🌍 Frontier Markets News, January 30th 2026

A weekly review of key news from global growth markets

Africa

African funding flows reverse as China reprofiles lending

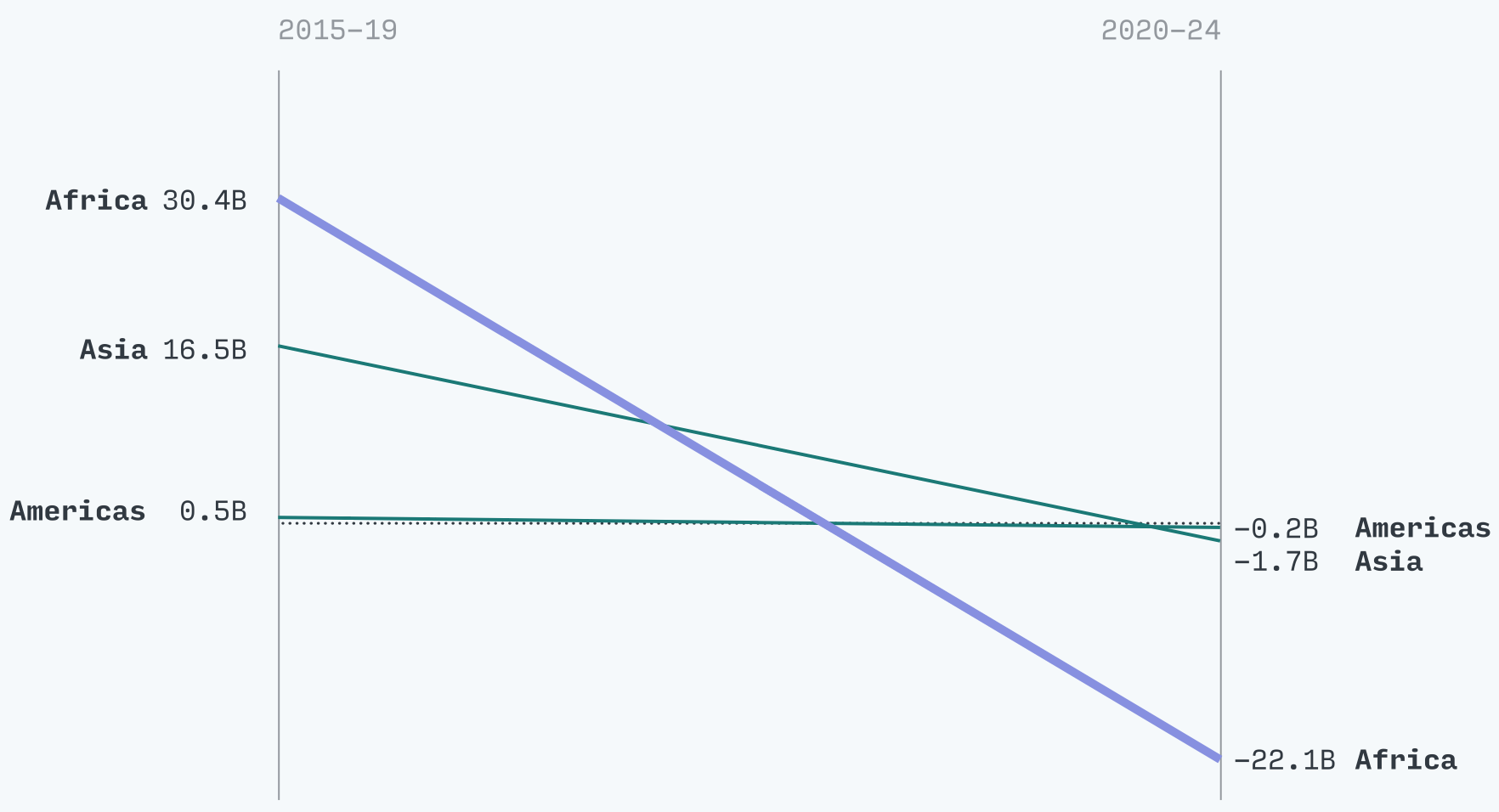

African governments are sending more cash to China in debt-service payments than they are receiving in fresh Chinese lending, Reuters reports. Analysis by ONE Data shows Africa swung from a net inflow of about $30 billion in 2015–2019 to a net outflow of about $22 billion in 2020–2024, as repayments rose while new sovereign lending fell.

The pullback in new loans does not mean China has stopped building, but the model has changed. Now, headline sovereign lending is smaller and more frequently structured as public-private partnerships that are often yuan-denominated. In tandem, Chinese corporations have ramped up investments in critical minerals, energy and batteries.

