🌍 Frontier Markets News, January 16th 2026

A weekly review of key news from global growth markets

Africa

Uganda’s president aims for a seventh term

Ugandans headed to the polls this week in a tense presidential election that is widely expected to return incumbent President Yoweri Museveni to office for a seventh term and cement his National Resistance Party’s control of the country’s 353 seat parliament. The octogenarian leader’s main rival, musician-turned-politician Bobi Wine, has drawn significant youth support by campaigning on a platform of political reform, economic opportunities, and change from decades of the same leadership.

Despite Wine’s strong support, many anticipate a result similar to that of the 2021 election in which the two men first faced off. On Tuesday, the government imposed a nationwide internet blackout and deployed military assets to the streets in what opposition leaders say is a move to disrupt organizing and protests

The election takes place against a backdrop of ambitious economic projects, most notably the construction of a crude oil pipeline to the Tanzanian port of Tanga, which is scheduled to be completed this October and is expected to facilitate Uganda’s first significant crude exports. The $5 billion pipeline, a roughly 1,443-kilometre route from the Lake Albert oilfields, represents a key part of the government’s effort to transform Uganda into a significant oil exporter and attract foreign investment.

Ghana clears debts to boost funding

Ghana has cleared roughly $1.47 billion in legacy energy sector arrears as part of a broader push to restore fiscal credibility and unlock critical international financing, government officials said on Monday.

The payments, executed through 2025, included about $597 million to the World Bank, restoring a partial risk guarantee originally created to secure payments for the Sanfoka gas project which supplies domestic electricity production. The guarantee’s lapsing threatened nearly $8 billion in private investment in gas supplies. The government also settled roughly $480 million in gas-related invoices under the Sankofa Gas Project and about $393 million owed to independent power producers, steps Accra said would stabilize power sector finances and reduce dependence on costly liquid fuels.

Officials said clearing the energy debts was important to boost investor confidence and maintain access to multilateral programs. The effort comes as the country has successfully beaten back inflation, which fell every month in 2025, ending at 5.4%, the lowest the country has seen since 2021.

Simultaneously, the government announced its plans for a cedi-denominated $935 million domestic infrastructure bond to finance road construction. The government said the bonds are expected to be “self-financed” through tolls.

Zambia’s bourse outperforms peers

Zambia’s stock market emerged as one of the best performing globally so far this year as a copper-price boom and stronger growth expectations lifted the Lusaka Securities Exchange to the top of African equity returns. The benchmark index climbed 17% in dollar terms since the turn of the year, propelled by record copper prices that have boosted mining sector earnings—and investor appetite for Zambian assets.

Higher metal revenues have underpinned broader confidence in the country’s economic trajectory, supporting expectations of faster GDP growth.

The country still faces considerable challenges, however. Inflation, which clocked in at 11.2% in December, is well above target, energy blackouts remain a drag on mining and industrial output, and the government’s decision not to extend its IMF credit facility has removed a key source of concessional funding.

Asia

Pakistan signs deal with Trump-linked crypto firm

Pakistan’s finance ministry this week signed a deal to develop digital assets with crypto firm World Liberty Financial, which is backed by President Donald Trump’s family. The ministry said it would explore using the firm’s stablecoin, USD1, for international payments.

Photos of the deal signing show Pakistan’s Prime Minister Shehbaz Sharif and army chief General Asim Munir with Zach Witkoff, the chief executive of World Liberty and son of Steve Witkoff, a special envoy for Trump.

- Pakistan and Indonesia near defense deal focused on planes and drones (Reuters)

The unprecedented arrangement could see a foreign government directly enrich the US president. A document published by World Liberty Financial shows that a Trump-linked business claims the right to 75% of revenue from sales of the firm’s tokens, though it is unclear if this applies to USD1 stablecoins.

Myanmar continues election process despite low turnout

Myanmar hosted the second round of voting this week in a planned three-part election that international observers have described as a “sham.”

The elections are the first since the military seized power in a 2021 coup, starting a civil war that has killed and displaced many thousands of citizens.

The military has made protesting or criticizing the vote a crime punishable by up to 10 years in prison, Al Jazeera reports, with 200 people now facing charges under the rule. The Union Solidarity and Development Party, a military-aligned party, claimed to have won 88% of seats in Myanmar’s lower parliament during the first round of voting last month, Reuters reports. The final round will take place on January 25.

