🌍 Frontier Markets News, June 7th 2025

A weekly review of key news from global growth markets

Africa

Chad seeks $30 billion for national development plan

Chad’s finance minister Tahir Hamid Nguilin announced this week that the country’s national development plan needs to attract $30 billion in public and private investment to reach its growth goals, Reuters reports.

The “Chad Connection 2030” plan, which includes areas such as digitalization and infrastructure, is expected to boost average annual economic growth by 8% from 2025-2030, Nguilin said. Among its aims: doubling agricultural production, encouraging private investment in roads, electricity and the digital economy, and increasing production in the oil and mining sectors.

Chad’s government will launch the plan, which already has the support of the IMF and the World Bank, in September in Abu Dhabi. Late last month Chad reached an agreement with the IMF for a four-year $630 million extended credit program.

Côte d’Ivoire launches West Africa’s first commodities exchange

Côte d’Ivoire has debuted an agricultural commodities exchange, the first of its kind for West Africa, Semafor reports. The exchange took seven years to plan and is designed to replace the informal trading practices in the region with a more regulated platform that can adapt to shifting supply and demand.

Within the first 10 minutes of the exchange’s going live, around $54,000 of maize, raw cashews and kola nuts were traded. Cocoa, Côte d’Ivoire’s main agricultural export, will join the exchange in the near future, the West African Regional Stock Exchange has said.

Africa ‘can unlock $4trn for infrastructure’

The African continent has the potential to tap into at least $4 trillion in domestic capital to boost its infrastructure growth, according to a new report by the Africa Finance Corporation. The AFC says Africa’s institutional investors alone are failing to mobilize $1.1 trillion, with pensions, insurance and sovereign wealth funds—and public development banks—channeling funds into “low-risk and short-term instruments” instead of “the real economy.”

While foreign-currency reserves constitute a majority of the non-bank portion at some $2.5 trillion, about 28% is made up of pensions alone. The AFC estimates that $455 billion is domiciled in pension funds and another $150 billion is held by sovereign wealth funds.

The African Development Bank estimates the continent needs between $130-$170 billion per year to fund infrastructure development. The AFC report indicates that Africa has what it needs to do so—although others argue that most African nations lack the regulatory clarity and financial instruments to unleash the funds.

Asia

Vietnam prepares trade package for US

Vietnam this week promised to buy $2 billion more in produce from US farms as part of its effort to reduce US President Donald Trump’s 46% “reciprocal” tariff, announced in April, Reuters reports. The duties were paused after less than a week but are due to return in July.

Vietnam’s top trade negotiator Nguyen Hong Dien also this week met with US Trade Representative Jamieson Greer in Paris to try to push forward negotiations over a trade pact, Vietnam+ reports.

- Vietnam scraps two-child policy (NY Times)

Vietnam’s exports to the US have surged in recent years—as have Chinese exports to Vietnam—in part because Chinese manufacturers built up capacity in Vietnam to sidestep earlier sanctions on China. Trade data released this week will do little to allay concerns about the US’ ballooning deficit with Vietnam: The Southeast Asian nation’s exports rose 14% in May.

Afghanistan and Pakistan reach detente after China-mediated talks

Pakistan will upgrade diplomatic ties with Afghanistan, Pakistani foreign minister Ishaq Dar announced on X. The two sides met last month in Beijing and have been working in the weeks since on mending ties that have been strained since the Taliban took over Afghanistan in 2021.

The move highlights Pakistan’s growing alignment with Chinese foreign policy. Although the Taliban initially faced international isolation, China became the first country to reappoint an ambassador to Afghanistan in 2023, Nikkei reports.

- Pakistan ramps up drive to deport Afghan migrants (Hindustan Times)

The decision follows a recent conflict between Pakistan and India, during which Pakistan used China-made weapons to shoot down Indian fighter jets. The hostilities, which ended in a cease-fire agreement after four days, briefly saw Pakistan’s benchmark stock index crater. It is now back at record high levels.