Recent examples include Egypt’s $1.8 billion solar and battery storage manufacturing project being led by a partnership between Norwegian and Chinese developers, Kenya’s $1.5 billion highway expansion backed by Chinese state firms under a new debt-and-equity structure, and a $2 billion joint venture battery factory led by a Moroccan fund and Chinese battery conglomerate.

Libya moves to boost oil output

Libya’s Tripoli–based government led by Prime Minister Abdul Hamid al-Dbeibah this week signed a $20 billion, 25-year oil development deal with ConocoPhillips and TotalEnergies aimed at increasing production by 850,000 barrels per day, Reuters reports. Alongside the agreement, the Dbeibah government signed an MoU with Chevron for logistical support, and a cooperation agreement with Egypt’s petroleum ministry.

The deal marks a breakthrough for Dbeibah, who is vying with rival leader, eastern Libyan commander Khalifa Haftar, for influence and investment. Both Libyan leaders have chalked up successes recently: Haftar’s government signed a $4 billion deal to buy Chinese warplanes from Pakistan in December, while Dbeibah’s government continues to appeal to the US for economic investment and the release of approximately $35 billion in sovereign assets frozen during Muammar Gadhafi’s rule.

Since Libya’s de facto split, Egypt, the UAE and Russia have been among the few international backers of Haftar’s eastern government. However, the signing of this cooperation agreement with the western Tripoli government comes as Cairo ramps up pressure on the eastern Benghazi government to stop trafficking arms and supplies for the UAE to the Sudanese Rapid Support Forces, which launched a new offensive in southwestern Sudan this week.

Asia

Indonesia’s stock market crashes after MSCI freeze

Indonesia’s benchmark index fell more than 16% in just two days this week after index provider MSCI issued a warning about the country’s investability, the FT reports.

In a report released on Tuesday, MSCI said it had found trading irregularities and transparency issues related to Indonesian shareholding structures. The firm said that it could downgrade Indonesia to a frontier market from its current emerging status.

- Indonesia appoints president’s nephew to central bank board (Jakarta Post)

The ensuing rout, Indonesia’s worst in almost 30 years, wiped out around $80 billion in market value, Reuters reports. Stocks recovered some losses on Thursday after Indonesian regulators agreed to double the minimum number of shares available for public trading in listed firms.

Bangladesh prepares for first election since Hasina’s ouster

Bangladesh will host elections in two weeks for the first time since student-led protests led to the resignation of former prime minister Sheikh Hasina in 2024.

Despite the optimism that initially followed her ouster, the upheaval failed to produce a unified political party. Instead, Bangladeshis will be choosing between the two parties that have long presided over an economy that many say lacks opportunity, Reuters reports.

Bangladesh has also struggled under the interim leadership of Nobel laureate Muhammad Yunus, who returned from exile to lead the country after Hasina’s ouster. Mobs have continued to violently target political leaders and journalists, while economic growth is expected to have slowed to 3.9% in 2025 from 4.2% a year earlier, according to the Asian Development Bank.

Vietnam upgrades ties with EU

Vietnam and the EU this week elevated their relationship to a “comprehensive strategic partnership,” Reuters reports. While the upgrade carries no binding commitments, it has symbolic weight as the US puts allies on edge. It puts the EU at Vietnam’s highest level of relationship, alongside the US, China, Russia and a few other countries in Europe and Asia.

- Vietnam’s leader consolidates power in second five-year term (BBC)

Vietnam and the EU will deepen cooperation in sectors such as critical minerals, chips and AI, according to a joint statement the governments published on Thursday. The EU and Vietnam have had a free-trade agreement since 2020.

Middle East

Saudi Arabia cuts costs and ramps up search for cash

After months of uncertainty, Saudi Arabia has decided to significantly downsize and redesign the embattled Neom megaproject, the FT reports. Sources cited by the FT claim that construction is to be rapidly scaled back, and that Neom’s chairman is considering a pivot from focusing on tourism and residential investment to using the project’s footprint as a foundation for massive data centers, in line with the new Vision 2030 focus on AI.

- Saudi pushes further reforms to open real estate market to foreign investors (Bloomberg)

- Saudi Arabia weighs expansion of premium residency program to lure rich (Reuters)

Riyadh has also moved to strengthen oversight of the project, creating a new chief of staff division to liaise between Neom and the government, suggesting tighter financial and management controls are forthcoming. The government has, since announcing a comprehensive strategic review of the PIF’s strategy towards the end of last year, moved to cancel key projects like ‘The Cube’ skyscraper and the Trojena ski resort. “Redesigning” Neom will likely involve further project cancellations.

