🌍 Frontier Markets News, June 28th 2025

A weekly review of key news from global growth markets

Africa

Peace plan opens door for DRC-Rwanda hydropower plant

A long-anticipated hydropower plant between Democratic Republic of Congo (DRC) and Rwanda got a nudge forward this week when a US firm announced it was supporting the public-private partnership, Bloomberg reports. In the wake of successful US-backed peace talks between DRC and Rwanda over conflict in the Congo’s northeast, US firm Anzana Electric Group said it will work with Rwanda-registered Ruzizi III Holding Power Company to develop the project.

- Africa doubled new hydropower capacity last year, adding 4.5 GW (Bloomberg)

- Burundi commissions first phase of $320mn hydropower project (Reuters)

The 206 megawatt, $760 million plant on the Ruzizi River between the two countries aims to “drive regional integration” the companies said in a press release on Tuesday. The project, which could open as soon as 2030, will join two other plants on the river. It could nearly double power capacity for neighboring Burundi, increase Rwanda’s by almost a third, and provide baseload power for eastern DRC.

The hydropower plan has been in the works for almost a decade but has been stalled by the conflict in the area. The two countries’ foreign ministers signed a peace deal in Washington on Friday aiming to put an end to decades of fighting.

Climate finance slipping from reach in Africa

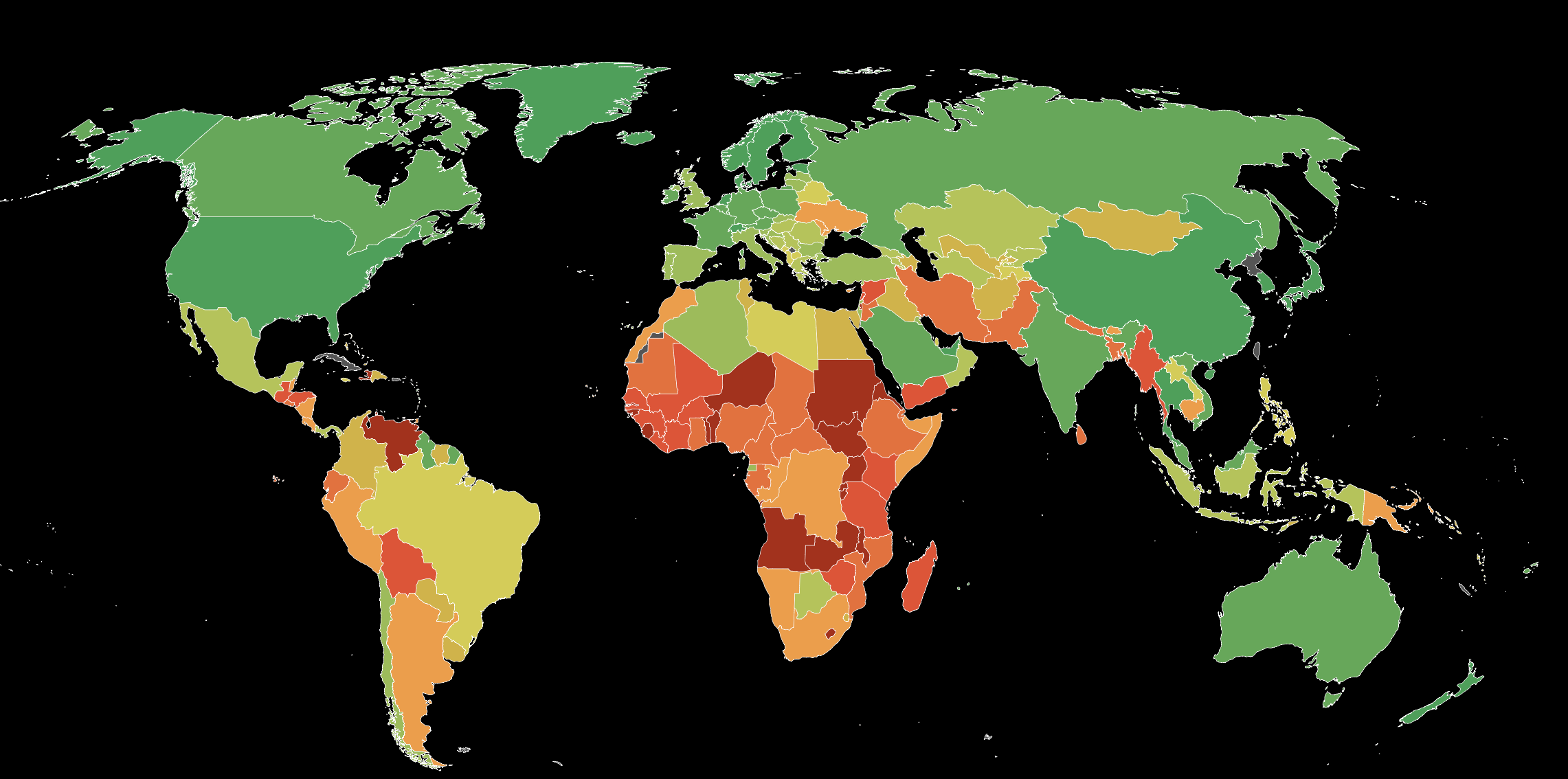

A new Climate Finance Vulnerability Index released by the Columbia University Climate School has shown that all the countries facing the direst threat from climate change are in Africa. At least two billion people live in countries with both high risk for climate effects and low access to financing, with the four most vulnerable countries being Guinea Bissau, Eritrea, Angola and Zambia.

The continent is warming faster than the rest of the world on average, despite generating less than 4% of global greenhouse gas emissions. Morocco, for example, reached a new high of 122 degrees Fahrenheit in 2023; Tunisia, Uganda, and Mali reached their own temperature records.

The UN Environment Program estimates it will cost developing countries $215–387 billion to adapt to climate change. Adaptation funding from public sources amounted to just $27.5 billion in 2022. Aid cuts by major donor countries such as the US and UK are expected to reduce that funding further.

Kenya expands labor exports to counter unemployment

The Kenyan government plans to double down on a labor export program in an effort to curb the high youth unemployment and drive up foreign remittances, Semafor reports. The country already has several overseas partnership agreements, and so far some 400,000 people have begun jobs in countries such as the UK,UAE, Qatar and Poland, primarily in low-skill sectors such as domestic work and social care.