Mongolian protests prompt PM to step down

Mongolia’s prime minister resigned on Tuesday after losing a parliamentary vote of confidence sparked by concerns over his son’s ostentatious displays of wealth.

Protesters have demonstrated across Mongolia for the past several weeks after photos reportedly emerged of Prime Minister Luvsannamsrain Oyun-Erdene’s son on a luxurious vacation. The photos, including a now infamous shot of a Dior shoulder bag, led protesters to question the source of the younger Oyun-Erdene’s wealth, AP reports.

Oyun-Erdene fell 20 votes short of the 64 votes he needed to overcome the no-confidence vote, BBC reports. He has denied wrongdoing.

Middle East

Saudi Arabia’s growing investment commitments pile pressure on fiscal policy

Saudi Arabia’s deep fiscal deficit continues to grow, as recent foreign direct investment commitments made during US President Donald Trump’s state visit are expected to add to Riyadh’s financing gap, Bloomberg reports. De facto leader Crown Prince Mohammed bin Salman has already committed $300 billion to US investments, arms purchases and joint ventures, with a total $1 trillion expected over the coming 10 years.

Bloomberg estimates that Saudi Arabia’s sovereign wealth fund the PIF has total assets of $940 billion, most of which is held in illiquid investments. The Saudi central bank reports liquid FX reserves of $154.9 billion as of April 2025, most of which are earmarked for defending the currency’s peg to the dollar.

To fund its massive commitments—including the Vision 2030 plan, which alone is forecast to cost at least $2 trillion—Saudi Arabia is expected to issue another $12.6 billion in sovereign bonds this year on top of the $14.4 billion already issued. The country was the largest EM debt issuer last year.

Kurdish parties threaten to quit Iraq’s political process over deepening budget row with Baghdad

Kurdish political parties this week threatened to pull out of Iraq’s federal government as a years-long dispute spilled over into the electoral process, The New Arab reports. Members of the Kurdish Regional Government are protesting over a suspension of revenue transfers that support Kurdish public sector salaries and government operations, arguing the move is an attempt by Baghdad to force the KRG to transfer oil revenues to the central government.

Kurdish political parties could play a crucial role in forming a governing coalition following parliamentary elections in November. With independent candidates gaining strength, regionally-focused political parties such as the Kurdish coalition are expected to wield more power in future Iraqi governments, Amwaj reports.