Cost overruns are at the heart of Neom’s woes, as Saudi Arabia has been forced to leverage its finances by issuing record amounts of debt to fill shortfalls in expected FDI. However, Crown Prince Mohammed bin Salman is reportedly looking within the kingdom for fresh financing by pressuring wealthy families and private sector firms to commit credit and equity investments to support Vision 2030 projects.

Syrian president courts Russia in effort to balance relationship with great powers

Syrian President Ahmed al-Sharaa made a second visit to Russia this week to discuss bilateral relations, particularly regarding the status of Russia’s military bases in Syria, Al Jazeera reports. In a meeting with President Vladimir Putin, al-Sharaa praised Russia’s historic role in the region and thanked Putin for supporting “unity” in Syria.

The meeting is further evidence of al-Sharaa’s diplomatic pragmatism, as he played down Russia’s support for the Assad regime and its role in the civil war, and avoided insisting on Assad’s extradition as he had in the previous meeting. Despite strong US support for his new government—which remains apparently unaffected by a recent Syrian offensive against US-backed Kurdish forces—al-Sharaa appears to be hedging his reliance on the US by engaging with other major world powers.

Last November, Syria sent a high-level delegation to China, which said it was looking to get bilateral relations “back on track” and would “actively consider” supporting Syria’s post-war reconstruction.

Lebanon sees investment from Qatar, litigation from UAE

Qatar this week pledged to invest over $430 million to support Lebanon’s reconstruction, with most of the money earmarked for improving local electrical infrastructure, Reuters reports. Since the election of President Joseph Aoun’s reform coalition in 2025, Qatar has supported Lebanon with grants for fuel imports and armed forces salaries; the pledge of investment support is reportedly a mix of loan financing and grant funding.

Qatar also committed to support the voluntary return of Syrian refugees from Lebanon, initially committing some $20 million to helping 100,000 refugees return home.

However, Lebanon’s good political relations with the Gulf governments have not fully shielded it from private-sector disputes. This week, the UAE’s Al-Habtoor group, a major regional real estate and automotive player, announced it is seeking legal remedies for some $1.7 billion in losses it claims were caused by the Lebanese government’s failure to protect foreign investments.

Europe

Poland changes tack on euro adoption

Poland’s leadership appears to be cooling on the prospect of the country adopting the euro, the FT reports. In an interview this week, the country’s finance minister Andrzej Domański said the case for adopting the single currency had weakened, with Poland continuing to outperform most economies in the eurozone.

While Poland is legally obligated to join the single currency under EU accession rules, Domański said Warsaw is more interested in joining the G20 than in dropping the zloty in favor of the euro. According to the FT, Poland’s economy is now the 20th-largest in the world and is expected to grow around 3.4% this year.

The Polish finance minister’s statements come on the heels of Bulgaria’s smooth adoption of the euro this month, which has helped boost the country’s stock market. Fears of inflation in Bulgaria due to the currency switch remain low.

Latin America

Ecuador sees strong demand in return to bond markets

Ecuador has returned to international debt markets for the first time since its 2020 restructuring, selling $4 billion in bonds in its largest-ever sovereign issuance, Bloomberg reports. The deal was split between 2034 and 2039 maturities and priced at the low end of guidance, underscoring strong investor demand amid a broader rally in emerging market credit.

Proceeds will be used in part to buy back shorter-dated notes, smoothing the country’s debt profile.

- Argentina’s debt hopes get boost from Ecuador’s bond success (Buenos Aires Times)

The issuance reflects growing market confidence in President Daniel Noboa’s fiscal stance. Investors are betting that disciplined macro policy and continued engagement with markets can hold, but the durability of demand will depend on fiscal execution and political stability as the country moves deeper into its adjustment cycle.

Ecuadorian bonds were among the best performers in emerging markets last year, benefiting from tighter global spreads and a shrinking pool of distressed sovereigns. The successful sale places Ecuador alongside peers such as Mexico and Chile, which have already tapped markets this year.

Bolivia cancels Chinese mining project in a gambit for Western investment

Despite signaling last week that it would honor all minerals contracts, Bolivia’s new center-right government has canceled a $350 million zinc refinery project awarded to a Chinese consortium, citing overpricing and contract deficiencies, Bloomberg reports. The government has ordered audits of other Chinese-built industrial projects.

