🌍 Frontier Markets News, February 13th 2026

A weekly review of key news from global growth markets

Africa

Zimbabwe moves to extend Mnangagwa’s grip on power

Zimbabwe’s cabinet this week approved sweeping constitutional changes that would extend presidential terms from five to seven years and shift presidential elections from direct popular vote to parliamentary selection, Barron’s reports.

The amendments, which have to be approved by Parliament, would enable 83-year-old President Emmerson Mnangagwa to remain in power until 2030. He will also be able to appoint 10 additional senators, expanding the Senate to 90 seats, while paving the way for his ZANU-PF party, which holds a supermajority in Parliament, to hand-pick his successor.

The government this week predicted the country’s economy would grow by 8.5% this year, fueled in part by IMF program reforms and a recovery in agriculture and mining. The IMF and World Bank cast doubt on the government’s projections, suggesting 4.6-5% growth was more realistic.

US brokers Western Sahara talks

The US hosted high-level meetings in Madrid on Monday bringing together representatives from Morocco, Algeria, Mauritania and the Polisario Front—the Sahrawi national liberation movement—to discuss Western Sahara, the territory occupied by Morocco since 1975. The talks were led by US presidential advisor Massad Boulos and UN Ambassador Michael Waltz, and they reportedly centered on Morocco’s preferred autonomy plan that would maintain Moroccan control while offering nominal self-governance to the Sahrawi people.

The Polisario Front, backed by its longtime patron Algeria, still wants a long-promised but now seemingly scrapped UN-backed referendum on full independence for Western Sahara.

The US recognized Moroccan sovereignty over Western Sahara in 2020 when US President Donald Trump brokered Morocco’s normalization with Israel. Morocco has since become Africa’s largest purchaser of American military equipment, with $8.5 billion in contracts signed in 2025.

Boulos declared resolving Western Sahara an “absolute priority” for Washington, signaling greater US diplomatic involvement. Moroccan media claim Algeria showed openness to the autonomy plan, although Sahrawi leaders continue to demand self-determination.

Botswana raises taxes as diamond revenues wane

Botswana this week proposed raising corporate taxes by 2.5 percentage points to 24.5% and top personal income tax rates to 27.5% as the diamond slump squeezes national revenues, Business Insider reports.

Finance minister Ndaba Gaolathe said the budget forecasts a deficit of BWP 26.3 billion ($2.1 billion), representing 8.9% of GDP, far surpassing the country’s 4% fiscal ceiling and pushing total public debt projections past the statutory 40% limit, reaching 44.66% by March 2027.

Foreign exchange reserves have also diminished significantly after two consecutive years of economic contraction, falling from a 2023 high around $5 billion—9.1 months’ import cover—to around $3.5 billion.

Despite these headwinds, the government projects 3.1% GDP growth in 2026, driven by emerging copper mining activity, a moderate diamond market recovery, infrastructure investments under the Botswana Economic Transformation Programme (BETP), and agricultural gains (citrus exports have surged 390%). Diamonds, which generate one-third of national revenue and 75% of foreign exchange earnings, face persistent pressure from lab-grown alternatives and weak demand in key markets.

2026 Q1 Meta Report

Headline forecasts for frontier and emerging markets by major banks and financial institutions are showing an unusual degree of consensus. The real situation is far more nuanced, of course. Read FMN’s 2026 Q1 Meta Report synthesizing the insights from 27 institutions for a unique perspective on the risks and opportunities that lie behind the consensus.

Full report available to paying subscribers.

Asia

Opposition BNP wins convincing victory in Bangladesh election

Bangladesh’s opposition Bangladesh Nationalist Party this week won a commanding majority in the country’s first election since student-led protests toppled longtime leader Sheikh Hasina in 2024, CNBC reports. The election provides the new government with a chance to reset Bangladesh’s economy, which has struggled in recent years after a long stretch of solid growth.

Years of political turmoil, which peaked with Hasina’s resignation and self-imposed exile in India, have left the South Asian nation facing slowing growth and high inflation, and put pressure on its foreign-exchange reserves. Investors hope the new government will be able to create a stable platform that will restore confidence in the country’s garment sector, a key export earner that has been battered by US tariffs and labor unrest.

The IMF has warned that Bangladesh’s new government will face significant challenges as it seeks to revive economic growth, Views Bangladesh reports. The multilateral forecasts GDP growth at 4.7% this year, potentially rising to 6% if the government is able to effectively implement needed policy reforms.

