🌍 Frontier Markets News, January 23rd 2026

A weekly review of key news from global growth markets

Africa

DRC pitches state-owned mineral assets to US investors

The Democratic Republic of Congo this week formally offered US investors a shortlist of state-owned assets, including manganese, copper-cobalt, gold and lithium projects as part of a burgeoning strategic minerals partnership between the two countries, Mining.com reports. The move is the latest in a deepening relationship that will see the US provide hundreds of millions of dollars of financing for projects aimed at increasing exports from Southern Africa’s mineral producers.

Earlier this month, state-owned mining company Gecamines confirmed a plan to export 100,000 metric tons of copper from the Tenke Fungurume mine to the US.

Next week, DRC’s President Félix Tshisekedi will be attending a Washington minerals summit alongside representatives from Kenya and Guinea at which US officials are looking to lock in long-term access to critical minerals.

Libya joins wave of African port expansions

Libya signed a $2.7 billion partnership to redevelop the Misurata Free Zone, home to the country’s largest and busiest port, into a major Mediterranean logistics hub, Middle East Eye reports. The partnership brings together Geneva-based terminal operator Terminal Investment Limited (TiL), Qatar’s Maha Capital, and other investors to modernize, manage and expand the non-oil terminals.

The plan envisions deep-water container capacity of up to four million containers annually, upgraded logistics zones and digital systems, with officials projecting roughly $500–600 million in annual operating revenues and thousands of direct and indirect jobs.

The deal is part of a wider wave of African port upgrades. Tanzania is moving ahead with construction of the long-delayed Bagamoyo deep-sea port, and positioning itself as a major transshipment center for East Africa.

In Mozambique, terminal operator Cornelder Mozambique is betting around $125 million on new cranes and yard upgrades at Beira container terminal, aiming to double capacity and capture cargo diverted from congested Tanga and Mombasa. And this week Nigeria’s president Bola Tinubu attended the signing of an MOU with the UAE’s AD Ports Group to explore large-scale port infrastructure investment.

Museveni wins seventh term as Uganda’s president

Uganda’s President Yoweri Museveni is tightening his grip after winning a seventh term in last week’s disputed election, extending his rule toward a fifth decade. Official results gave the octogenarian leader about 72% of the vote, while his main challenger Bobi Wine took roughly a quarter.

Wine has rejected the tally as fraudulent and cited widespread irregularities, including ballot-stuffing and intimidation in opposition strongholds. Wine says he escaped a military raid on his home and remains in hiding, and that his family is effectively under house arrest—a claim authorities deny.

- Museveni’s son tells hiding opposition leader to surrender (Reuters)

Internet services have been partially restored after being blocked during the election, but security forces remain heavily deployed after deadly clashes around Kampala and in central districts.

Asia

Vietnam’s leader seeks to boost growth—and consolidate power

Vietnam’s ruling Communist Party hosted its twice-a-decade congress this week in a gathering that will see it select new leadership. To Lam, currently the party’s general secretary, is expected to retain his role and seek the additional office of president, NPR reports.

In a sign that he will succeed, 1,600 party delegates began voting in Hanoi on Wednesday with the goal of wrapping the conference on Friday, two days earlier than planned, Reuters reports. The election could solidify power for To Lam, a former policeman who rose to the party’s highest office in 2024 on the back of a corruption scandal and the death of the previous general secretary.

Vietnam’s next leader will guide the country through a pivotal moment. The nation of 102 million is looking to capitalize on a demographic window during which much of its population will be working age.

Vietnam is also increasingly caught between China, its neighbor and key source of investment, and the US, its largest export market. In speeches this week, To Lam argued the country needed a “new model” that could power annual economic growth of 10% over the next five years, Bloomberg reports.

Major gas find to support Philippines’ energy needs

The Philippines has discovered its first significant natural gas deposit in more than a decade, President Ferdinand Marcos Jr. announced on Monday. Authorities in the country said the site contains 98 billion cubic feet of natural gas, enough to power almost six million homes, AP reports.