The decisions mark a sharp departure from two decades of state-led, China-focused resource policy and signal a deliberate attempt to rebrand Bolivia as open to Western capital. The crackdown aligns with a broader geopolitical push by the US and its allies to dilute China’s role in critical-mineral supply chains, placing Bolivia’s resource sector squarely in a global realignment.

- US presses Bolivia ‘over Iran and militant groups’ (Reuters)

The pivot, however, does not resolve deeper challenges in the country. Execution risk, legal uncertainty, social opposition to mining, and technical hurdles, particularly in lithium, continue to weigh on bankability. While La Paz hopes tougher standards and new partners will unlock capital, markets remain cautious, viewing Bolivia’s assets as rich but still heavily discounted by governance and delivery risks.

Trump-backed candidate assumes presidency in Honduras

Businessman Nasry Asfura has assumed the presidency of Honduras following a narrowly decided and heavily disputed election, AP reports. Asfura, who was openly backed by US President Donald Trump, pledged to shrink the state, attract investment, and take a harder line on crime, signaling a break from the leftist Libre government he replaces.

The inauguration was low-key and underscored lingering domestic tensions over the legitimacy of the result.

Asfura’s victory fits a wider rightward drift in the region, but his mandate is fragile. Allegations of electoral irregularities, association with the National Party’s controversial past, and expectations of a tougher security approach mean his early months will be defined by efforts to build trust and consolidate his authority while delivering visible gains on jobs and public safety.