Vietnam’s leader launches US charm offensive

Vietnam’s top leader To Lam is planning to visit Washington next week to attend the inaugural meeting of President Donald Trump’s Board of Peace, Reuters reports. He is also expected to preside over the signing of a number of trade agreements involving US aerospace and infrastructure firms.

Lam—who last month won reelection as leader of Vietnam’s Communist Party and confirmed he would also become the country’s president—is also reportedly hoping for a one-on-one meeting with Trump to unlock trade negotiations that have stalled over the treatment of exports transshipped through Vietnam from China, Bloomberg reports.

- VinFast targets 50% jump in EV sales in 2026 (Nikkei Asia)

Vietnam’s exports to the US have surged over the past year, despite Trump’s imposition of heavy tariffs on the country’s exports. Lam is hoping that presenting Vietnam as a constructive partner in Trump’s peace initiative will encourage the US leader to appreciate Vietnam’s role as an alternative to China in supply chains—and support Lam’s pledge to turbocharge growth above 10% in the coming years.

Pakistan rolls out plan for AI ecosystem

Pakistan’s Prime Minister Shehbaz Sharif this week doubled down on his promise to turn Pakistan into a leader for emerging technologies with a pledge to invest $1 billion in AI by 2030, Dawn reports. At a weeklong government-backed conference on AI, Sharif also promised to launch an AI curriculum in all the nation’s schools, and to “train a million non-IT professionals” to help build an AI ecosystem in the country.

Pakistan’s government is already using AI to enhance tax compliance and revenue collection, according to finance minister Muhammad Aurangzeb. At the same conference, Aurangzeb told attendees “AI-enabled systems are playing an increasingly important role in strengthening compliance, enforcement and decision-making,” Arab News reports.

Pakistan’s government is focusing on applied AI solutions that deliver measurable gains in efficiency, transparency and productivity, Aurangzeb added.

Middle East

European leaders push to deepen relations with GCC

The UK’s Prince William this week made an official state visit to Saudi Arabia, meeting de facto leader Crown Prince Mohammed bin Salman in a bid to strengthen economic ties, Reuters reports. Prince William toured Vision 2030 projects, and was expected to discuss energy and environmental investment and trade partnerships.

Earlier this month, German Chancellor Friedrich Merz conducted a similar visit to Saudi Arabia, Qatar and the UAE as part of an effort to widen Germany’s options for trade and investment. Merz was accompanied by energy and industrial CEOs seeking to capitalize on Saudi Arabia’s mission to reduce the economy’s dependence on oil.

Last week, Germany’s economy minister Katherina Reiche said Germany and Saudi Arabia are to deepen energy cooperation, which could help the European nation diversify its energy import mix. Merz also promised Qatar more arms “cooperation” in exchange for energy imports.

Saudi Arabia moves to build regional influence amid rift with UAE

Saudi Arabia this week continued to build on its momentum in Yemen after reasserting control in an offensive in January, earmarking some $3 billion to cover salaries for Yemeni armed forces and civil servants, Reuters reports. A third of the money will go to proxy organizations formerly backed by the UAE.

The financial package is intended to help the internationally recognized Yemeni government consolidate control over the country’s armed forces, which is considered the logical next step after it regained control of territory taken by separatist UAE proxies.

Also this week, Riyadh signed a military cooperation agreement with Somalia, an implicit rebuke of the UAE’s growing support for the breakaway region of Somaliland. And last weekend, Saudi Arabia announced a major investment package for Syria, including $2 billion to develop airport infrastructure, and $800 million for the telecom sector.

Europe

Armenia and Azerbaijan sign major US deals during Vance visit

US Vice President JD Vance visited Yerevan and Baku this week to sign significant economic and security agreements with Armenia and Azerbaijan, AP reports.

Armenia is set to receive an unprecedented amount of foreign investment from Washington with $9 billion allotted to the development of a nuclear power plant and $4 billion for an artificial intelligence project. The combined investment is equivalent to nearly half of Armenia’s $27 billion GDP.

The planned nuclear plant is intended to replace Armenia’s aging Soviet-era facility, which currently provides about 40% of the country’s electricity. The AI project, led by Firebrand.ai and powered by large deliveries of Nvidia chips, is designed to make Armenia one of the world’s top five AI GPU hubs and would be among the largest technology-focused investments in the country’s history. The deals build on Armenia’s rapid growth in recent years, including a doubling of GDP between 2020 and 2024, helped in part by rising trade with Russia linked to its war on Ukraine.

