🌍 Frontier Markets News, August 29th 2025

A weekly review of key news from global growth markets

Africa

IMF digs deeper into Senegal’s debt misreporting

The IMF this week said it wasn’t ready to consider providing new funding for Senegal as the multilateral continues to investigate the country’s misreporting of its debt, Bloomberg reports. Leaders of an IMF delegation to Senegal said they would seek more information on why and how Senegal’s previous government had underreported sovereign debts by around $7 billion.

Those faulty calculations translated to debt at 119% of GDP, the fund said on Tuesday. The current government, which discovered the misrepresentation of the debt during an audit of state finances late last year, has made it clear it would like a new IMF-supported program.

Prime Minister Ousmane Sonko last month announced a recovery plan founded heavily on domestic borrowing to reduce Senegal’s reliance on foreign funds. The West African country is also rebasing its economy for the first time in seven years to reset its debt-to-GDP ratio.

Botswana taps Lazard to advise on De Beers ownership

Botswana’s government has hired French bank Lazard to explore a potential takeover of diamond giant De Beers, the FT reports. Last month, the southern African country’s President Duma Boko said that De Beers was “not doing its job” and suggested it was time for his government to “take over” control of the mining company.

De Beers’ leading stakeholder Anglo American is looking to sell its share and has received at least nine bids. Lazard, with its track record of advising countries on complex financial situations, will work alongside Swiss boutique lender CBH on “the potential acquisition of all or part of the De Beers Group,” a government spokesperson told the FT.

The announcement came just days after Boko announced a $12 billion investment pledge from Qatar’s Al Mansour Holdings, reportedly focused on infrastructure, energy, mining, diamond refinement, agriculture, tourism, cybersecurity and defense.

