🌍 Frontier Markets News, May 17th 2025

A weekly review of key news from global growth markets

Africa

Ethiopia signs minerals and energy deals amid economic reform

Ethiopia this week inked minerals and energy deals worth more than $1.7 billion, primarily with Chinese companies, Reuters reports. The move comes as Ethiopia is in the thick of a far-reaching economic reform process.

The reform push has included floating the birr, Ethiopia’s currency, and a drive to push through an $8.4 billion debt restructuring with creditors, including China. Under its current program with the IMF, Ethiopia must reduce debt service by $3.5 billion until 2028 to make its debt “sustainable,” and will get a $2.5 billion in debt service relief.

This week’s deals, signed at a two-day investment conference in Addis Ababa, include $500 million for minerals exploration and processing, $600 million for coal mining, and another $610 million for solar energy development, Addis Ababa’s finance ministry said. The ministry did not specify when the country will receive the funds.

Nigeria sees opportunity in foreign oil companies’ withdrawal

As foreign firms are increasingly pulling out of Nigeria’s oil sector, local companies are looking to fill the void, creating a Nigerian-led industry, the FT reports. Nigerian firms, including Heirs Energies and Chappal Energies, are looking to move up the value chain from providing ancillary services to running their own oil fields.

The withdrawal of foreign companies is due to dwindling returns, concerns over environmental damage and oil theft, and tensions between firms and local communities. The latter has been so drastic that President Bola Tinubu called a state of emergency over pipeline sabotage.

Despite the headwinds, output has risen steadily over the past year to reach 1.4 million barrels per day in March, OPEC data. Leaders of the domestic oil producers credit their success to their better relationships with local communities and a willingness to develop assets often neglected by larger corporations.

Egypt weighs Suez discount to revive traffic

Egypt’s Suez Canal Authority is considering a transit fee discount ranging from 12% to 15%, Business Insider Africa reports, in an effort to boost traffic through the waterway. Commercial shipping has reduced sharply because of the ongoing attacks by the Yemen-based, Iran-backed Houthi militant group.

Late last year, Danish shipping giant Maersk estimated that traffic through the Suez Canal had plunged by two thirds. Before the attacks, around 15% of global trade passed through the canal. The downturn in ship passage has raised concern for Egypt’s economic stability.

The disruptions have increased shipping costs and eaten into the canal’s revenue, which dipped to $881 million—down from $2.4 billion the previous year, Egypt’s central bank said. Earlier this month, after a series of tit-for-tat strikes between the US and the Houthis, the two sides agreed to a surprise truce in the Red Sea.

Asia

Vietnam grapples with its place in post-tariffs world

Vietnam is still in the crosshairs of the Trump administration, despite the suspension last month of the heavy tariffs it wanted to impose on the Southeast Asian nation, the Council on Foreign Relations reports. Washington is intent on imposing tariffs on goods originating in China, many of which now pass through Vietnam.

The country is “probably the single middle-income economy most endangered by the Trump administration’s tariff policies,” senior CFR fellow Josh Kurlantzick said.

Vietnam still stands to benefit from Trump’s trade war, however. Seeking to reduce exposure to tariffs on China, some Chinese firms are investing heavily in Vietnamese facilities. Fast-fashion giant Shein, for example, is now leasing a warehouse in Ho Chi Minh city, Reuters reports. The country’s auto sector is another bright spot, with car sales rising 24% year-over-year in the first quarter, Nikkei reports.

Sri Lanka restructures near-$1bn credit line with India

Sri Lanka has signed a $931 million credit restructuring deal with India, the Sri Lankan finance ministry announced on Thursday. The deal covers some 11 lending arrangements between the two countries, and is set to bolster cooperation between them in areas such as energy, Reuters reports.

Last month, Sri Lanka signed a deal with India and the UAE to turn an east coast port city into an oil hub.

Sri Lanka has signed similar restructuring arrangements with other creditors in recent months, but it still needs to figure out how to deal the billions in outstanding debt to China.

Bangladesh unlocks $1.3bn funding from IMF

The IMF will release $1.3 billion funding for Bangladesh next month, the country’s finance ministry said on Wednesday. The disbursement will cover two tranches of the $4.7 billion bailout Bangladesh won from the IMF in 2023. Payments had been stalled while the lender pushed Dhaka to increase the flexibility of its exchange rate, Reuters reports.

- Bangladesh bans ex-PM Hasina’s party (NYT)

After securing the funding, Bangladesh then requested an additional $760 million in IMF support, the fund said. The IMF is now pushing Bangladesh to use the money to support economic reforms, including the shift to the market-based exchange rate and the reduction of subsidies.

Middle East

Saudi Arabia agrees to $600 billion in investments following Trump visit

Saudi Arabia is to commit up to $600 billion in foreign direct investment, energy agreements and arms purchases with the US following President Donald Trump’s visit to Riyadh this week, the FT reports. The agreements include a $142 billion arms purchase with around a dozen US defense companies, a $20 billion direct investment into US energy generation capacity, and various direct investments into US gas export and oil refining capacity.