An infrastructure investment fund backed by Filipino billionaire Enrique Razon Jr. said the discovery was the result of its $893 million drilling program at a nearby natural gas field. It said that it expects the new well to begin production by the end of this year.

Separately, the firm’s chief executive said that it planned to invest $9 billion in natural gas and hydropower projects in the Philippines over the next five years. It said the majority, around $7 billion, will go toward hydropower.

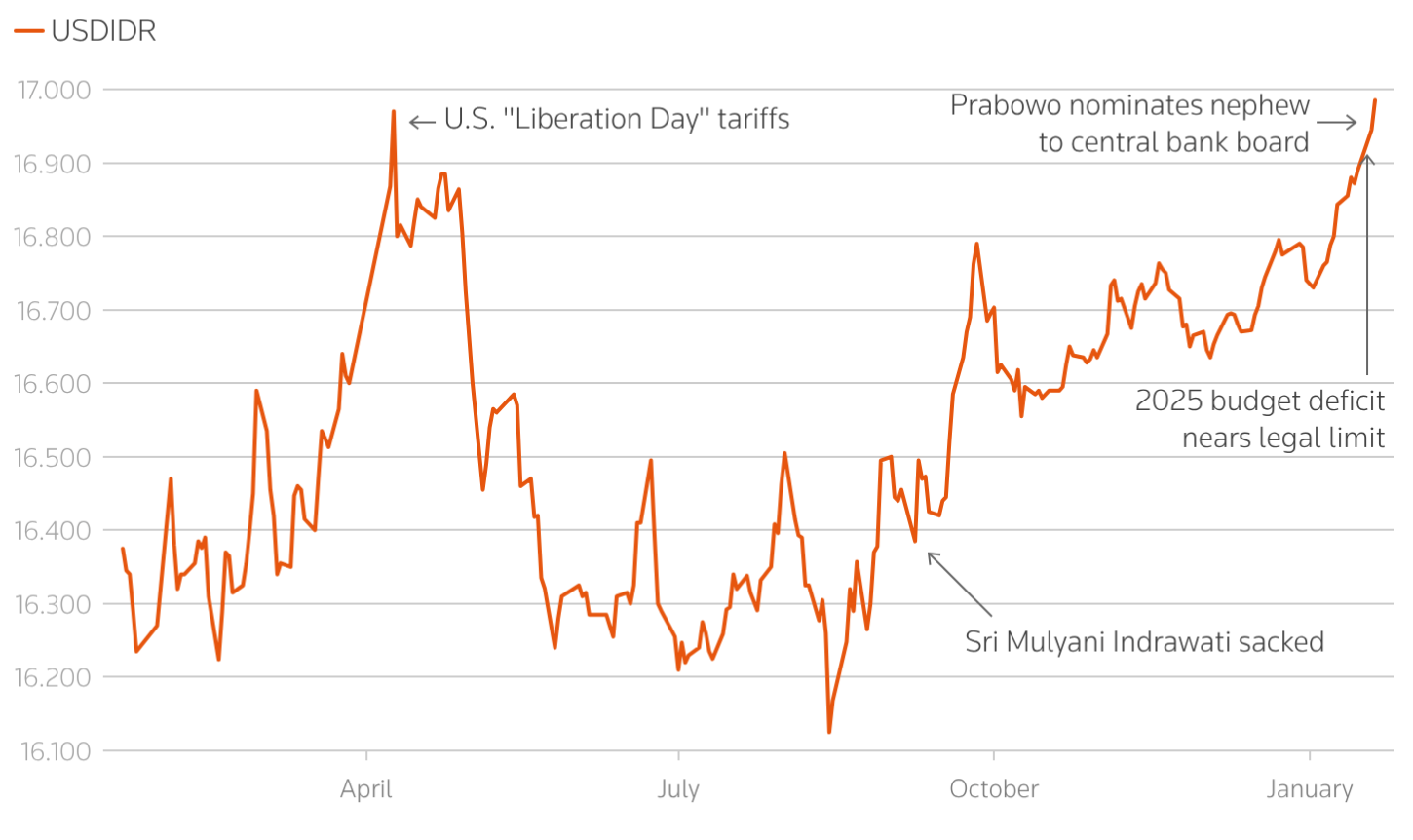

Indonesia’s currency slumps to record low

The Indonesian rupiah fell to an all-time low this week, days after President Prabowo Subianto nominated his nephew to the leadership of the Indonesian central bank.

The selection sparked concerns about the bank’s independence, the FT reports, knocking the rupiah down 2% against the dollar even as the greenback slid against other Asian currencies. The rupiah is now one of the worst performing currencies this month among Asia’s frontier markets, Reuters reports.

Economists say Prabowo is seeking more aggressive rate-cutting action from Indonesia’s central bank, which kept interest rates steady this week. The deputy governor position for which he nominated his nephew will be filled by the lower house of Indonesia’s parliament, where Prabowo’s ruling coalition has a majority.

Middle East

S&P issues warning after Saudi Arabia’s latest borrowing spree

On the heels of another year of record debt issuance in 2025, and despite signals from Riyadh that it would slow the pace of borrowing this year, Saudi Arabia has issued some $20 billion in sovereign and bank bonds so far this January, Bloomberg reports. The central government has sold $11.5 billion in dollar-denominated bonds, state-owned Saudi Electricity and Saudi Telecom have raised $2.4 billion and $2.0 billion in sukuks, respectively, and the three major banks in the kingdom are reported to have borrowed at least $1 billion each.

- Saudi economy hits new levels of oil independence (Semafor)