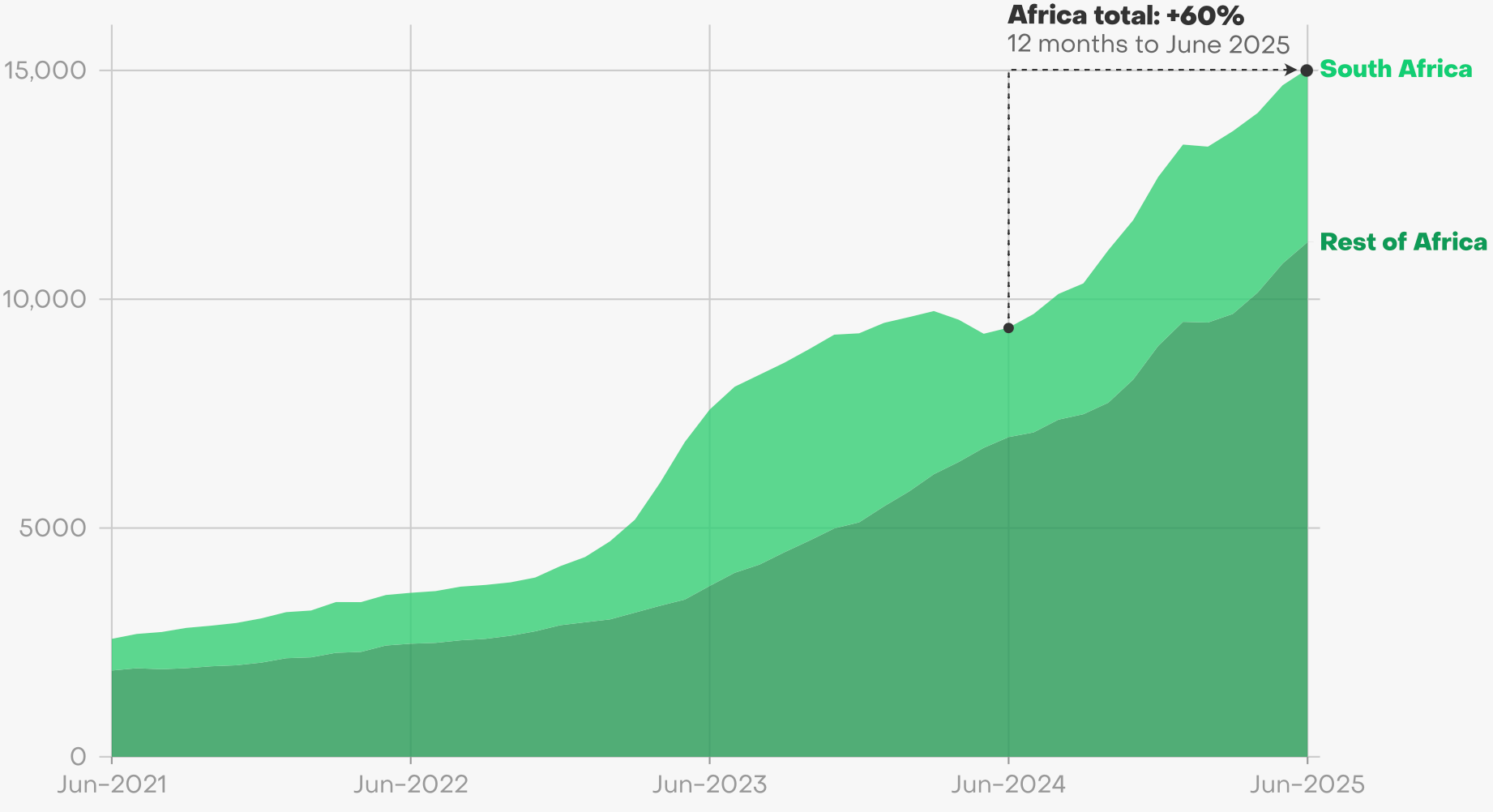

African solar adoption surges

Imports of solar panels from China to Africa surged by 60% to 15,000 megawatts over the past year, according to a report by energy thinktank Ember. The report also found that over the past two years imports to sub-Saharan countries excluding South Africa nearly tripled in terms of capacity, from 3,734 MW to 11,248 MW—and 20 of those countries set a new record for their solar panel import levels.

If all the panels imported into Sierra Leone in the last year were installed, they could generate the equivalent of 61% of the country’s electricity generation. In Chad, that would be 49%, and in Liberia 25%. At least 16 countries would see at least a 5% bump, Ember estimates.

Many of these panels will directly replace diesel-fueled generators, giving countries a significant cost advantage, Ember says. Currently, the value of refined petroleum imports ranges between 30 to 107 times as large as that for solar panels for most of the top solar panel importers.

Asia

Chinese interest in Vietnamese tungsten mine alarms West

A plan to put a tungsten mine up for sale is rattling Western diplomats in Vietnam who are concerned it will be sold to Chinese buyers, Reuters reports. A subsidiary of the Vietnamese conglomerate Masan is planning on putting the Nui Phao mine up for sale, and two Chinese companies have approached international firms asking them to serve as proxies for their bids, according to Reuters.

- Vietnam to buy more ethanol-blended fuel in bid to increase US imports (Reuters)

China is already the largest producer by far of tungsten, which is used in products ranging from bullets to light bulbs, but the country’s increasing weaponization of critical minerals is heightening concerns over its ownership of foreign resources.

The Nui Phao mine is Vietnam’s largest, producing almost all of the Southeast Asian nation’s tungsten output. Vietnam is the world’s second-most prolific producer of tungsten of any country, and Western diplomats fear that Chinese ownership of the mine could reduce global access to the mineral.

Pakistan taps Asian Development Bank to fund transport and mining projects

The multilateral Asian Development Bank is in talks to provide $2 billion to help Pakistan fund a long-planned upgrade to its aging railway system, Reuters reports, filling a funding role previously held by China.

The ADB is also planning to provide some $410 million funding to develop a major copper mine in Balochistan in southwest Pakistan, which is one of the largest untapped deposits in the world, according to Arab News. Pakistan’s Prime Minister Shehbaz Sharif described the ADB’s investment plans as “revolutionary” for the country’s economy.