Europe

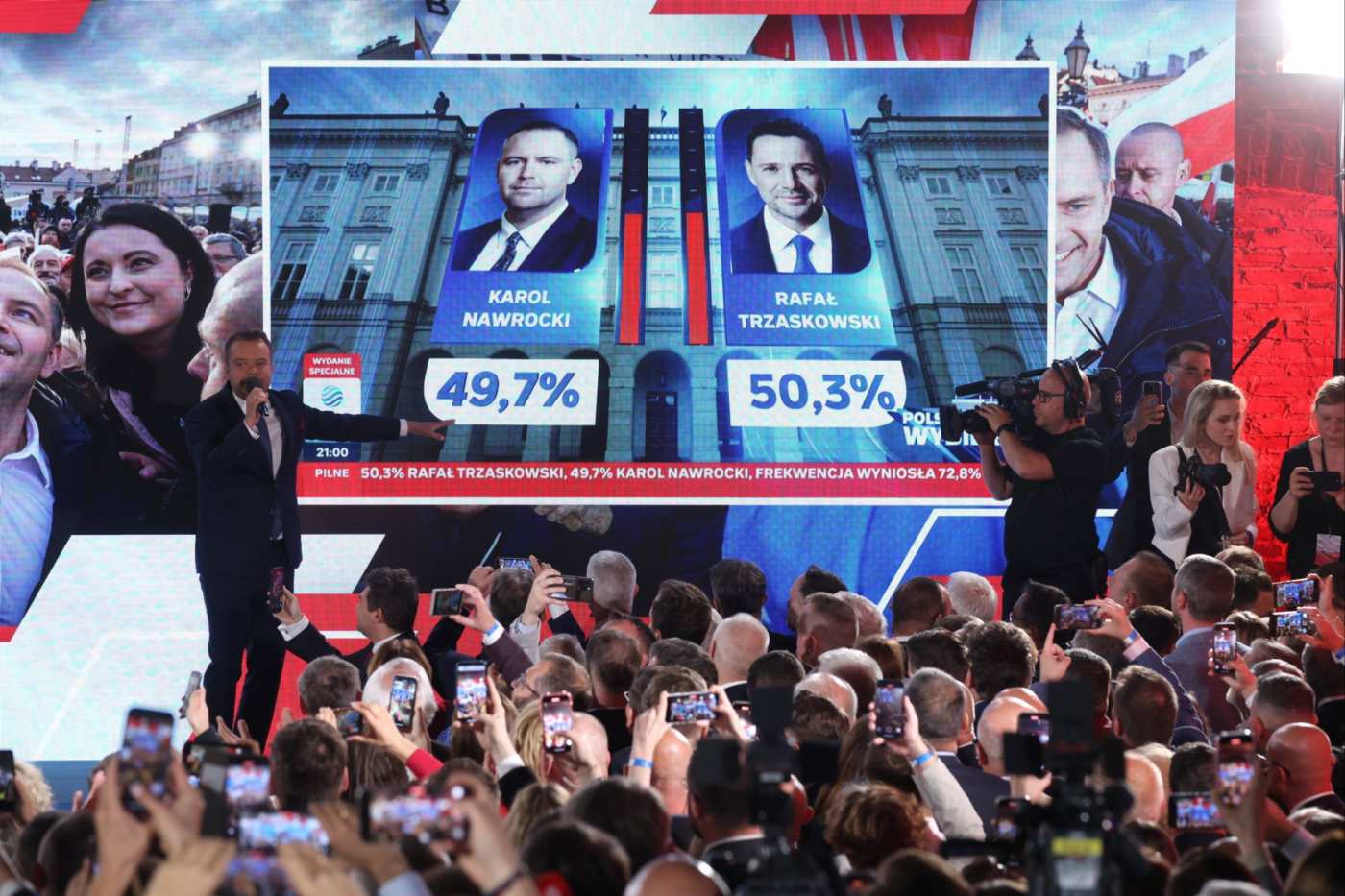

Poland's nationalist presidential victory upends government

Poland’s government was thrown into turmoil this week after conservative historian Karol Nawrocki’s narrow presidential victory prompted Prime Minister Donald Tusk to call for a confidence vote, the FT reports. The nationalist president-elect, backed by the opposition Law and Justice party and allied with far-right voters, has vowed to block key legislation through presidential vetoes just as his predecessor did, Balkan Insight reports.

The outcome paralyzes critical policy, threatening €40 billion in EU recovery funds tied to judicial reforms. Fitch warns this political deadlock will also obstruct fiscal consolidation efforts as Poland’s debt trajectory deteriorates amid mounting defense spending pressures.

Nawrocki has also said he will oppose Ukraine’s NATO membership and resist sending Polish troops to Ukraine, according to Reporting Democracy.

Latin America

Argentina reaps benefit of shock therapy

Argentina is set to emerge as a frontier market darling in 2025, Mercopress reports. The OECD is projecting the South American nation’s economy will grow by 5.2%, putting it ahead of all G20 peers except India.

The OECD credits President Javier Milei’s so-called shock therapy reforms and a fresh $20 billion IMF package for driving the economic recovery from last year’s 1.7% contraction.

The dramatic turnaround highlights the potential rewards for investors willing to stomach volatility in reform-driven emerging economies, with Argentina’s growth rate dwarfing regional peers Brazil (2.1%) and Mexico (0.4%).

While inflation remains a significant headwind at 36.6% projected for 2025—still the highest among G20 nations—the sharp decline from 2024’s hyperinflationary 219.9% suggests the country may finally be turning the corner on its chronic monetary instability.