US visa pauses hit frontier Asia

The US State Department announced on Wednesday that it would pause visa processing for immigrants from 75 countries, including 15 frontier economies in Asia.

The pause will go into effect on January 21 and includes Thailand, a US treaty ally, and Pakistan, with which Washington has been actively cultivating ties since the Trump administration took office last year. One expert said the addition of Thailand risked “pushing the Thai government and its people closer to China,” Fortune reports.

The other countries affected are Afghanistan, Azerbaijan, Bangladesh, Bhutan, Cambodia, Georgia, Kazakhstan, Kyrgyzstan, Laos, Mongolia, Myanmar, Nepal, and Uzbekistan. The State Department did not target the Philippines and Vietnam, both of which are significant sources of migrants to the US.

Middle East

Saudi Arabia pledges development in Yemen after forcing UAE withdrawal

Saudi Arabia this week pledged to give Yemen $500 million for humanitarian support, reconstruction, and fuel donations, Reuters reports. The move suggests Riyadh is committing to be more hands-on with Yemen’s internationally recognized government (IRG) moving forward.

- Yemen appoints new prime minister amid Saudi-UAE tensions (Middle East Eye)

Late in December, the UAE-sponsored Southern Transitional Council (STC) in Yemen launched an offensive against the Saudi backed IRG, seizing key ports and oil fields and presenting a direct challenge to Riyadh’s regional influence. A successful counterattack by Saudi proxies has since led to the claimed dissolution of the STC, but continued diplomatic pressure against UAE by Saudi Arabia threatens to deepen a growing rift within the GCC.

Lebanon’s bonds rally on bank deposit plan

Investor optimism about the prospects for a sovereign debt restructuring drove a surge in the value of Lebanon’s dollar-denominated bonds this week, BondbloX reports. The move, which pushed the value of the defaulted bonds up to roughly 30 cents on the dollar, came after Lebanon’s cabinet approved a plan for repaying 85% of individual depositors up to $100,000 within 4 years, with up to 60% of the cost covered by the central bank.

Repaying lost bank deposits is a key step in Lebanon’s economic recovery plan, and a milestone watched by the IMF, but the proposal has yet to be passed by parliament and faces considerable opposition from special interest groups.

Investors are also betting that protests in Iran will further reduce Hezbollah’s strength in Lebanon as the group continues to resist disarmament, the FT reports.

Europe

Hungarian PM grants asylum to former Polish justice minister

Hungary this week granted political asylum to Poland’s former justice minister, Zbigniew Ziobro, who is being prosecuted for multiple crimes including embezzlement of public funds and the use of spyware against political opponents, The Record reports.

Ziobro, who is a political ally of Hungarian Prime Minister Viktor Orbán, said he was accepting the offer in order to continue fighting the charges against him.

Poland’s current justice minister Waldemar Zurek condemned Hungary’s decision, describing it “as deeply troubling,” Balkan Insight reports. A year ago, Orbán’s administration granted asylum to another former Polish government official, Marcin Romanowski, who was under investigation for corruption.