Pakistan and Chinese banks have been planning to revamp the country’s railway network for a decade. But the infrastructure plan, which was set to be a cornerstone of the Belt and Road agreement the two nations struck in 2015, has never materialized. Other China-funded projects, including a port in the city of Gwadar, have been delayed. Pakistan has meanwhile become mired in debt that it has taken on to pay for the programs.

Casinos fuel Sri Lanka’s tourism push

Sri Lanka is placing a billion-dollar bet on casinos as a way to increase tourism to the island. The country opened a $1.2 billion gaming house in the capital city of Colombo this month, as part of a push to raise tourist arrivals by 50% from last year.

The casino, a joint venture between domestic firm John Keells Holdings and Macau’s Melco Resorts & Entertainment, will target Indian and Chinese tourists. Indians account for about a quarter of all tourist visits to Sri Lanka.

- Ex-president’s arrest sparks corruption debate (DW)

The effort to increase tourism comes on the heels of an economic crisis that resulted in the ouster of Sri Lanka’s leaders, a sovereign default, and a 7% contraction in the country’s GDP. The South Asian nation’s financial scars are still healing, and finding new revenue streams is becoming increasingly urgent as the deadline for resuming debt repayments approaches.

Middle East

Oman joins neighbors with ‘golden visa’ program

This week, Oman became the latest GCC member to introduce a golden visa–part of a broader competition to attract foreign direct investment with its neighbors Saudi Arabia, UAE and Qatar. The program offers five- or 10-year visas to investors who commit at least OMR 250,000 ($650,000) into commercial or real estate investments, or long-term bank deposits.

Oman already offers an investment-for-residency program for those investing at least OMR 500,000 in local companies or government bonds for 10 years with an option to extend. The new program with a lower minimum investment is designed to attract a broader base of inward-bound FDI, which in the first quarter of 2025 totaled OMR 5.2 billion ($13.6 billion), over 80% of which was to the oil and gas sector.

Neighboring UAE has offered a golden visa since 2019, costing AED 2 million ($544,000) in local investment funds or real estate, with some 284,000 issued between 2021 and 2023, the most recent officially reported numbers. Saudi Arabia’s program, dubbed “Premium Residency”, casts a wider net, offering unsponsored residency for investors but also entrepreneurs and skilled professionals.

Saudi Arabia’s Vision 2030: ‘Could do better’

Halfway through its closely watched Vision 2030 program Saudi Arabia has admitted most of its ambitious targets are unlikely to be met on schedule, according to London-based economics consultancy Capital Economics. But, FMN’s Nojan Rostami writes, the much-publicized frustrations are balanced by some solid successes.

Read the full analysis at Frontier Markets News.

Iraq’s soaring domestic debt hampers economy

Iraq’s government this week announced that its domestic debt burden has risen to nearly ID 92 trillion ($72 billion) due to a higher than expected public wage bill and sharp fluctuations in oil prices, AGBI reports. The debt growth has been exacerbated by parliament’s inability to pass a budget, which has led to greater reliance on debt issuance.

The debt burden is already hindering Iraq’s economy. In July, the IMF said financing constraints caused by heavy public debt servicing costs had slowed non-oil sector growth from 13.8% in 2023 to 2.5% in 2024. The IMF also said heavy government spending since Covid had “increased economic vulnerability.”

A silver lining is that the ratio of total debt to GDP, around 47%, is below the IMF 60% ceiling, meaning that despite the negative pressure of high debt service on the broader economy Iraq remains in good standing with multilateral lenders should it need further support.

Europe

Poland provides early warning of Chinese dumping threat

Poland’s largest online marketplace, Allegro, has sounded the alarm over Chinese ecommerce platforms flooding Europe with cheap goods as they look to boost sales dented by US tariffs, the FT reports. CEO Marcin Kuśmierz warned that companies such as Temu and Shein are shifting their focus to Europe, threatening to overwhelm smaller local players. Temu has already overtaken Allegro as the most visited platform in Poland.