Global Macro

FMN Meta Report highlights key themes for 2026

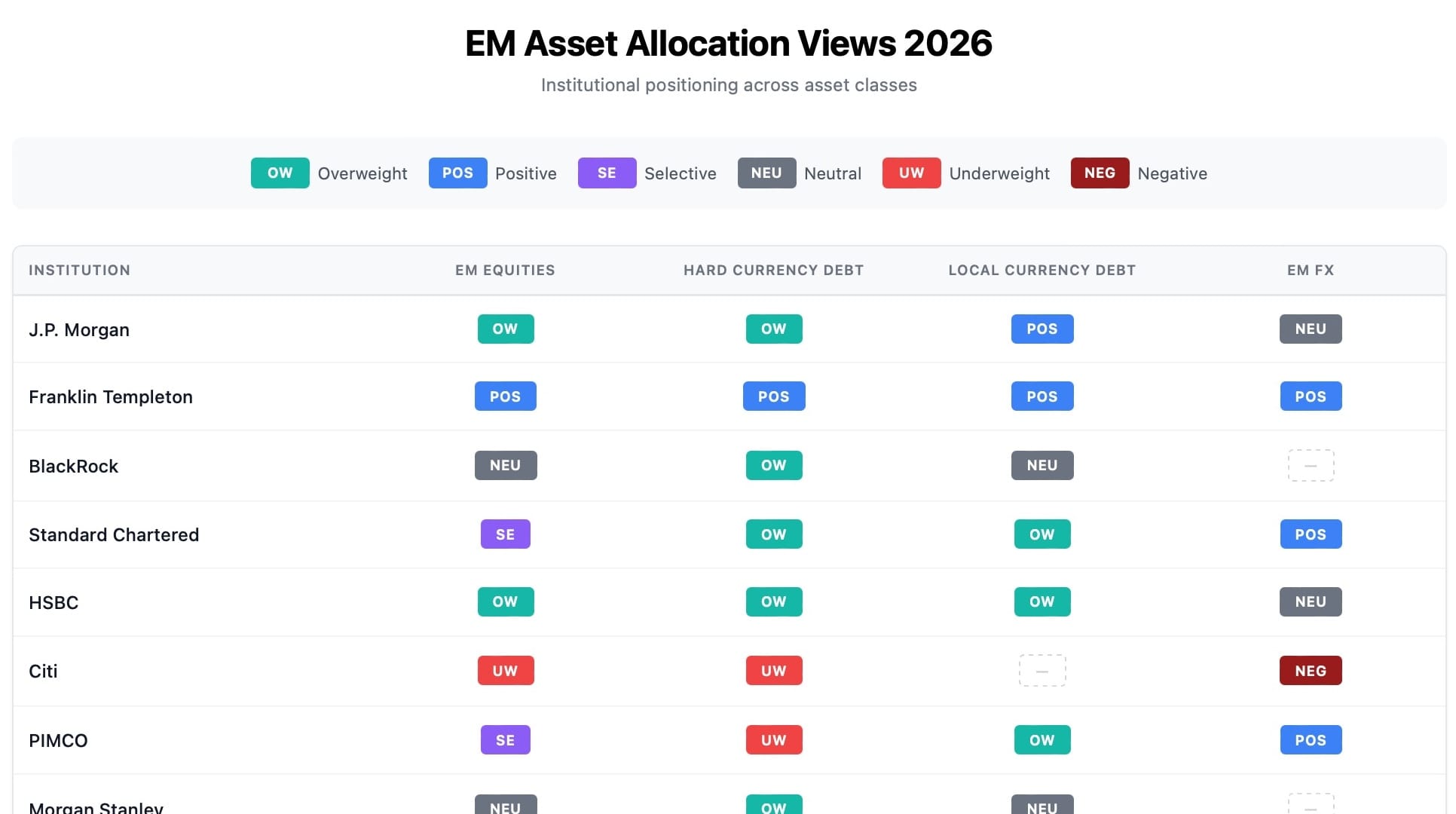

Global markets entered 2026 with an unusual degree of macro alignment, according to FMN’s latest research synthesizing data and insights from 27 institutions. Growth forecasts across advanced and emerging economies have converged, inflation has moderated without undermining demand, and financial conditions have eased just enough to sustain risk appetite.

In our report, which will be available to paid FMN subscribers early next week, we find institutions experiencing a sense of stability that feels earned, but is also fragile. Consensus today reflects relief more than conviction, and relief has a habit of fading quickly.

The foundations of that consensus are already under strain. Higher-for-longer interest rates are colliding with record public debt. Trade policy uncertainty is re-emerging as a structural variable rather than a headline risk, and geopolitical fragmentation is reshaping supply chains in ways that are inflationary in some places and disinflationary in others. The AI infrastructure build-out adds another layer of distortion, accelerating capital flows into energy, commodities, and data-intensive regions while leaving others behind. This is not a synchronized global cycle. It is a selective one.

The lessons for investors are clear, and readers of the report will be able to dig into deep sectoral, regional and thematic research bringing together insights from analysts at more than two dozen institutions, helping them to identify where resilience is real, where optimism is crowded, and where consensus may be most exposed.

Paid FMN subscribers will receive the full report access early next week. Not subscribed yet? Follow this link to choose from monthly or annual options.

What We’re Reading

Dubai-based group develops 200 MW thermal power plant in Burkina Faso (Reuters)

Amadou Oury Bah re-appointed prime minister under Guinea’s new government (AfricaNews)

Guinea bauxite exports surge amid Chinese demand (Semafor)

Gabon’s new president faces first social protest (ModernGhana)

Gabon in talks with World Bank on $500mn loan (Bloomberg)

DRC plans to raise $750 million with maiden Eurobond sale (Bloomberg)

India buys 2mn barrels of crude from Angola as it cuts Russian oil to appease the EU and US (Business Insider Africa)

Afreximbank cuts ties with Fitch over credit assessment concerns (Business Insider Africa)

Cambodia ‘to join Trump’s Board of Peace’ (Reuters)

Laos tourism beats target, welcoming 4.6 million (Laotian Times)

Malaysia’s data center capacity set to double by end-2026 (Nikkei)

Kazakhstan’s vast Tengiz oil field to resume output (OilPrice)

Kuwait readies $7 billion pipeline deal as Gulf turns to foreign capital (Reuters)

Saudi Arabia-UAE tensions put Middle East businesses on edge (Bloomberg)

Iranian stocks sell off as US ‘armada’ approaches (FT)

Jordan signs gas supply deal to support Syrian electricity sector (Zawya)

Zelensky says Ukraine to join EU (The Independent)

HANetf set to launch first-ever Ukraine recovery ETF (CityWire)

Turkey plans buffer zone if Iran government falls (Middle East Eye)

From Georgia to Serbia, surveillance is being weaponized against dissent (Balkan Insight)

Peru moves to expand connectivity with Chile and Panama (Aviation Week)

Argentina requests suspension of discovery process for YPF case in US court (Reuters)

Venezuela pushes oil law overhaul to draw investment (Mercopress)

Rubio says Venezuela will submit monthly budget to US (NYT)

Emerging markets make roaring start to 2026 as dollar slides (FT)

We are committed to providing FMN readers with a free weekly digest of politically unbiased, succinct and clear news and information from frontier and small emerging markets.

Please consider becoming a paid supporter to help cover some of our costs and support our continued development of sharp markets-focused coverage and new informational products. Paid subscribers will also gain exclusive access to our quarterly EM/FM report that aggregates EM insights from 25 major banks, international institutions and consultancies.