All of the sales are reported to have drawn strong demand, but ratings firm S&P has raised concerns about the capital adequacy of some of the participating banks. This month’s use of Additional Tier 1 (AT1) hybrid bonds that can be converted into equity or written off—among the riskiest forms of debt finance for banks—prompted S&P to warn that a significant increase in hybrid finance in the capital mix, currently some 19%, could weaken Saudi Arabia’s bank capital quality, potentially affecting ratings scores.

Middle East governments to join ‘board of peace’ for Gaza

Jordan, Qatar, Saudi Arabia and the UAE announced this week that they are to join US President Donald Trump’s Board of Peace initiative, the next phase of his plan to achieve a “permanent ceasefire” in Gaza, Al Jazeera reports. The board has a two-year mandate from the UN Security Council to oversee management of Gaza during the ceasefire and disarmament process, although its charter makes no specific reference to that, instead suggesting a much wider mandate.

An official statement from the White House sketches out a 20-point “roadmap for lasting peace, stability, reconstruction, and prosperity” in the Middle East, and establishes a National Committee for the Administration of Gaza to be led by Dr. Ali Sha’ath, a Palestinian Authority administrator. A security agency called the International Stabilization Force, led by a US general, is tasked with overseeing security and a “demilitarization” process in Gaza.

Each country joining the board is to contribute $1 billion in financial support, but it’s unclear whether Jordan, Qatar, Saudi Arabia or the UAE will commit security forces or maintain an actual presence on the ground in Gaza. The broad mandate of the board has raised concerns by some that the US is establishing a parallel multilateral forum for international relations that could potentially undermine—or at least sideline—the UN.

Iran’s central bank reportedly turning to cryptocurrency

Iran’s central bank has rapidly accumulated at least $500 million in Tether, a cryptocurrency pegged to the US dollar, according to a study by a UK-based cryptocurrency analytics group, The Guardian reports. The assets are not directly owned by the central bank, but through a network of 50 proxy accounts ultimately controlled by the central bank, which can be easily converted to hard currencies because of Tether’s stablecoin status.