- US consulting firm begins feasibility study for TRIPP (US embassy)

In Azerbaijan, Vance and Prime Minister Ali Asadov signed new economic and security cooperation agreements. They also discussed the Trump Route for International Peace and Prosperity (TRIPP), a proposed 27-mile rail, road, digital and energy corridor linking mainland Azerbaijan to its Nakhchivan exclave and onward to Turkey across Armenian territory. Under a framework outlined last month, the US would receive a 74% stake in TRIPP for 49 years, while Armenia would hold the remaining 26%. Vance also announced that the US plans to provide ships to bolster Azerbaijan’s defense of its territorial waters.

Rubio looks to shore up European allies

US Secretary of State Marco Rubio will travel to Hungary and Slovakia next week for meetings focused on energy, security, and broader US ties with Central Europe, RFE reports.

In Budapest, Rubio is expected to meet Hungary’s Prime Minister Viktor Orbán to discuss bilateral efforts toward “peace” and regional stability, as well as energy cooperation. The trip follows US President Donald Trump’s recent public endorsement of Orbán ahead of Hungary’s April parliamentary elections, in which Orbán is trailing opposition candidate Péter Magyar in the polls. Trump’s administration views Orbán, a long‑serving right-wing leader who has often clashed with the EU over rule‑of‑law and support for Ukraine, as a key partner on both security and energy issues.

In Slovakia, Rubio will meet Prime Minister Robert Fico—another vocal supporter of Trump—and other senior officials to advance cooperation on military modernization, NATO commitments, and nuclear energy. US and Slovak officials are expected to discuss upgrading Slovakia’s armed forces and expanding cooperation on nuclear power and energy diversification, part of a broader push to reduce reliance on Russian energy.

Latin America

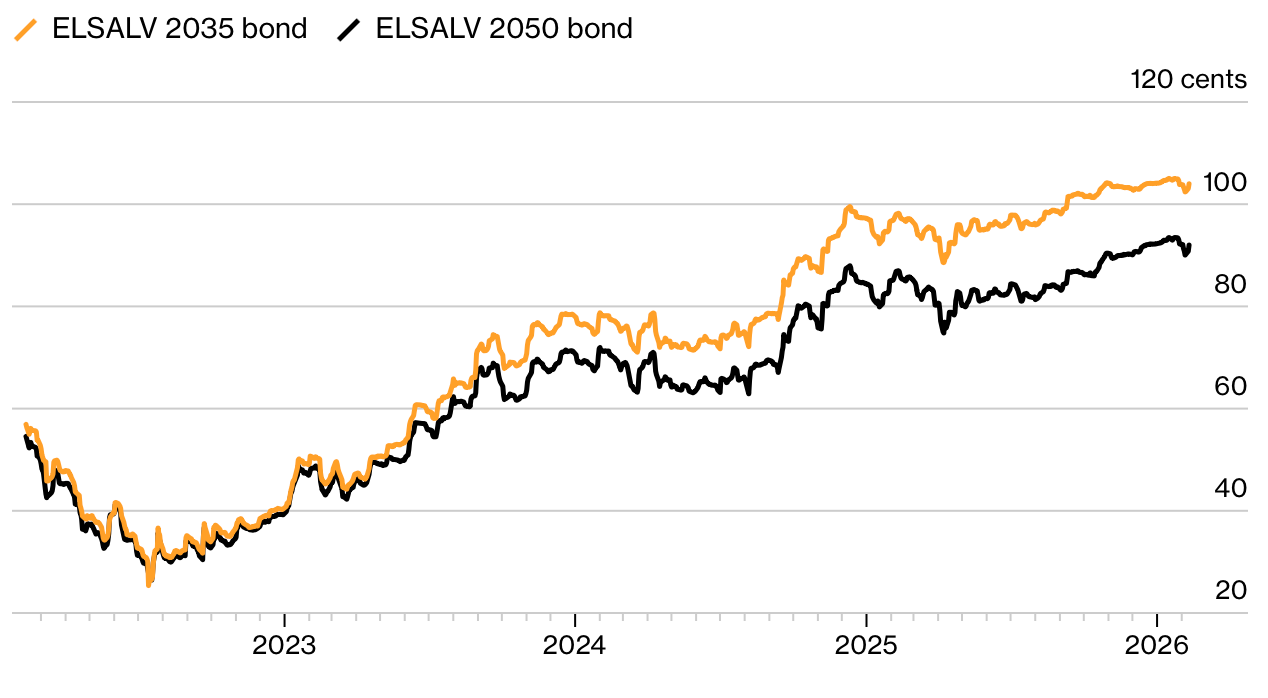

Falling bitcoin threatens confidence in El Salvador

El Salvador’s bitcoin exposure is back at the center of its debt story after the latest cryptocurrency selloff wiped roughly $300 million from government holdings, cutting its portfolio to around $500 million. President Nayib Bukele has pledged to continue buying bitcoin, despite it being a sensitive issue in the country’s ongoing talks with the IMF over a $1.4 billion program.