Chinese platforms have pulled back on US marketing since US President Donald Trump rolled out his tariff strategy. But in Europe’s major markets, Temu’s users have surged by up to 70%, while Shein continues to expand aggressively.

The European Commission has begun probing Temu for illegal product sales and is considering reforms to address the import surge. Yet without swift action, the imbalance could accelerate. Allegro, whose shares are up 40% this year, remains confident in its growth, but warns Europe may be underestimating the scale of the threat generated by Trump’s tariffs.

Latin America

Corruption allegations present Milei’s government with stiffest test yet

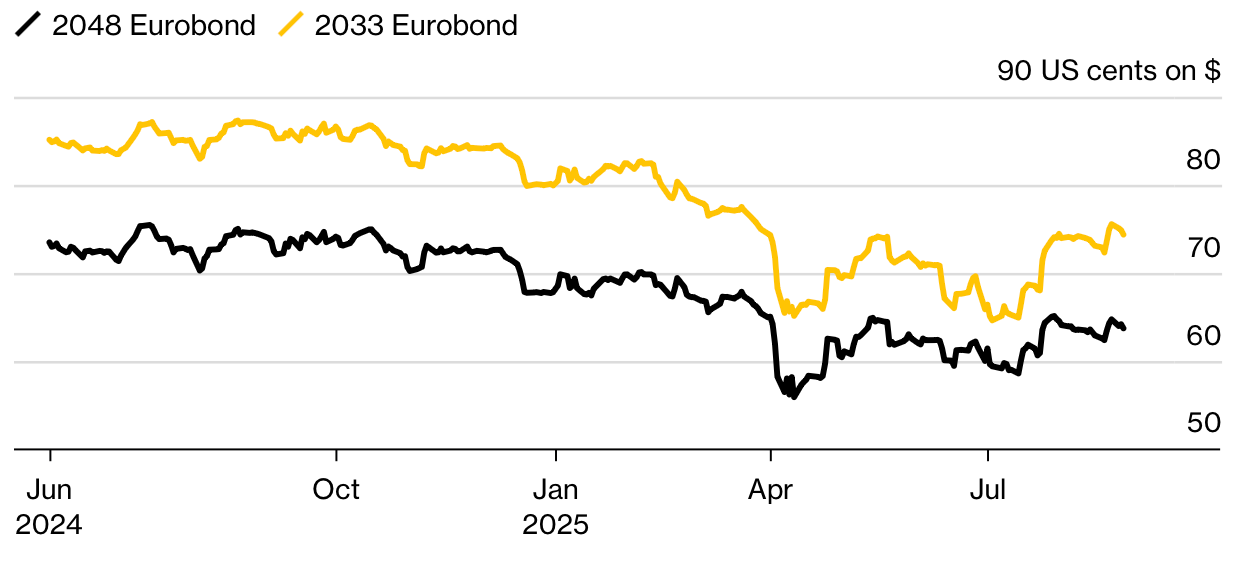

Argentina’s markets have been shaken by a corruption scandal, with allegations reaching President Javier Milei’s inner circle, Reuters reports. Audio recordings apparently implicate Milei’s sister and chief of staff, Karina Milei, although the government questions their authenticity. The scandal comes just weeks before critical provincial and midterm elections.

Markets reacted sharply. The peso dropped nearly 3% against the dollar, the country’s benchmark stock index slid 4% in a day, and sovereign bonds hit multi-month lows. Investors fear the incident could weaken Milei’s ability to advance his market-friendly reforms, which have so far propped up his support despite his initiating a painful economic adjustment.

- Argentina: Interest rates soar in response to new BCRA rules (Mercopress)

Milei’s reform agenda hinges on popularity and confrontation, and any loss of credibility could derail it. For investors, the scandal raises new uncertainty over whether Argentina can sustain both political and economic stabilization.

