbia has officially joined the Single Euro Payments Area (SEPA) following approval by the European Payments Council, with practical implementation expected by May 2026, BalkanInsight reports.

The move allows Serbian citizens and businesses to conduct euro transactions with EU member states more efficiently and at lower costs by eliminating intermediary banks, marking a significant step in the European Commission’s Growth Plan to integrate Western Balkan countries into the EU’s single market ahead of formal accession.

Latin America

Argentina’s Milei consolidates power

Argentina’s libertarian President Javier Milei delivered a strong victory in Buenos Aires elections on Sunday, with his La Libertad Avanza party securing over 30% of votes. The victory relegates former president Mauricio Macri’s center-right PRO party to third place with just 15.9%.

The result positions Milei’s anti-establishment movement as the primary alternative to Peronism ahead of crucial October midterms, marking a seismic shift in the country’s political landscape.

Capitalizing on this momentum, Milei is preparing reforms to lure an estimated $271 billion in hidden savings back into Argentina’s formal economy, the FT reports. The president plans to relax anti-tax evasion controls to entice savers who stashed undeclared dollars away from volatile pesos, betting that regularizing these funds will boost consumer spending and provide economic stimulus ahead of the midterm vote.

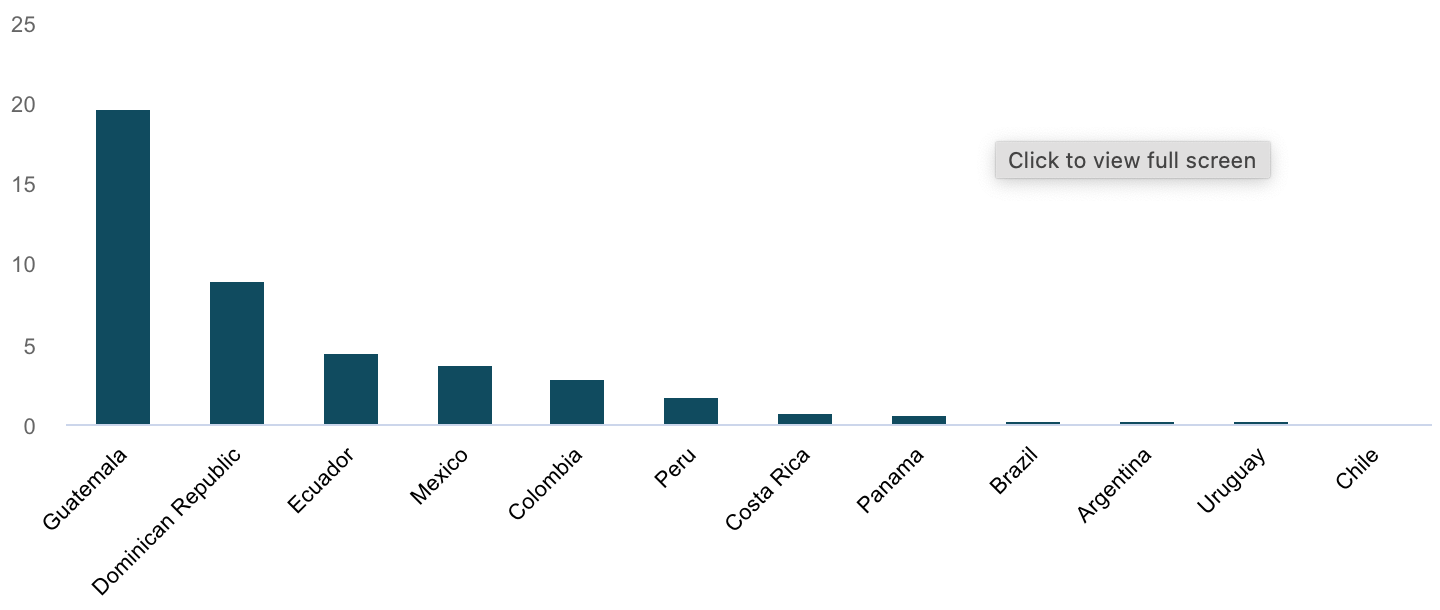

US remittance tax threatens Central American economies

A proposed 3.5% US tax on remittances could severely impact Central America’s economies, particularly Guatemala where money transfers constitute 19% of GDP and serve as the primary income source for 30% of the population, FrontierView reports. The measure, approved by just one vote in the House of Representatives this week, threatens to reduce critical cash flows that have become 1.5 times larger than formal employment income in Guatemala—and fund essential expenses across the region.

Almost 80% of remittances to Central America fund basic necessities including food, healthcare and education across households with limited formal employment opportunities. If the measure is enacted on January 1, 2026, analysts expect it to slow consumption growth and harm multinational companies targeting lower-income segments.

Global Macro

JPMorgan upgrades emerging market equities

Easing China-US trade tensions and a weakening dollar prompted J.P.Morgan to upgrade emerging market equities to “overweight” from “neutral” this week, Reuters reported. The move follows last week’s 90-day tariff reduction agreement that cut US duties on Chinese goods to 30% from 145% and Chinese tariffs on US imports to 10% from 125%, taming a significant headwind for EM stocks.

The MSCI emerging markets index has gained 9% year-to-date while the dollar index has declined 7.5%, creating favorable conditions for emerging market assets. J.P.Morgan remains bullish on India, Brazil, the Philippines, Chile, UAE, Greece and Poland, while highlighting promising opportunities in Chinese technology stocks despite ongoing trade uncertainties.

Valuations appear attractive with EM equities trading at 12.4 times forward earnings versus 19.1 for developed markets. J.P.Morgan expects further support from anticipated dollar weakness in the second half.

What We’re Reading

Ghana expects $12bn a year from small-scale gold production (Bloomberg)

State-owned refineries lag in Nigeria, forcing traders to rely on imports (Business Insider Africa)

Nigerian sovereign fund boosts exposure to Asia and Europe (Bloomberg)

Kenyan solar company using $80 mn World Bank loan to connect electricity-deprived (Semafor)

Uganda’s exports surge despite US setback (Bloomberg)

Mauritius wants to ride a wealth boom out of its tax haven reputation (Bloomberg)

Gas shortage hits Egypt’s fertilizer giants (Reuters)

25 African startups to watch in 2025 (Bloomberg)

Trump organization breaks ground on $1.5 billion Vietnam resort (Reuters)

Japanese logistics firm to build $10bn complex in Thailand (Nikkei)

Thailand and Indonesia agree to boost trade (Bangkok Post)

Philippines woos Google in push for data centers (Nikkei)

Philippines’ Marcos says open to reconciling with Dutertes (Reuters)

Oman debt issuance likely to slow to reduce debt, majority is Sukuk (Fitch Ratings)

EU to lift all remaining sanctions on Syria following US lead (NYT)

Saudi Arabia’s Sabic ‘exploring IPO’ of industrial gas unit (Bloomberg)

Morocco and Syria to reopen embassies after Assad fall (Barron’s)

Turkey detains Istanbul officials in escalating crackdown (FT)

Equinor, Polenergia agree on Polish offshore wind project (Reuters)

New fuel shortage hits Bolivia due to logistical delays (Mercopress)

Brazil’s command of soy markets tested by record crops and Argentina (Mercopress)

We are committed to providing FMN readers with a free weekly digest of politically unbiased, succinct and clear news and information from frontier and small emerging markets.

Please consider becoming a paid supporter to help cover some of our costs and support our continued development of sharp markets-focused coverage and new informational products. Paid subscribers will also gain exclusive access to our quarterly EM/FM report that aggregates EM insights from 25 major banks, international institutions and consultancies.