🌍 Frontier Markets News, December 5th 2025

A weekly review of key news from global growth markets

Africa

Junta in Guinea-Bissau takes control

Guinea-Bissau’s new military junta this week tightened its grip after ousting President Umaro Sissoco Embaló, even as accusations surfaced that the coup could have been staged to prevent the release of the results of the recent presidential election. In response, leaders of the regional bloc ECOWAS suspended Guinea-Bissau and dispatched a delegation to the country to push for a return to constitutional order.

In the wake of the coup, the military leadership banned protests and refused calls to release the results of the presidential election that were set to be announced a day before the coup. The headquarters of the main opposition party were raided at the weekend.

The transitional government said it would provide a one-year leadership roadmap at the next ECOWAS meeting slated for December 14th.

Mali recovers $1.2bn from miners after audit

Mali’s economy minister Alousseni Sanou announced on Monday that the country had clawed back 761 billion CFA ($1.2 billion) from mining companies following a sector-wide audit, Reuters reports.

The arrears stemmed from a 2023 revision of the country’s mining code that scrapped tax exemptions, increased royalties, allowed the government and Malians to buy additional shares in companies, and increased the state’s stake in new projects to 35% from 20%. The government estimates it will gain an additional $1 billion per year in tax revenues from the sector.

The recovery announcement follows a detente in a two-year tax and ownership dispute with Canadian miner Barrick, during which Mali seized gold, blocked exports, jailed workers and briefly placed the flagship Loulo-Gounkoto complex under provisional administration. The government and Barrick agreed to a $430 million settlement last week in which Mali dropped all charges against the company, released jailed employees, and returned operational control of the mine.

Egypt leads Africa’s largest economies in growth surge

Egypt’s economy continues to outperform regional peers, with growth hitting a three-year high in the most recent quarter, Finance In Africa reports. Tourism, financial intermediation, ICT and industrial businesses helped power a 5.3% expansion in the first quarter of the 2025/26 fiscal year. Structural reforms tied to an $8 billion IMF program and blockbuster tourism investments from Qatar and the UAE boosted the economy, too.

Nigeria also saw strong growth, supported by solid gains in services and agriculture, alongside a rebound in oil output after years of disruption. Its GDP growth reached almost 4% in the third quarter, easing from 4.23% in the previous three months.

South Africa’s economy eked out a 0.5% quarter-on-quarter expansion to achieve its fourth consecutive quarter of growth. Mining and agriculture led the gains, helping drive year-on-year growth to 2.1%.

Across the three economies, growth is being driven by non-oil sectors and tentative recoveries in investment, but analysts caution that high inflation, tight monetary policy and long-standing infrastructure and governance bottlenecks continue to weigh on living standards and job creation. Nigeria’s inflation remains at 16%, South Africa’s unemployment hovers near 32%, and Egypt is still digesting a sharp currency devaluation.