The US also agreed to sell advanced AI chips to Riyadh, a move that will help Saudi Arabia achieve its ambitions to develop a domestic high-tech sector and diversify away from overdependence on energy exports. The agreement comes on the heels of a move to scrap Biden-era export controls on the highest-end semiconductors.

Saudi de facto leader Crown Prince Mohammed bin Salman said the kingdom is exploring additional deals that could bring the total bill to $1 trillion—roughly the country’s GDP. With oil prices far below the $90 per barrel budget breakeven and a rapidly growing fiscal deficit, it’s not clear how Riyadh will finance these investments, however.

US promises sanctions relief for Syria

US President Donald Trump this week promised to lift sanctions against Syria, in order to “give them a chance at greatness,” Reuters reports. Trump made the announcement ahead of a meeting—reportedly brokered by Saudi Crown Prince Mohammed bin Salman and Turkey’s President Recep Tayyip Erdoğan—with Syria’s President Ahmed al-Sharaa, the former leader of the militant group HTS, which led the coalition that toppled the Assad regime.

- Investors eye Syria after Trump sanctions move (Reuters)

Lifting sanctions will facilitate delivery of humanitarian aid, reopen trade, and give Syria access to the international financial system to fund reconstruction efforts.

Saudi Arabia and Turkey’s key roles in facilitating the gesture come amid regional competition for influence in the “new” Syria. As al-Sharaa’s primary security backer since the formation of HTS Turkey already has considerable influence, and Qatar has committed to clearing Syria’s debt arrears to unlock World Bank financing.

Jordan’s exports to region surge

Jordan this week reported that its exports to the Greater Arab Free Trade Area (GAFTA), which comprises 18 states from the Gulf, Levant, and North Africa, rose 12.2% year on year to $726 million, largely driven by strong demand for industrial products. Shipments of fertilizers, medicine and processed agricultural goods led the way as buyers sought alternative sources of supply amidst global trade uncertainty and supply chain crunches.

Jordan’s total trade volume grew to $1.92 billion and its trade deficit declined by 6%.

Strong growth in first-quarter earnings for companies listed on the Amman Stock Exchange suggest the economy is maturing, the Jordan Times reports. Financial services and industrials led a 7.6% year-on-year rise in net profits. Jordan’s turn toward regional trade and a shift from extractive exports to services and manufactured goods is also bolstering reserves, which stood at $22 billion as of January.

Europe

Albania’s ruling party wins historic fourth term

Albania’s Socialist Party secured an unprecedented fourth consecutive term in the country’s parliamentary elections, capturing 52% of the vote with 98% of ballots counted, Reuters reports. The party, which skews center right and is considered pro-business despite its name, will have 82 seats in the 140-seat parliament, giving Prime Minister Edi Rama substantial leverage to pursue his ambitious pledge to have Albania join the EU by 2030.

The opposition Democratic Party refused to accept the result, alleging “massive” vote-buying, and international observers from the Organization for Security and Cooperation in Europe said it had seen evidence of “misuse of public resources” and “widespread intimidation” during the campaign. Albania’s special prosecutor has launched investigations into 39 cases of alleged electoral violations.

Despite the controversy, the Socialist victory likely ensures political stability in Albania, in contrast with recent governmental crises across other Balkan nations. Prime Minister Rama, who forgave all government fines from 2015-2024 just days before the election, has cultivated Western support by accepting migrants from Italy and housing Afghans awaiting US visas.

Latin America

China races to enhance trade with South America

As tensions with the US escalate, Beijing is aggressively expanding its South American infrastructure footprint to secure vital agricultural imports, the Wall Street Journal reports.

State-owned agricultural conglomerate Cofco is constructing its largest export terminal outside China at Brazil’s Santos port, aiming to triple annual export capacity to 14 million tons by next year. Simultaneously, Chinese enterprises are developing extensive railroad networks across Brazil’s agricultural heartland and completing a $3.5 billion deep-water facility on Peru’s Pacific coast.

Brazil’s emergence as China’s agricultural lifeline—the country now supplies some 70% of Chinese soybean imports—is creating significant logistical bottlenecks as swelling export volumes overload port, rail and road infrastructure. Compounding these challenges, Brazil’s intensive three-harvest system continues to deplete soil nutrients as fertilizer costs soar, with the country importing 85% of its requirements, primarily from Russia.

Bolivian presidential election thrown into turmoil

Bolivia’s August elections broke into chaos this week as both sitting President Luis Arce and former president Evo Morales exited the race, Mercopress reports. Arce’s surprise withdrawal, ostensibly to preserve leftist unity and prevent a conservative resurgence, came as his odds of winning dwindled amid an economic crisis and infighting in his Movement for Socialism (MAS) party.

A day after Arce’s withdrawal Bolivia’s Constitutional Court ruled that Morales was barred from seeking reelection because he had already served the maximum two terms. Morales’ disqualification comes after rape allegations prompted the former president to flee from arrest, with the support of hundreds of coca farmers.

The political realignment could deepen uncertainty in the Andean nation and exacerbate an already dire economic crisis, which has seen sharp rises in prices prompt widespread protests.