Wind energy projects stall in Colombia

Colombia’s renewable energy ambitions are under threat as major international players including Italy’s Enel, Portugal’s EDP Renewables, and Norway’s Statkraft have abandoned or sold off wind projects in the resource-rich La Guajira region, AP reports. The exodus has been prompted by concerns over limited grid infrastructure, regulatory changes that squeeze returns, and complex social tensions with indigenous communities.

The stalled projects pose significant risks to Colombian President Gustavo Petro’s pledge to reach net-zero emissions by 2050 and his government’s energy transition strategy, particularly as the massive Cerrejón coal mine—a major regional economic anchor—has only nine years of reserves remaining. The delay in tapping into what the government claims is a wind-power capacity of 18 gigawatts also raises questions about the country’s ability to diversify away from oil dependence.

Industry experts warn Colombia is now more than 20 years behind Brazil, which has built over 1,300 wind farms in two decades. Just two wind farms in Colombia are operational with less than 32 megawatts of combined capacity.

Global Macro

Trade war poses a bigger threat than Covid, says IMF

Trump’s trade war poses a tougher challenge for emerging markets than Covid-19 because tariffs create “differential effects” rather than synchronized global easing, according to IMF’s Gita Gopinath, quoted in the FT.

Complicating the outlook is the fact that the US central bank will be reluctant to cut interest rates as tariffs drive up prices. That could tighten financial conditions for developing economies just as they need to cushion their economies from the impact of the global trade war.

Unlike during Covid when central banks worldwide slashed rates together, this divergence leaves emerging markets particularly vulnerable to capital flow disruptions. Gopinath warns of additional risks from rising cryptocurrency adoption, particularly dollar-backed stablecoins that could destabilize local currencies through capital substitution in developing economies.

What We’re Reading

World Bank to restart lending to Uganda after anti-LGBTQ bill pause (Bloomberg)

Botswana cuts 2025 growth forecast to near-zero (Reuters)

DRC surprises US with UAE mining deal (FT)

Ghana’s currency appreciation drives demand for imports (FrontierView)

Nigeria calls for private sector-led ECOWAS integration (Premium Times)

Nigerian drone startup wins $1.2mn contract for hydropower plant security (Semafor)

Côte D’Ivoire bars ex-Credit Suisse leader from presidential ballot (Bloomberg)

Madagascar courts UAE investment to offset US tariff threat (Bloomberg)

Bill Gates will give majority of his wealth to health and education in Africa (Business Insider Africa)

Hydrogen from Africa to Europe to remain “prohibitively expensive” without interventions (Nature Energy)

Chinese pullback reshapes African energy investment landscape (Semafor)

Bangladesh issues another arrest warrant for ousted PM Hasina (NYT)

Pakistan to offer to buy more soybeans to slim trade surplus with US (Nikkei)

Laos president says must lure more countries to invest (Nikkei)

Indonesia rolls out $1.5bn stimulus as economic fears mount (FT)

Turkish banks face pressure from higher interest rates (Fitch Ratings)

Syrian stock exchange reopens after a 6-month hiatus (Fortune)

Iran’s Khamenei dismisses US nuclear proposal (Reuters)

Iran’s outsized gold-price rise increases inflationary pressure (FT)

EC gives Bulgaria green light to adopt euro from January 1 (Radio Free Europe)

Romania’s growth outlook ‘weakens amid growing downside risks’ (ING)

Hungarian economic data surprise to the upside (ING)

Peru’s leader clings to power despite rock bottom approval rating (France24)

US and China spar for influence on the Paraguay-Paraná river system (Americas Quarterly)

IMF approves $1.5bn credit line for Costa Rica (Reuters)

Momentum for red tape reform in Chile picks up (Americas Quarterly)

We are committed to providing FMN readers with a free weekly digest of politically unbiased, succinct and clear news and information from frontier and small emerging markets.

Please consider becoming a paid supporter to help cover some of our costs and support our continued development of sharp markets-focused coverage and new informational products. Paid subscribers will also gain exclusive access to our quarterly EM/FM report that aggregates EM insights from 25 major banks, international institutions and consultancies.