Asia

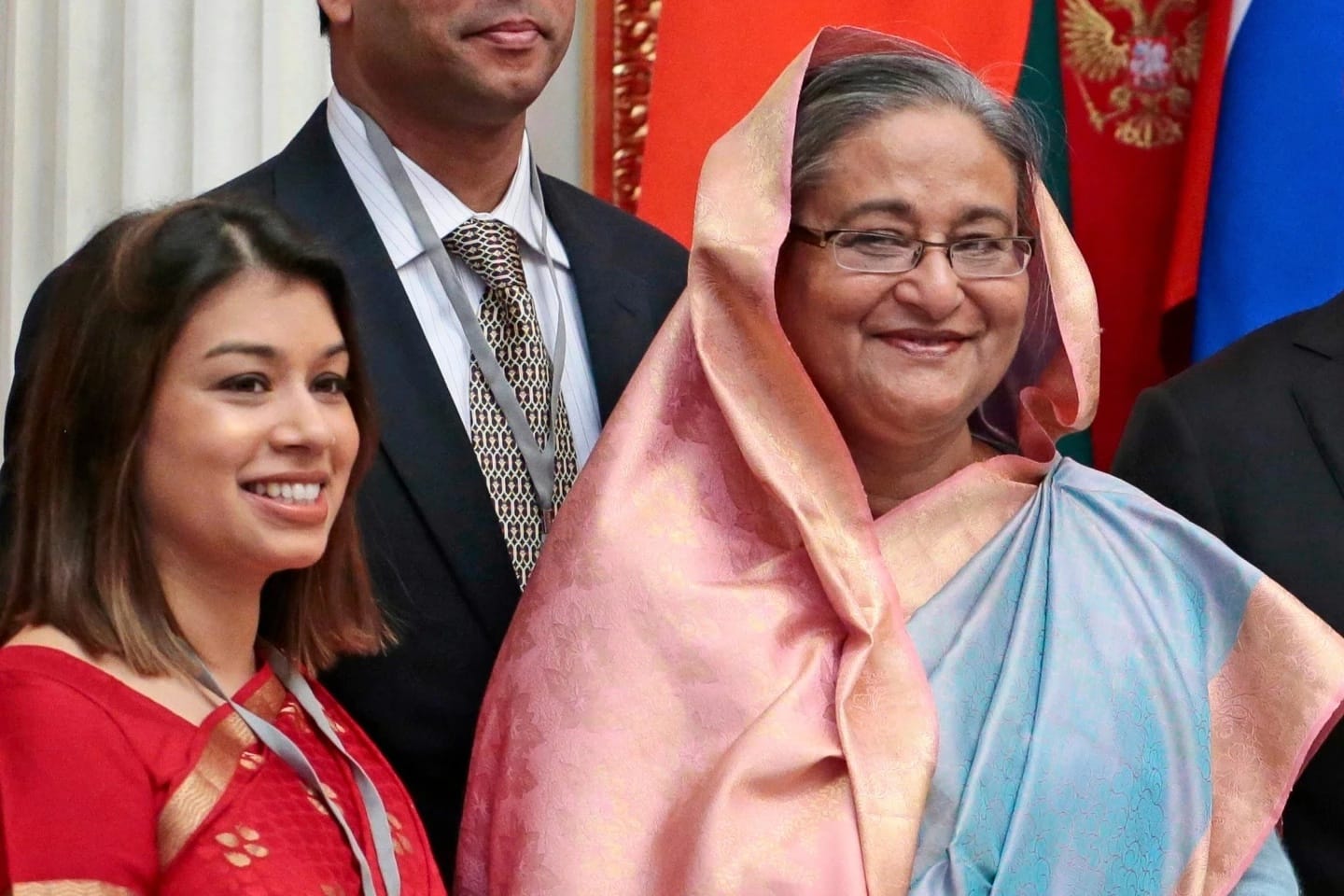

Bangladesh hands down two-year sentence to former PM’s niece

A court in the Bangladeshi capital of Dhaka sentenced the niece of ousted prime minister Sheikh Hasina to two years in prison on Monday for corruption related to a government land project, AP reports.

The court ruled that Tulip Siddiq, a former lawmaker in the UK, had illegally influenced Hasina to give a plot of land to her family. Siddiq dismissed the ruling as a “farce.”

In Bangladesh, the protesters who toppled Hasina have struggled to translate their movement into political power. Opinion polls show that the youth-led National Citizen Party trails the establishment Bangladesh National Party by a wide margin, Reuters reports. Interim leader Muhammad Yunus has vowed not to seek office in upcoming February elections, while Hasina’s Awami League is banned from participating.

Vietnam’s economy shrugs off tariffs … for now

Vietnam’s economy is still running hot, Asia Times reports, even as the country contends with 20% tariffs from the US, its largest export market. The country recorded 8.22% year-on-year growth in the third quarter, the highest such figure in more than a decade.

- Vietnam is the fastest-growing trade partner at Port of Savannah (DC Velocity)

There are signs the tariffs are beginning to bite, however. Exports to the US fell 1.5% in October compared to a month prior, marking the third straight month of declines, Reuters reports. Still, Vietnam’s trade surplus with the US is set to hit another record this year.

The Vietnamese coffee industry has been one winner. Exports are set to increase by 7% this year, Bloomberg reports. They could get another boost soon: US President Donald Trump announced last month that the US would exempt coffee and other agricultural products from tariffs.

Floods wreak havoc in South and SE Asia

Cyclones battered South and Southeast Asia this week, unleashing extreme floods and killing at least 1,350 people, the New York Times reports.

In Sri Lanka, President Anura Kumara Dissanayake said on Monday that his country faced the “largest and most challenging natural disaster in our history.” More rain fell in three days than the country typically gets in October and November combined, NBC reports. Official data showed 479 people killed as of Thursday, with tens of thousands of homes damaged.

