🌍 Frontier Markets News, February 6th 2026

A weekly review of key news from global growth markets

Africa

Guinea-Bissau opposition leaders reject junta’s ‘power-sharing’ offer

Guinea-Bissau’s military junta this week proposed a power-sharing arrangement, offering three ministerial positions each to the parties of opposition leaders Fernando Dias and Domingos Simões Pereira, Reuters reports. Despite the junta’s claims of fostering inclusion, both leaders firmly rejected the offer, saying they would not “dirty their names” by participating in the junta’s government with little actual power to influence governance.

The junta, which was brought to power in a coup that Dias and Periera have alleged was orchestrated by then-president Umaro Sissoco Embaló to avoid electoral defeat, has set December 6, 2026 as the date for new elections in defiance of ECOWAS pressure for a shorter transition. Critics warn the military has already altered the constitution to expand presidential powers, potentially facilitating Embaló’s return to office.

Madagascar restarts mining permitting system

Madagascar this week lifted a 16-year suspension on issuing most new mining permits, Mugglehead reports. The policy reversal by the military-led transitional government is reportedly aimed at unlocking stalled investment and accelerating extraction of the island’s critical minerals.

Tapping into Madagascar’s rich nickel, cobalt, and graphite deposits could bring needed fiscal relief and hard currency to Antananarivo’s military leader Col. Michael Randrianirina. However, officials now face a backlog of roughly 1,650 pending applications to work through, and the task of capturing new projects in the tax base.

One clear beneficiary could be US-based Energy Fuels, which owns Madagascar’s Vara Mada project. With permitting reopened, the company should be able to resume technical and environmental work, which has been stalled since 2019, potentially setting up a financial investment decision in early 2026. Vara Mada targets titanium-bearing mineral sands, including ilmenite, rutile and zircon, in a country where titanium is already among the top export earners.

Somalia snags EU funds to support stability and reforms

Somalia notched a rare political and financial win this week, sealing a €30 million commitment from the EU aimed at shoring up governance, resilience and economic growth even as the state’s internal politics and security remain fragile. The agreement is part of a broader €102 million EU package to support core public services while accelerating state-building and fiscal reforms as part of Somalia’s National Transformation Plan.

- Why US airstrikes in Somalia are reaching record levels under Trump (Semafor)

The deal landed as a push by President Hassan Sheikh Mohamud to revise the provisional constitution triggered open disorder in parliament, with opposition lawmakers arguing the move would allow for a two-year extension of parliament’s term, which currently expires in April. At the same time, the fight against Islamist militant group al-Shabaab rages on, prompting Turkey to step up strikes against the group last week.

Asia

Central Asia courts US investment at Kyrgyzstan business forum

Leaders of Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan and Uzbekistan are hoping to build on the recent strengthening of political ties with the US by developing deeper business relationships, too, the Times of Central Asia reports. At a forum in Kyrgyzstan this week, representatives from the five Central Asian countries gathered with more than 50 American companies, including pharmaceutical, infrastructure, and commodities firms, as well as officials from Washington, to discuss ways to enhance US engagement in the region.

Addressing the forum, US Special Envoy for South and Central Asia Sergio Gor said the private sector would be the primary force for deepening the US relationship with Central Asia.

The summit comes as the US looks to offset China and Russia’s increasing influence and interest in the region. In a sign of early success, Kazakhstan and Uzbekistan have agreed to join the US plan for Gaza, known as the Board of Peace. At the conference, Uzbekistan reiterated its earlier pledge to invest tens of billions of dollars in the US over the next decade, RFE/RL reports.

Thailand to hold general elections on Sunday

Thai voters are gearing up for elections on Sunday that could see the country elect its fourth prime minister in two years.

Observers see the vote as a three-way contest between the progressive People’s Party as well as the more establishment Pheu Thai and Bhumjaithai. No party is expected to win a majority, the Diplomat reports.

The People’s Party is leading in the polls, Reuters reports, but may face difficulty forming a government. Its predecessor party Move Forward won the most votes in 2023 but failed to win the support of Thailand’s military-backed Senate, and Pheu Thai instead formed a coalition government.