- Iran’s protests ‘completely squashed,’ government says (NYT)

- Internet shutdown squeezes Iran’s ailing businesses already hurt by crashing currency (AP)

- Iran seizes properties and businesses in crackdown after unrest (FT)

Iran is unable to conduct dollar-denominated transactions because of US sanctions, and is therefore unable to easily source and pay for imports. Cryptocurrency payments through proxy accounts are one way of getting around US controls.

However, some experts think the more likely use of the crypto assets is to prop up Iran’s embattled currency by selling dollar-pegged USDT for Iranian rials to artificially prop up the currency amidst a worsening depreciation crisis, Bloomberg reports.

Europe

Freed Belarusian opposition leader urges EU rapprochement with Lukashenko

One of Belarus’ leading opposition figures, Maria Kalesnikava, this week urged European leaders to work with the country’s authoritarian President Alexander Lukashenko or risk pushing him closer to Russia.

In an interview with the FT, Kalesnikava, who was released from prison last month under a prisoner swap deal negotiated by the US, warned Europe against its strategy of isolating Lukashenko’s regime. She said Lukashenko, who has ruled Belarus since 1994, was a “pragmatic person” who could be motivated by the relaxation of sanctions.

Kalesnikava’s stance alarmed many in Belarus’ opposition who argue that reducing pressure on Lukashenko would prompt him to arrest more activists in order to trade them for concessions in the future.

Bulgaria’s president resigns amid continuing turmoil

Political upheaval continued in Bulgaria this week, with the president, Rumen Radev, stepping down amid rumors that he intends to launch a new political party, DW reports. His move follows last week’s refusal by the country’s second-largest political party to form a government.

The country has been racked by protests in recent months and in December Prime Minister Rosen Zhelyazkov resigned in the face of concerted opposition to his policies. The country is now facing the prospect of its eighth election in four years, Politico reports.

While Bulgaria’s political situation remains uncertain, public support for the country’s transition to the euro this month is increasing, and the adoption of the currency has gone smoothly.

Latin America

Bolivia resists pressure to revoke energy deals with China and Russia

Bolivia’s centrist government has promised to honor all existing hydrocarbons and lithium contracts, including controversial agreements with Chinese and Russian firms, as part of a push to restore investor confidence after years of policy volatility, Reuters reports. Energy minister Mauricio Medinaceli framed the decision as a credibility signal rather than an ideological endorsement, stressing that contract sanctity is essential to reversing declining output and chronic fuel dependence.

The commitment sits alongside plans for a broad overhaul of hydrocarbons and lithium laws aimed at loosening fiscal terms and reducing the dominance of state firm YPFB. Fuel subsidy cuts and plans to open distribution to private operators underscore a shift away from resource nationalism, despite the risk of renewed protests.

The government is positioning the reforms as groundwork for renewed exploration, with bidding rounds tentatively planned for 2027.

Guatemalan centrist pushed into Bukele-style crackdown

Guatemala’s President Bernardo Arévalo has declared a 30-day state of emergency after prison riots and gang reprisals killed 10 police officers, marking a sharp turn for a government elected on institutional reform rather than force. The measure curtails civil liberties and expands detention powers, echoing the security model popularized by El Salvador’s President Nayib Bukele, and reflecting how quickly political pressure can narrow reformist space.

The move fits a broader regional pattern in which centrist and progressive leaders face voter impatience and external pressure, particularly from Washington, to deliver rapid security gains, AP reports. Bukele’s dramatic homicide reductions have reshaped public expectations, even as his methods have drawn sustained human-rights criticism. In Guatemala, near-unanimous congressional backing shows how security has become one of the few cross-cutting political issues.

The central risk is duration. Arévalo’s instincts point toward restraint, but regional precedent shows how temporary emergencies can become entrenched, the Latin American Risk Report assesses. Whether violence escalates or subsides will shape next steps, but politically, ending the measures after 30 days could leave Arévalo vulnerable ahead of looming institutional battles, including control of the attorney general’s office.