The IMF discussions have been stalled since September last year over concerns that Bukele is dragging his heels on reforms requested by the multilateral, and that he might use disbursements to fund future bitcoin purchases. Questions over future IMF disbursements, which anchor El Salvador’s refinancing outlook, have shaken investor confidence, raising the cost of insuring its debt.

El Salvador’s bonds are still among the world’s best performers, however, having returned around 100% in three years on the stabilization narrative.

Fiscal fundamentals have also improved. The deficit has narrowed to roughly 3% of GDP and reserves sit near $4.5 billion. However, with $450 million in payments due this year and nearly $700 million next year, external support remains crucial.

Colombian equities fall as Petro declares economic state of emergency

Colombian equities fell 2% after President Gustavo Petro declared an economic emergency in response to severe flooding, granting him the authority to raise taxes and adjust spending by decree, Latin America Reports writes. Officials are targeting roughly COP 8 trillion ($2.1 billion) in additional taxes.

Financials and utilities led losses as investors reacted to Petro’s renewed use of executive powers.

The move follows a prior emergency declaration, which was suspended by the Constitutional Court, prompted by lawmakers’ rejection of a broader tax proposal. For markets, the concern is less the headline spending than the precedent: fiscal stress and climate shocks are increasingly colliding with constitutional limits, adding political risk to Colombia’s macro outlook.

Argentina passes labor market liberalization package

Argentina’s Senate this week approved President Javier Milei’s labor reform package, marking a crucial step in his mission to liberalize the country’s economy, Reuters reports. The reform would ease hiring rules and recalibrate severance costs as part of a broader market-oriented overhaul.

The bill now heads to the lower house amid union resistance, but the vote reinforces reform momentum and signals that Milei retains legislative traction at a critical stage in his adjustment program.

What We’re Reading

Mali creates state-owned company to manage mining holdings (Reuters)

Burkina Faso’s parliament bans all political parties (Africa News)

US to send 200 troops to help Nigeria fight Islamist insurgents (WSJ)

Saudi Arabia commits $49m to Liberia electricity drive (Liberian Observer)

Cameroon President Biya delays elections again (Africa News)

Ethiopia ‘builds secret camp’ to train Sudan RSF fighters (Reuters)

Kenya to join growing list of African countries buying gold for reserves (Reuters)

US and Burundi sign strategic health cooperation MOU (US Embassy Burundi)

Scrutiny grows over DRC-US minerals deal (Mongabay)

Sri Lanka launches digital nomad visa for remote workers (Condé

Naste Traveler)

Bangladesh secures tariff-free rate on some clothes sales to US (FT)

Thai voters decisively reject progressive party (NY Times)

Middle East sovereigns face stable ratings outlook (S&P)

Uber snaps up Getir in Turkey as Mubadala exits battered delivery bet (AL-Monitor)

Poland risks a rating downgrade if debt isn’t stabilized (Reuters)

Trial of far-right Romanian former presidential candidate set to begin (Balkan Insight)

Hungary’s Orbán flags fourth year of 5% deficit as election spending bites (Reuters)

CK Hutchison escalates legal battle over Panama ports ruling (GCaptain)

US-led oil sales from Venezuela ‘to bring in $5bn’ in months (Reuters)

Venezuela plans to grant more oil blocks to Chevron and Repsol (Bloomberg)

Chile to send humanitarian aid to Cuba after US blocks oil imports (CyberCuba)

US and China clash over Peru’s Chancay megaport (SCMP)

Bolivia looking for up to $3.3 billion in IMF financing (Bloomberg)

We are committed to providing FMN readers with a free weekly digest of politically unbiased, succinct and clear news and information from frontier and small emerging markets.

Please consider becoming a paid supporter to help cover some of our costs and support our continued development of sharp markets-focused coverage and new informational products. Paid subscribers will also gain exclusive access to our quarterly EM/FM report that aggregates EM insights from dozens of major banks, international institutions and consultancies.