Indonesia was hit hard as well. Flooding there has killed 836 people and displaced hundreds of thousands more as of Thursday, according to government statistics. Hundreds more have died this monsoon season in Malaysia, the Philippines, Thailand and Vietnam.

Middle East

Saudi Arabia plans continuing deficits but sharper focus on value

Saudi Arabia plans to focus more closely on the value it receives from its investments as it seeks to rein in a ballooning budget deficit, Reuters reports. Finance minister Mohammed Al-Jadaan says the “deficits by design” will continue through at least 2028 but spending will focus on “what we are spending on, rather than how much we are spending.”

The government’s 2026 budget estimates a smaller deficit of $44 billion, or about 3.3% of GDP. This year, the deficit is expected to hit 5.3% of GDP, sharply higher than the initial target of 2.3%.

Al Jadaan also said that the government is open to canceling some of its “Vision 2030” economic diversification projects if they continue to underperform—a direct acknowledgement of widely reported challenges faced by projects such as the futuristic city Neom. But despite the purportedly more prudent spending plans for 2026, Riyadh has signaled that it will continue to tap international debt capital markets for bonds and loans to fill budget gaps and fund its Vision 2030 program.

Oman cancels two green hydrogen projects amid wider demand concerns

Oman this week announced the cancellation of two of its nine green hydrogen projects under construction, scaling back its strategy amidst wider market signals suggesting weak demand, Semafor reports. The projects—one with UK’s BP and another with French and South Korean partners—were ended by “mutual agreement” according to Hydrogen Oman, which says that the seven remaining projects are still on track with a production target of 1 million tonnes a year by 2030.

Earlier this year, citing similar demand concerns, Saudi Arabia’s Neom megaproject also pared back its hydrogen subsidiary after failing to find a buyer for more than half of its potential output. In Europe, French rail company Alstom shelved its plans for green-hydrogen powered trains, and Portuguese EDP is reportedly ‘seriously considering’ exiting its own investments due to similar demand and regulatory concerns.

Europe

EU’s ‘reparation loan’ for Ukraine faces criticism

The European Commission proposed a €140 billion loan to Ukraine this week that would be backed by frozen Russian assets. The Commission asked the European Central Bank to act as a lender of last resort for the loan, which the bank refused due to legality concerns. The EU has frozen €210 billion in Russian assets since Russia invaded Ukraine in 2022.

The US has also proposed using frozen Russian assets as part of a peace deal. The Trump administration’s Ukraine-Russia peace plan would place $100 billion of frozen Russian assets in US-led investment funds to rebuild Ukraine, with the US entitled to 50% of profits.

Ukraine launched an additional plan this week to provide for the country’s war funding needs, which would restructure $2.6 billion of the country’s growth-linked debts. Ukraine’s finance minister released the offer on Monday.

Bulgaria scraps proposed budget after mass protest

Just weeks before Bulgaria is due to adopt the euro, the country’s government withdrew a proposed budget in the wake of large-scale, mostly peaceful protests, the FT reports. Tens of thousands of Bulgarians demonstrated against government corruption, which the opposition argued would have become worse under the proposed budget.

Sofia was hoping for a surge in investment after Bulgaria joins the eurozone on Jan. 1, but the government’s unpopularity could trim investors’ deployment of capital, according to Mario Bikarski, an analyst at consultancy Verisk Maplecroft.

Figures released this week show Bulgaria’s economy grew by 3.2% last quarter compared with the same period in 2024. The growth rate was the lowest in a year, while exports fell by 5.6% and imports rose by more than 4%.

Latin America

New Bolivian government faces immediate pressure over economic reforms

Bolivia’s new government is barely two weeks old and already grappling with internal fractures and an economy under acute pressure, Bolivia Brief reports. President Rodrigo Paz took office promising institutional repair, only to find ministries stripped of equipment and records. At the same time, food shortages and mounting costs of long-standing subsidies have exposed how little room the administration has to maneuver, Reuters reports.

A more immediate political challenge is coming from inside the government. Vice President Edman Lara, a populist outsider elevated late in the campaign, has turned publicly on the president after losing influence over cabinet appointments. His criticism, delivered through social media and small street demonstrations, has widened a rift that threatens to undercut the government’s ability to build consensus for fiscal reforms.