Bulgaria’s market surges despite political uncertainty

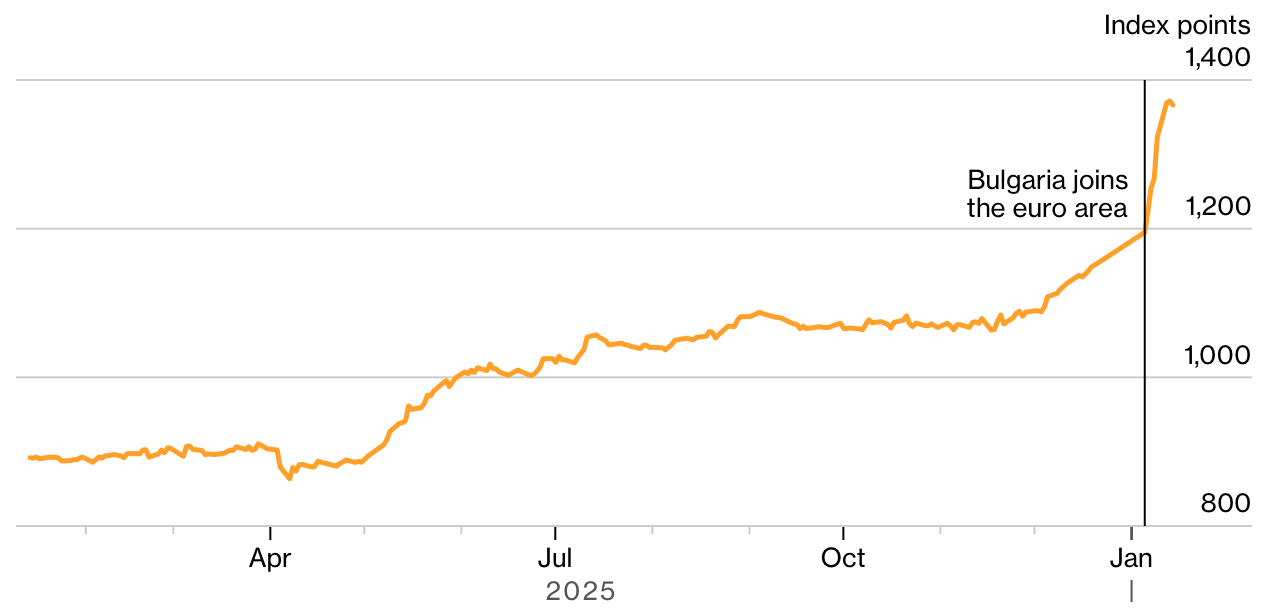

Bulgaria’s stock market continued a post-euro-adoption surge that has seen it gain almost 20% since the start of the year, MSN reports. Bulgarian stocks are now the best performers of 2026, according to Bloomberg, and the country’s benchmark SOFIX index is at its highest value in nearly 20 years.

Bulgaria successfully adopted the euro at the start of the year, enhancing investors’ already optimistic views on the country. But political upheaval could take off some of the shine, after the country’s second largest parliamentary grouping denied a request from the president to form a new government.

The decision comes in the wake of the resignation of the previous coalition government which stepped down in the face of intense protests over alleged corruption and budget concerns. Bulgaria now faces the possibility of a snap election—its eighth in four years.

What We’re Reading

Coalition chief visits Sierra Leone for security talks (Arab News)

Somalia ends port deals and security cooperation with UAE (Reuters)

Fresh violence tests Touadéra in Central African Republic (RFI)

Namibia and Russia look to fast-track ‘peaceful use of nuclear energy’ (Business Insider Africa)

Amethis closes $472mn pan-African SME-focused fund (Ecofin)

US House passes 3-year AGOA extension (Africa News)

Indonesia and Malaysia block Grok, chatbot from Elon Musk’s X (BBC)

Philippines signs trade deal with UAE (Rappler)

Gulf countries join rush to debt with new bond issuances (Semafor)

Saudi mining giant Maaden outlines $110bn investment plan (AGBI)

Saudi sovereign wealth fund preps for a wave of IPOs (Semafor)

Lucid set to start manufacturing cars in Saudi Arabia in 2026 (Bloomberg)

Syrian army tells civilians to evacuate new front with SDF east of Aleppo (Al Jazeera)

Poland blames Russia for ‘major cyberattack’ on power grid (The Record)

Baltic countries on alert after series of suspicious undersea cable outages (FT)

EU to split Ukraine financial support with €30bn for budget, €60bn for military (Reuters)

Maduro’s fall defuses border-conflict risk for oil-rich Guyana (Bloomberg)

Bolivia’s government reaches deal to end fuel protests (UPI)

Bolivia receives $4.5bn financing package from IDB (Central Banking)

US treasury secretary says Argentina has repaid its credit line (ABC)

EU and South America to form free-trade zone with 700mn people (NY Times)

We are committed to providing FMN readers with a free weekly digest of politically unbiased, succinct and clear news and information from frontier and small emerging markets.

Please consider becoming a paid supporter to help cover some of our costs and support our continued development of sharp markets-focused coverage and new informational products. Paid subscribers will also gain exclusive access to our quarterly EM/FM report that aggregates EM insights from 25 major banks, international institutions and consultancies.