- How Thailand became the ‘sick man’ of Asia (FT)

Some analysts expect current Prime Minister Anutin Charnvirakul’s Bhumjaithai to form an alliance with Pheu Thai, which is controlled by the billionaire Shinawatra family, after Sunday’s vote.

Middle East

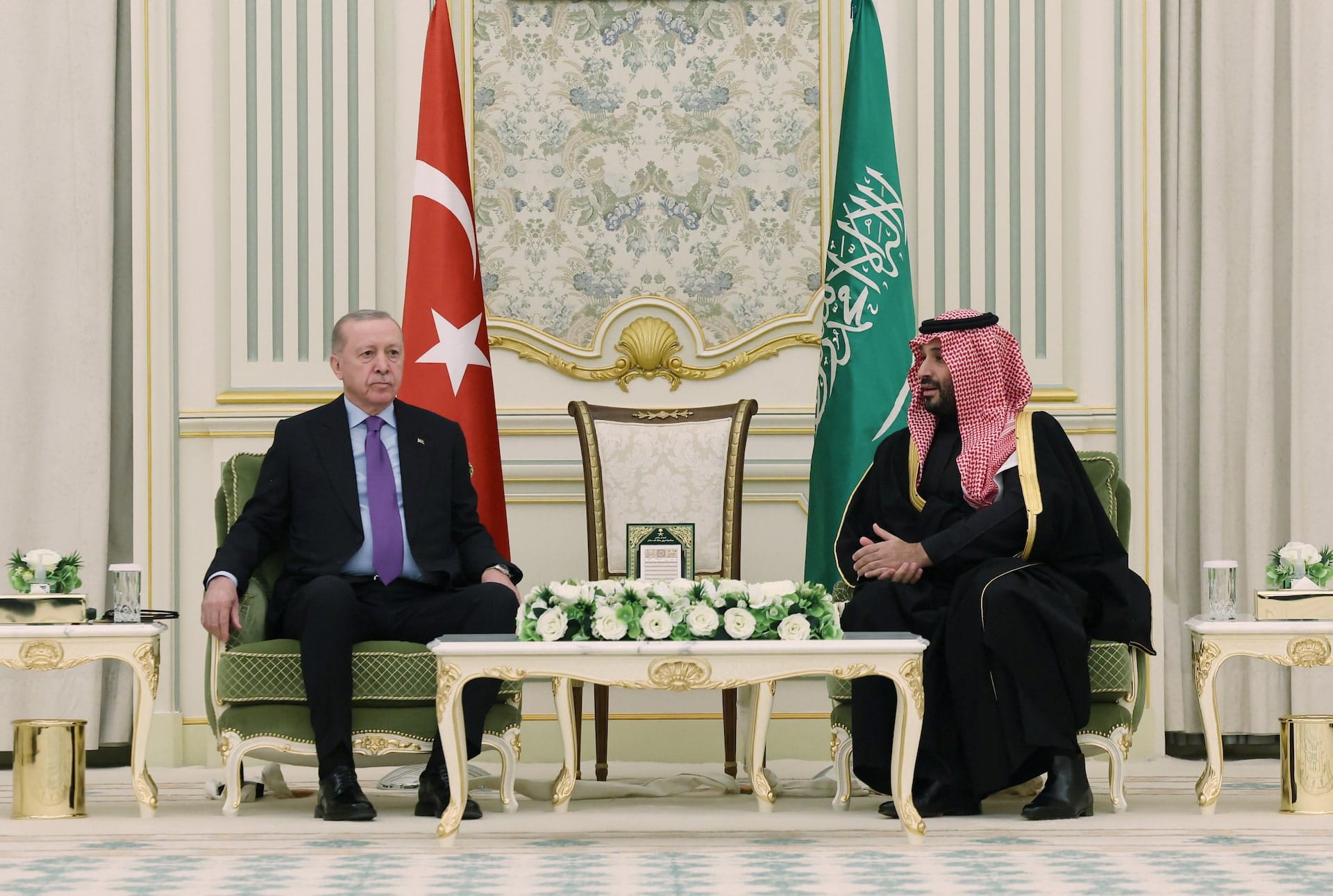

Turkey and Saudi Arabia to strengthen defense and economic ties

On a state visit to Saudi Arabia this week, Turkey’s President Recep Erdogan committed to take relations with the kingdom “to a higher level,” Reuters reports. According to a joint statement, Turkey and Saudi Arabia agreed to deepen their partnership on defense, coordinate alignment on regional diplomatic issues, and cooperate on energy investments by establishing a Saudi-Turkish Coordination Council and a GCC-Turkey free trade agreement.