The government, which has faced criticism for the program, hopes to eventually send up to a million Kenyans per year to work overseas.

Critics, including lawmakers and youth, are concerned about the socio-economic implications of putting more focus on jobs abroad. They have pointed out the need instead for a better balance by adding jobs at home, too.

Asia

Indonesian wealth funds to boost renewables-related investments

Indonesia’s two sovereign wealth funds will boost investment in projects related to clean energy development, their leaders announced on Wednesday.

The Indonesia Investment Authority will focus on critical minerals for electric vehicles and solar energy development, Nikkei reports. Danantara, a fund established in February, will focus on upgrading transmission lines that were built for fossil fuel-generated power, its chief investment officer said.

- Indonesia president flags free-trade deal during Russia visit (Indonesia Business Post)

Both national funds have previously signaled an openness to partnering with foreign players. Last month they signed a deal to invest in Indonesia’s nickel sector with the French mining firm Eramet. The goal of the partnership is to develop a domestic battery supply chain.

IMF approves $1.3bn tranche for Bangladesh

Bangladesh secured IMF approval on Monday for the disbursement of another $1.3 billion in its $4.7 billion loan agreement.

The lender had previously approved the tranche in a staff-level agreement last month, during which Bangladesh requested an additional augmentation equivalent to nearly $800 million in additional borrowing. The IMF called the performance of the Bangladesh loan program “broadly satisfactory despite the difficult political and economic context and increased downside risks.”

The IMF and Bangladesh agreed to a $4.7 billion bailout in 2023. But after the lender approved the augmentation in the Monday package, total assistance has blown past the initially agreed upon sum to $5.5 billion, Bloomberg reports.

Middle East

Saudi Arabia eyes ambitious cultural sector growth plan to diversify economy

Saudi Arabia’s culture ministry this week said the nation’s cultural sector has surpassed its target of contributing 0.91% to the country’s GDP ahead of schedule, and raised the target to 3%—about $48 billion—by 2030, Arab News reports. Employment in the cultural sector, which encompasses the art, tourism and media industries, has more than quadrupled since 2018 on the back of an ambitious government-led investment program.