Venezuelan dollar crackdown boosts crypto adoption

Venezuelans are increasingly turning to cryptocurrencies as President Nicolás Maduro’s government clamps down on black market dollars and the bolívar plunges, the FT reports. Shops from corner stores to national chains now accept stablecoins such as USDT, and universities are offering courses on digital assets.

The shift reflects necessity as annual inflation hit 229% in May and the bolívar has lost 70% of its value in under a year.

Maduro’s government is both enabling and resisting the trend. Authorities have arrested operators of black-market exchange-rate websites, while officials themselves have turned to crypto to evade sanctions. Citizens, however, view stablecoins as safer than bank or the state investments, despite potential transaction losses and limited access to platforms such as Binance due to sanctions.

For businesses, cryptocurrencies are becoming key to survival. Hardware stores pay suppliers in USDT, for example, employees receive wages in it, and shopkeepers say refusing digital payments can turn away customers.

Global Macro

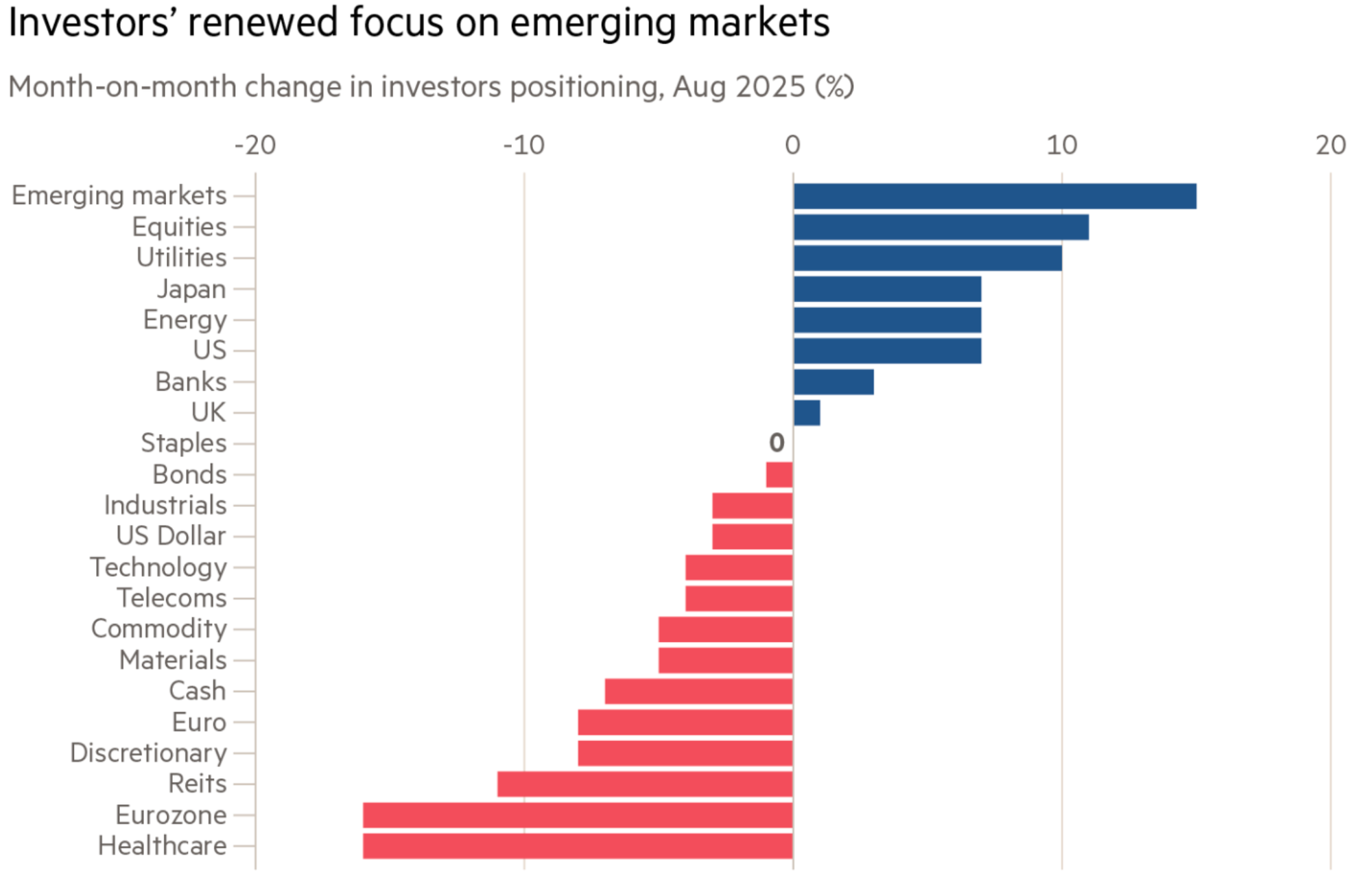

Emerging markets benefit from nervousness in developed markets

Emerging markets are drawing renewed investor interest as large economies struggle with debt and political interference in monetary policy, the FT reports.

The US is core to their concerns, in part because of President Donald Trump’s dismissal of the US labor statistics chief and open pressure on the central bank. Investors are now reassessing reliance on US assets and shifting capital toward higher-yielding EM debt and equities.

The macro case is compelling: EMs boast stronger demographics, cheaper valuations, and in many cases, tighter fiscal discipline after years of crisis. Real yields remain far higher than in the US, with Brazil offering nearly 10% versus 2% in the US. Current account balances are healthier, and many EM currencies look undervalued. Flows into EM debt and equities have accelerated to multi-year highs.

Latin American and EMEA equities are already outperforming global peers, with MSCI LatAm up more than 30% year-to-date. If the dollar’s decline continues, investors may finally reward EM fundamentals after a decade of neglect, making this rotation more durable than prior rallies.