Saudi Arabia has committed to building a $2 billion solar project in Turkey, and is reported to be considering investing in Turkey’s KAAN fighter jet project.

The two sides also agreed to “preserve Syria’s security, stability, and territorial integrity” and called for the withdrawal of Israeli forces from the country. Saudi Arabia and Turkey also joined Egypt, Indonesia, Pakistan, Qatar, Jordan and the UAE in condemning Israel for ceasefire violations in Gaza and committing to “the Palestinian right to self-determination and statehood.”

Syria signs up foreign investors for offshore energy projects

Syria has agreed a deal with US energy company Chevron and the Qatari Power International Holding to explore and develop its offshore oil and gas fields, a first step toward establishing offshore capacity—and a potentially major milestone in its energy industry, AP reports. The Syrian Petroleum Company says it aims to begin drilling as early as this summer, although tapping gas reserves could take up to four years.

The agreement comes as Syria’s central government has seemingly stabilized its relations with the country’s semi-autonomous Kurdish region, with the national army entering the former SDF strongholds of Hasakah and Qamishli this week following the signing of a ceasefire and integration agreement last week.

Europe

Armenia and Azerbaijan maintain momentum on economic cooperation

The leaders of Azerbaijan and Armenia this week said they plan to continue deepening the cooperation between their two countries, Hurriyet Daily News reports. After a meeting in Abu Dhabi, Azerbaijan’s President İlham Aliyev and Armenian Prime Minister Nikol Pashinyan said their countries had experienced considerable economic benefits from signing a peace treaty last August.

Both leaders praised the material gains from normalizing relations, as oil exports, grain and third-party cargo move freely across their borders. According to BNE Intellinews, Aliyev said the peace agreement was a “turning point” after decades of conflict, and that the six months since then had brought “partnership, cooperation, and progress toward a long-term, sustainable peace.”

Russia has also benefited from the normalization of relations between Armenia and Azerbaijan, having shipped nearly 20,000 tons of grain to Armenia via Azerbaijan since November. Russia is by far Armenia’s top trade partner, capturing over a third of Armenia’s imports and exports.

Investors bet on Hungarian election

Investors are betting longstanding Hungarian leader Viktor Orbán’s Fidesz party will lose April’s parliamentary election and are anticipating a substantial boost to the economy, Bloomberg reports. With opinion polls pointing to a victory for center-right, EU-friendly Tisza party, investors are expecting the country to repair relations with the EU, unleashing some $20 billion in EU funds that have been frozen due to Orbán’s illiberal policies.

Hungary’s stock market was already one of the top global performers in 2025, but the prospect of a Tisza victory is driving a continued surge. After gaining 40% last year, the Budapest Stock Exchange index is up 15% so far this year.

- Orbán orders courts to drop lawsuits against his government (FT)

Some Wall Street analysts are more cautious, warning that the forint is overvalued, and a recent report by investment firm OTP suggested that the Hungarian market may be close to a correction point.

Orbán, whose reelection bid was endorsed this week by US President Donald Trump, has been trying to enhance his chances by spending on easing Hungarians’ concerns over the rising cost of living. In response to Hungary’s mounting deficit, however, credit ratings firm Fitch downgraded the country’s outlook to negative in December, while fellow ratings firm Moody’s cut Budapest’s credit rating to junk.

Latin America

Policy continuity expected as Costa Rica elects right-wing populist

Costa Rica’s first-round presidential vote has delivered an unusually clear political outcome in a country known for fragmented governance. Laura Fernández, the chosen successor to President Rodrigo Chaves, secured a decisive victory that gives her party effective control of the legislature, reducing execution risk around fiscal policy and reform for the first time in years, the FT reports.

Markets have welcomed the result as a signal of continuity in a macro framework that has produced primary surpluses, declining debt pressures, and above-peer growth.