Saudi Arabia surpassed its annual tourism target for the second year in a row, recording 116 million visitors—an 8% annual increase. Riyadh has spent heavily on tourism mega-projects such as the troubled Neom project, and is drawing down public finances even more to host Expo 2030 and the 2034 soccer World Cup.

The country hopes income from industries such as tourism and technology will offset declines in oil-export revenues, which have slumped to the lowest level since Covid. The IMF appears to agree: It slightly increased its annual growth forecast for Saudi Arabia to 3.5%, citing increased government spending on construction projects and its potential to recapture oil-market share as OPEC increases production output.

Oman to impose personal income tax as part of non-oil economic strategy

Oman’s Sultan has issued a decree making it the first Gulf state to introduce income tax, the AP reports. Part of a broader move to reduce dependence on oil revenues, the 5% tax on annual incomes over $109,000 is designed to diversify the government’s revenue.

The non-oil strategy appears to be paying off. In the first quarter of this year, Oman’s GDP grew 4.7% year-on-year, even as oil’s GDP share slipped by 7.5% on the back of lower prices. The country’s manufacturing sector contributed 10% to national GDP in 2024, chalking up 8.7% growth.

Oman’s economy ministry attributes the success in part to greater-than-expect foreign direct investment flows, which reached an above-target $77 billion in 2024. This year’s first quarter saw US-originated investments rise by 58% to over $7 billion, UK by 21%, Qatar by 65%, and Switzerland more than doubling.

World Bank disburses $1bn to regional governments

The World Bank this week announced the disbursement of more than $1 billion in debt and grant aid financing to Iraq, Lebanon and Syria to support economic recovery and infrastructure development. An initial $250 million tranche of a total $1 billion from the Lebanon Emergency Assistance Project (LEAP) was disbursed to “support the most urgent repair and reconstruction of damaged critical public infrastructure and lifeline services” in Lebanon’s conflict-stricken regions.

The bank will also provide “enhanced implementation and supervision support measures” to assist the newly-formed government.

Syria received a $146 million emergency grant aimed primarily at restoring electricity supply and supporting the energy sector’s reconstruction. The funds will be managed by a new program, the Syria Electricity Emergency Project (SEEP), which is expected to provide hands-on technical assistance in repairing damaged electricity generation and transmission infrastructure.

The largest recent World Bank disbursement to the region has gone to Iraq, a $930 million debt financing package for improving local rail networks. The project will improve connectivity between the Umm Qasr Port in the south and Mosul in the north, effectively connecting Iraq’s largest oil fields to Turkey, making Iraqi energy exports to Europe logistically and economically viable.

Europe

Romania set to raise military spending despite debt woes

Romania is pushing ahead with plans to raise its defense budget from 2.5% to 3.5% of GDP by 2030, plus an extra 1.5% for military-related infrastructure and cybersecurity, even as it wrestles with a budget deficit over three times the EU’s recommended ceiling. Leaders argue bolstering defense is critical to maintaining NATO’s eastern flank stability, deterring Russian aggression, and preserving the US military presence, Balkan Insight reports.

Romania’s deficit last year hit 9.3% of GDP, prompting Brussels to demand the country produce a credible fiscal plan or risk sanctions. Political instability and delayed reforms have further complicated efforts to stabilize the economy.

Military experts warn that Romania’s armed forces still face major gaps, including a weak navy and outdated infrastructure.