Global Macro

Falling dollar cushions trade shocks in EMs

The unexpected depreciation of the US dollar has become a critical buffer for emerging markets facing mounting trade war pressures, according to an analysis by Fitch Ratings. The shift has eased debt burdens for sovereigns with substantial foreign-currency obligations and created greater flexibility for emerging-market central banks to cut interest rates.

Without this dollar weakness, emerging economies would face significantly greater strain as global growth is forecast to fall below 2% this year, with Chinese expansion dropping under 4% and US growth expected to slow sharply through 2025. The ratings firm notes the Asia-Pacific region remains particularly exposed given its relative openness and its dependence on US demand.

Many corporates in emerging markets remain vulnerable, too, particularly Chinese homebuilders, Mexican manufacturers and Latin American airlines facing supply chain disruptions, the report noted.

What We’re Reading

Guinea junta scraps dozens of private mining concessions (AFP)

Stability holds In Mauritania as jihadists ravage Sahel (Barron’s)

Mali dissolves all political parties as opposition figures disappear (Radio France International)

Uganda’s parliament introduces bill to let military courts try civilians (Reuters)

Eswatini plans $275 million wealth fund (Bloomberg)

Namibia to add 93 MW renewable capacity to reduce electricity imports (Bloomberg)

IMF cuts Angola’s growth outlook (Reuters)

Smaller African countries struggle in fragmented business landscape (FT)

AI ‘could unlock $100 billion per year’ for Africa (McKinsey)

Cambodia holds trade talks with US as 49% tariff weighs on outlook (Yahoo!)

Cambodia hosts China for largest joint military exercise (AP)

Malaysia’s PM meets Putin in Moscow (Moscow Times)

Marcos’ hold on Philippines senate grows shaky while Duterte wins mayor race from jail (BBC)

Kazakhstan, UAE sign over $5bn in agreements during crown prince’s visit (The Astana Times)

Oman plans $8bn natural gas assets sale (Offshore Technology)

Oman and Japan sign pact to boost green energy and environmental cooperation (Zawya)

US presents Iran with nuclear deal proposal as Trump says agreement is close (Reuters)

Grain exports from Ukraine’s Odesa ports surpass pre-war levels (Maritime Exeuctive)

Kaczyński’s presidential gamble tests his grip on Polish opposition (FT)

Hungary opposition slams move to curb critical NGOs and media using Russia-inspired law (BalkanInsight)

EU readies capital controls and tariffs to safeguard Russia sanctions (FT)

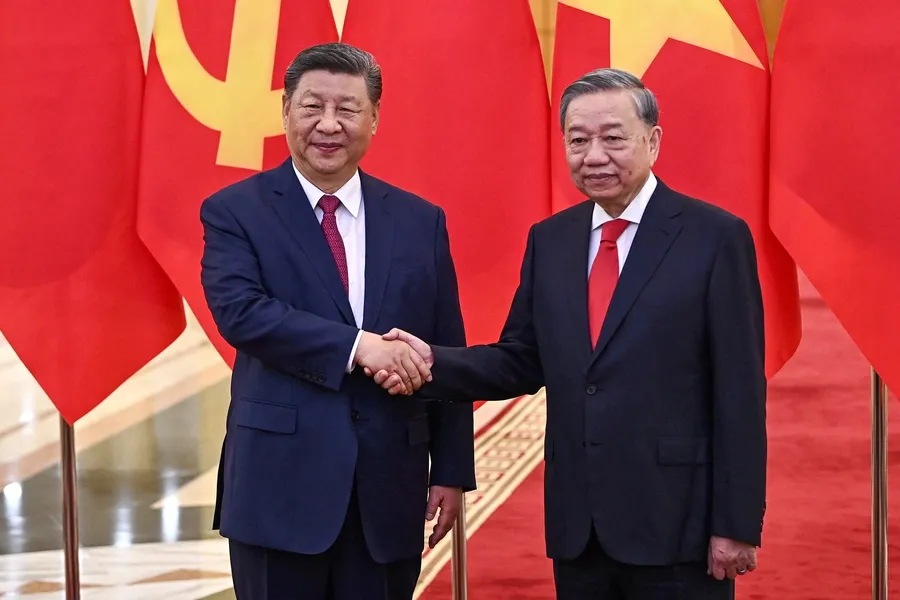

China’s Xi Jinping backs Panama against US over canal (FT)

Colombian lawmakers reject president’s labor reform referendum (AP)

Peru’s Boluarte taps justice minister for PM as cabinet resigns en-masse (Reuters)

Fitch upgrades Argentina (Mercopress)

Milei’s split with former president Mauricio Macri turns Argentina into conservative battleground (FT)

We are committed to providing FMN readers with a free weekly digest of politically unbiased, succinct and clear news and information from frontier and small emerging markets.

Please consider becoming a paid supporter to help cover some of our costs and support our continued development of sharp markets-focused coverage and new informational products. Paid subscribers will also gain exclusive access to our quarterly EM/FM report that aggregates EM insights from 25 major banks, international institutions and consultancies.