Rising crime dominated the campaign, and Fernández has promised tougher enforcement that could test Costa Rica’s traditionally strong institutional checks. For now, though, the election removes a key source of political uncertainty and supports stable financing conditions as growth moderates into 2026.

Chinese port operator takes Panama to court over canceled contracts

CK Hutchison has launched legal action against Panama after the country’s Supreme Court annulled the Hong Kong-based group’s long-standing concessions to operate ports at either end of the Panama Canal, the WSJ reports.

The company argues the cancellations violate contractual and investment protections, while Panamanian authorities maintain the ruling reflects judicial review rather than executive interference. The case introduces potential financial and legal liabilities for the state and could complicate future port rebidding, even as officials move to reassure markets that canal operations will remain unaffected.

Venezuela sees boost in oil exports and revenues

Venezuela’s oil exports jumped to roughly 800,000 barrels per day in January as US-controlled licenses allowed the release of crude that had been trapped by sanctions and blockades, Reuters reports. Exports were below 500,000 barrels per day the previous month.

The US said this week it had returned $500 million in initial oil-sale proceeds to Caracas, which is expected to provide short-term fiscal support and set the stage for a sharp rebound in economic activity this year. The move is part of Washington’s strategy to stabilize rather than transform Venezuela’s economy, prioritizing continuity of basic state functions over rapid political transition.

- Venezuelan business looks to post-Maduro opportunities (FT Opinion)

The recovery, however, is structurally constrained, and energy consultant Rystad expects Venezuela to trail other regional producers for years, given infrastructure decay and lingering political risk. While limited sanctions relief and improved cash flow could unlock incremental gains, sustained investment will depend on regulatory clarity and a credible political settlement.

What We’re Reading

Ghana and Zambia sign visa-free travel agreement (Africa News)

Uganda leads Africa’s private sector growth as Nigeria suffers surprise setback (FIA)

Cameroon and Equatorial Guinea sign agreement for cross-border gas project (Africa News)

Ethiopia sees return to double-digit growth on IMF-backed reforms (Daba Finance)

World leaders urge restraint as clashes in Ethiopia’s western Tigray resume (RFI)

UN to deploy ceasefire monitoring mission in DRC, Qatar says (Reuters)

US plans Mauritius visit and security deal after Trump criticism (Bloomberg)

Algeria opens 600-mile railway to tap vast iron-ore deposit (Bloomberg)

JP Morgan backs Afreximbank’s bonds after junk rating selloff (Reuters)

China’s military footprint in Africa grows (ACSS)

Africa’s economic growth set to overtake Asia’s. (Semafor)

Indonesia logs 5.1% GDP growth in 2025 but outlook remains downcast (Nikkei)

Military-backed party wins Myanmar election derided as sham (NBC)

IMF warns Bahrain over mounting debt (Semafor)

Oman to mediate latest round of talks between US and Iran (NYT)

Saudi Arabia and UAE to participate in US critical minerals deal in DRC (AGBI)

Saudi supply hikes help drive best GDP growth since 2022 (Bloomberg)

Saudi Arabia opens stock market to all foreign investors (Nikkei)

Businesses fear blowback from Saudi-UAE rift (FT)

Turkey to Ban Children Under 15 From Social Media (BalkanInsight)

Slovenia ends year-long dispute over central bank governor (FT)

JP Morgan sees Romania outperforming this year (Romania Insider)

Serbians pushed out as China takes over a mining empire (Politico)

How Russia weaponized global banking to silence dissidents (FT)

Colombian corporates face continued policy and macro uncertainty (Fitch Raitings)

China courts Uruguay as Argentina’s Milei embraces Trump (Bloomberg)

Argentina signs critical minerals deal with US, foreign ministry says (Reuters)

America’s new mineral alliance has China in its sights (Newsweek)

How emerging markets became the fiscal grown-ups. (UBS Global Wealth)

Chinese outbound investment in 2025 hit highest level since 2018 (Nikkei)

We are committed to providing FMN readers with a free weekly digest of politically unbiased, succinct and clear news and information from frontier and small emerging markets.

Please consider becoming a paid supporter to help cover some of our costs and support our continued development of sharp markets-focused coverage and new informational products. Paid subscribers will also gain exclusive access to our quarterly EM/FM report that aggregates EM insights from dozens of major banks, international institutions and consultancies.