Latin America

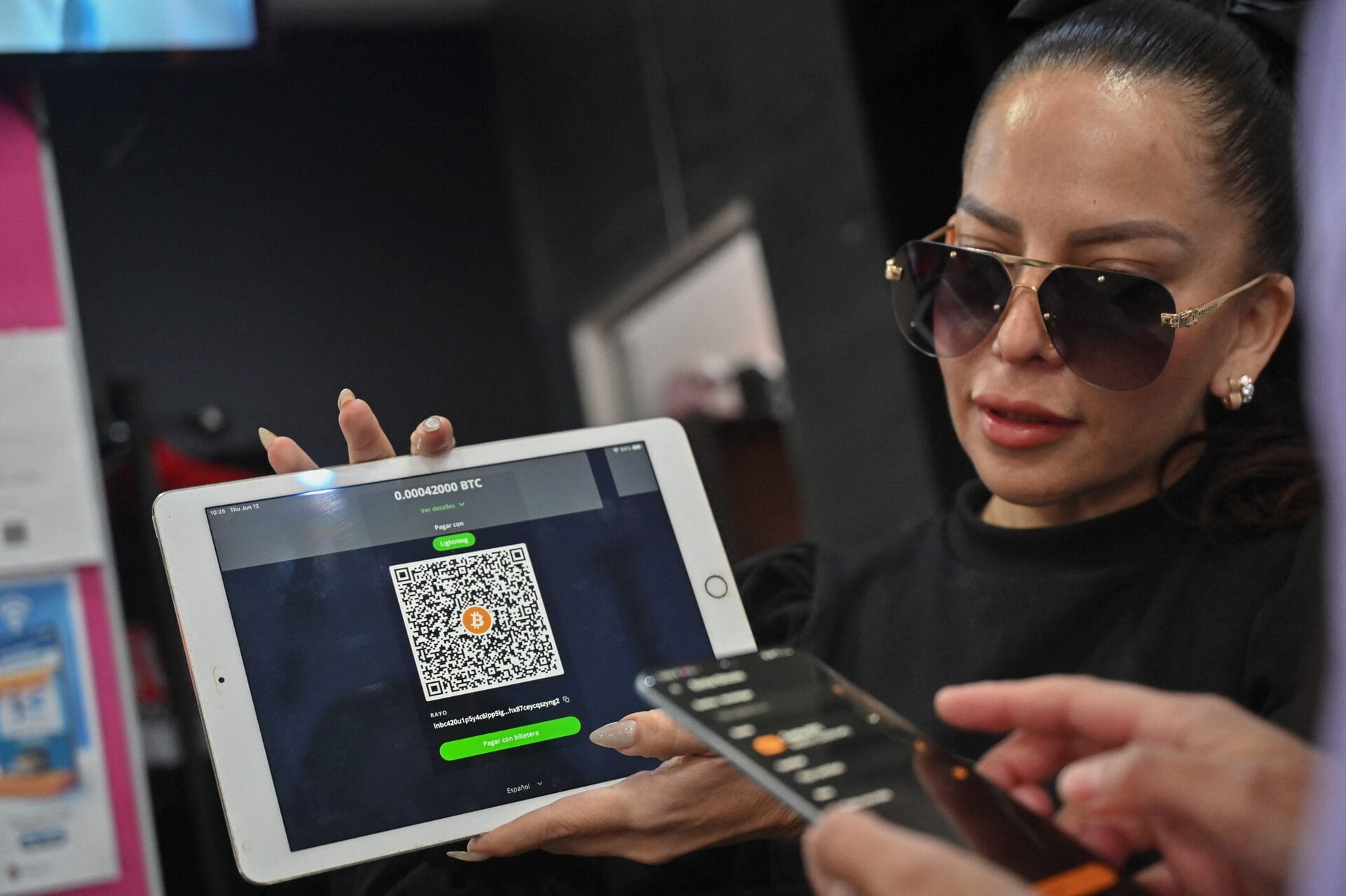

Bolivians turn to crypto

Facing record inflation, a dollar shortage, and a collapsing boliviano on the black market, Bolivians are increasingly adopting cryptocurrencies and stablecoins, with retailers and service providers offering discounts for bitcoin payments, Reuters reports. The domestic crypto market, estimated at around $600,000 in daily USDT volume, remains small compared to traditional channels but Bolivians increasingly see digital assets as a stable alternative to the national currency, which has halved in value on the black market this year.

The surge in crypto use comes as Bolivia grapples with its worst economic crisis in a generation, fueled by dwindling gas production, costly fuel imports and a wide spread between formal and parallel exchange rates. While supporters tout digital assets as a safeguard against currency collapse, critics warn that “crypto-colonialism” and volatility could deepen financial risks for already vulnerable households.

Uruguay’s Swiss franc bond highlights rush to diversify beyond dollar

Uruguay has tapped the Swiss franc bond market for the first time, issuing CHF 320 million ($400 million) in new debt to help finance its $6 billion 2025 fiscal deficit, MercoPress reports. Economy minister Gabriel Oddone praised the favorable 1.33% average interest rate and emphasized the strategic move to access Switzerland’s high-quality investor base, positioning Uruguay as the only Latin American issuer currently active in this currency.