Venezuela uses commercial opening to stabilize battered economy

Venezuela’s government says it plans to use proceeds from a US-brokered oil sale to intervene in foreign exchange markets, aiming to slow the bolivar’s slide, France24 reports. About $300 million in oil revenue is being deployed to stabilize the currency, highlighting how sanctions and capital controls have left the state short of hard currency.

- Venezuela opens debate on oil-sector overhaul (The Independent)

The government has also signaled a cautious reopening to foreign investment, with parliament preparing reforms to oil-sector laws that currently require PDVSA to retain majority control. Personnel changes, including the appointment of a US-educated banker to head the investment agency and the removal of Maduro-era figures, reinforce the message to Western firms that it is becoming safe to invest in Venezuela again.

The opening remains tightly bounded by politics. Limited prisoner releases and economic gestures are meant to reassure external partners, but hardliners still wield influence. For now, Caracas is prioritizing currency stabilization and selective investment signaling rather than broad liberalization, testing whether modest economic relief can hold without deeper political change.

What We’re Reading

Benin sells dollar bonds as sentiment improves (Bloomberg)

Opposition loses all seats in Benin election weeks after a thwarted coup (ABC News)

Senegal raises $254mn in regional debt auction as yields climb (Reuters)

Côte d’Ivoire to buy entire stockpile of cocoa beans as stocks pile up (AfricaNews)

Egypt and Sudan welcome Trump offer to mediate over Ethiopian dam (DW)

Ethiopia secures $261mn from IMF on back of forex and fiscal reforms (The East African)

Kenya seeks to raise $824mn in first IPO in 11 years (Bloomberg)

Guinea ships first Simandou iron ore after decades of delays (Ecofin)

Bill Gates and OpenAI back $50mn AI rollout in African health clinics (FT)

Kazakhstan, Uzbekistan to join Trump’s Gaza peace board (Reuters)

ASEAN will not certify Myanmar’s election (The Irrawaddy)

Plunge in Chinese visitors sinks tourism to Thailand (Nikkei)

USAID’s demise has created Asian vacuum for China to fill, says ex-official (Nikkei)

Qatari group in talks for stakes in Syrian banks (Semafor)

Oman hands economic control to crown prince (Semafor)

Saudi Arabian media steps up attacks on UAE as Gulf rift deepens (FT)

Arab Energy Fund plans up to $1.4bn in renminbi bond issuances (Zawya)

Czech billionaire’s CSG launches record defense IPO, aiming to raise $4.4bn (Reuters)

Albania to join Trump ‘peace board’ (Balkan Insight)

Enery starts one of Europe’s largest solar and BESS plants in Romania (Voice of Renewables)

Ukraine offers allies combat data to train AI (FT)

Poland spends billions to upgrade its navy against Russia’s Baltic threat (FT)

Hungarian MOL to buy majority in Serbian oil industry from Russian firm (BalkanInsight)

Ecuador and Colombia launch tariffs on each other amid border tensions (UPI)

Colombia slashes wages for legislators (AP)

Colombian guerrilla group backs pact to fight US (Le Monde)

Majority of Latin Americans endorsed Trump’s raid in Venezuela, polls show (NYT)

EU-Mercosur trade deal signed, then stalled as MEPs send it for judicial review (CNBC, Politico)

China’s Belt and Road financing surged in 2025 (FT)

EM sovereign outlooks for 2026 are ‘mostly neutral’ (Fitch)

We are committed to providing FMN readers with a free weekly digest of politically unbiased, succinct and clear news and information from frontier and small emerging markets.

Please consider becoming a paid supporter to help cover some of our costs and support our continued development of sharp markets-focused coverage and new informational products. Paid subscribers will also gain exclusive access to our quarterly EM/FM report that aggregates EM insights from 25 major banks, international institutions and consultancies.