If Lara succeeds in mobilizing his supporters ahead of 2026 local elections, Paz could struggle to secure votes for the subsidy cuts and regulatory changes needed to stabilize public finances. A tactical alignment between Lara and remnants of former president Evo Morales’ MAS party is also possible, raising the risk of legislative deadlock.

Trump-backed candidate tied in contentious Honduras election

Honduras’s presidential race has tightened into a near dead heat, raising the stakes in an election already shaped by aggressive US involvement and competing claims of victory. With more than 80% of ballots counted, conservative former mayor Nasry “Tito” Asfura and longtime candidate Salvador Nasralla are separated by only a few thousand votes.

Washington’s involvement has added an unusual layer of pressure, the FT reports. US President Donald Trump endorsed Asfura days before the vote and said he would cut US funding for Honduras if his preferred candidate didn’t win. He also this week pardoned former Honduran president Juan Orlando Hernández, who was serving a 45-year jail sentence in the US for drug-trafficking, injecting fresh volatility into an already polarized landscape.

Nasralla has vowed to break ties with Venezuela if elected, underscoring the foreign-policy stakes riding on the outcome. With both campaigns preparing for a protracted count, the credibility of the electoral authority will determine whether the next administration begins with a workable mandate or in the shadow of an immediate political dispute.

LatAm accelerates multilateral deals for minerals

Latin American governments are moving to expand their role in critical minerals supply chains as demand from the US pushes production and processing closer to home, the FT reports. Ilan Goldfajn, president of the Inter-American Development Bank (IDB), says countries from Mexico to Argentina are seeking to capture more value from lithium, copper and rare earth extraction by building out refining capacity rather than shipping raw ore to Asia.

China’s dominance in minerals processing keeps global prices low, making it difficult for new entrants to compete without long-term purchase agreements. To help address that challenge, the IDB is backing projects across the region, including lithium processing in Argentina and sustainable-industry investments in the Amazon, as part of record annual lending.

The US has shown a keener interest in the region’s supply chains as it looks to reduce exposure to China and strengthen economic ties across the hemisphere. Whether Latin America can capitalize on the moment will depend on governments’ ability to finance complex industrial build-outs and provide stable regulatory conditions for investors.

What We’re Reading

Kenya’s government to sell 15% Safaricom stake to Vodacom (Africa Report)

UK pulls $1.15bn support for Mozambique gas project (The Guardian)

Sudan offers Russia its first naval base in Africa (WSJ)

Fitch upgrades Zambia to ‘B-’; outlook stable (Fitch)

Afreximbank raises $528mln in second Samurai bond issue (Ecofin)

Trump is driving Africa to ‘look inwards’ for growth (FT)

Pakistan to sell national airline for first privatization in two decades (Dawn)

Intel to invest $208mn in Malaysia (Bloomberg)

Lebanon and Israel talks raise hope of more robust, expanded truce (Al Jazeera)

Iran’s currency falls to a new low as nuclear sanctions squeeze its ailing economy (NBC)

Qatar plans new data cable corridor to EU to reroute internet around Red Sea via Iraq and Turkey (Semafor)

Romania says 2026 funding needs will grow but plans to manage debt costs (Reuters)

Kosovo bars Serb party from parliamentary elections (Balkan Insight)

Serbian oil refinery suspends production due to US sanctions (Balkan Insight)

Euroskeptic Slovak leader targets whistleblowers in latest crackdown (FT)

Slovenia rejects Croatia’s bid to buy Ljubljana Stock Exchange (Bloomberg)

Hungary vows to fight EU’s Russian gas phase-out (Radio Free Europe)

Tension in the Caribbean reverberates in Cuba (El Pais)

Brazil clinches export deals with Philippines, Guatemala, and Nicaragua (Mercopress)

Uruguay picks up $1.3bn loan package. (Latin Finance)

Argentina labor reforms revive tensions between banks and fintechs (Buenos Aires Times)

We are committed to providing FMN readers with a free weekly digest of politically unbiased, succinct and clear news and information from frontier and small emerging markets.

Please consider becoming a paid supporter to help cover some of our costs and support our continued development of sharp markets-focused coverage and new informational products. Paid subscribers will also gain exclusive access to our quarterly EM/FM report that aggregates EM insights from 25 major banks, international institutions and consultancies.