The shift mirrors a broader trend among emerging markets to reduce dependence on the greenback. As US rate volatility and a weaker dollar reshape global flows, EM sovereigns are tapping local-currency and alternative hard-currency markets at record pace, with local-currency returns surpassing 10% year-to-date. Countries from Brazil to India are raising funds in euros, yuan and other non-dollar denominations, aiming to hedge currency risk and strengthen financial resilience in a changing rate environment.

Surging imports undermine Argentina’s growth

Argentina’s economy expanded just 0.8% in the first quarter, missing forecasts as rising imports, weaker exports and continued government austerity constrained momentum, Bloomberg reports. Although year-on-year growth reached 5.8% thanks to a low base after last year’s deep recession, the quarterly expansion fell short of the 1.5% median forecast, raising doubts about the pace of recovery under President Javier Milei’s sweeping reforms.

Household spending showed resilience with a 2.9% quarterly gain, supported by rising wages and looser credit conditions, while inflation eased to its lowest monthly rate in five years. Backed by a $20 billion IMF program and a more flexible currency regimen, Argentina’s economy is projected to grow 5.2% this year, but performance will depend on sustaining policy credibility as a fresh IMF review looms.

Global Macro

Emerging markets outperform amid global uncertainty

Emerging markets are outperforming their developed-market peers despite tensions over the trade war and Middle East conflicts, the FT reports. Both the JPMorgan local currency bond index and MSCI emerging-market equities index have gained more than 10% this year as investors have been shifting toward EM assets amid erratic US policymaking, higher EM real yields and low valuations.

A weaker dollar has also supported emerging-market currencies, giving central banks more room to cut rates and stoke domestic growth.

Structural concerns about emerging-market debt have eased compared to the 2010s, with fiscal worries now more acute in developed markets, according to HSBC’s Max Kettner. With Treasury-specific risk premiums rising and global investors looking for yield and growth, emerging markets have found renewed appeal.

What We’re Reading

Ghana’s parliament approves a $2.8 billion debt restructuring deal (CNBC Africa)

Senegal’s public debt soared since March (Reuters)

Gabon signs $3.8bn funding pact with Afreximbank (Bloomberg)

Ethiopia to allow international banks and investors to apply to operate in-country (Reuters)

Angolan president urges US firms to invest beyond oil and minerals (Bloomberg)

Angola and Zambia push Lobito Corridor rail project as financing talks advance (Reuters)

Egypt’s natural gas firm allocates six new exploration blocks to global groups (Business Insider Africa).

Libya and Turkey ‘sign offshore oil cooperation agreements’ (Reuters)

Vietnam signs off on country’s first free-trade zone (Vietnam Investment Review)

Cambodia-Thailand spat escalates with internet, trade and visa restrictions (Bangkok Post)

Thai PM to face no confidence vote (Bangkok Post)

Thailand moves to recriminalize cannabis, shaking $1 billion industry (Reuters)

Pakistan, fresh off nominating Trump for Nobel Peace Prize, says US trade talks will wrap next week (Dawn)

Pakistan approves $4.5bn in loans to local banks to ease energy debt (Reuters)

Japan doubles security aid recipients, adding Sri Lanka and Thailand (Nikkei)

Can the Gulf buy its way to AI supremacy? (Rest of World)

Iran’s parliament approves bill on suspending cooperation with IAEA (Reuters)

Turkey’s economic woes catch up with Erdoğan (FT)

Russian banks fear debt crisis is coming as war strains economy (Bloomberg)

Panama cracks down on protests (AP)

Colombia braces for US censure over faltering drug war (International Crisis Group)

Colombia’s China pivot raises US concerns (Americas Quarterly)

We are committed to providing FMN readers with a free weekly digest of politically unbiased, succinct and clear news and information from frontier and small emerging markets.

Please consider becoming a paid supporter to help cover some of our costs and support our continued development of sharp markets-focused coverage and new informational products. Paid subscribers will also gain exclusive access to our quarterly EM/FM report that aggregates EM insights from 25 major banks, international institutions and consultancies.