What We’re Reading

Nigeria’s Tinubu visits Brazil to deepen economic ties (Semafor)

Kenya Airways looks to raise $500mn after posting $94mn half-year loss (Reuters)

Ethiopia’s Ethio Telecom projects a 45.5% increase in revenue in a year (Reuters)

Uganda looks to AI and robotics training to drive GDP growth (Monitor)

Gates-and-Bezos-backed KoBold Metals receives seven lithium permits in DRC (Reuters)

Zanzibar to spend $400 million on transformation of port infrastructure (The Citizen)

Mauritius to sell a minority stake in national airline to support tourism (Bloomberg)

China pours exports into Africa faster than anywhere else (Bloomberg)

Moody’s to increase ownership in MERIS Ratings, deepening presence in the Middle East and Africa (Moody’s)

Thai court dismisses prime minister over call with Cambodia’s Hun Sen (FT)

Protests erupt in Indonesia over privileges for parliament members (The Guardian)

New Indonesian sovereign wealth fund to sell $3.1bn in ‘patriot bonds’ (Jakarta Post)

Kazakhstan takes oil majors to task for $4.4bn (Reuters)

Iraq faces water crisis amid one of worst droughts in a century (Al Jazeera)

EU gives Jordan €500m to support economic reforms (AGBI)

Poland presses ahead with 3% digital tax despite Trump threat (Politico)

Former labor union leader elected as Lithuania’s new prime minister (AP)

Ukraine’s Zelenskyy urges Global South to pressure Russia to end war (Al Jazeera)

Ukraine to allow young men to leave the country (FT)

Bolivia right-wing candidate pledges to scrap lithium deals with China and Russia (France24)

Runoff contender vows to rework Bolivia’s $14bn debt (Bloomberg)

South American bloc Mercosur to resume free-trade talks with Canada (Reuters)

We are committed to providing FMN readers with a free weekly digest of politically unbiased, succinct and clear news and information from frontier and small emerging markets.

Please consider becoming a paid supporter to help cover some of our costs and support our continued development of sharp markets-focused coverage and new informational products. Paid subscribers will also gain exclusive access to our quarterly EM/FM report that aggregates EM insights from 25 major banks, international institutions and consultancies.