🌍 Frontier Markets News, August 16th 2025

A weekly review of key news from global growth markets

Africa

Nigeria targets 7% GDP growth

Nigeria’s President Bola Tinubu has set an ambitious 7% annual economic growth target in an effort to tackle poverty and quadruple the size of his country’s economy by the end of the decade, Africanews reports. Raising the target from his previous goal of 6%, Tinubu urged his government to focus on increasing public investment to power economic growth.

One source of growth for the country could come from oil sales to India, which agreed to buy more than two million barrels of Nigerian crude. New Delhi is under intense political pressure from the US to reduce its purchases of Russian oil. The deal also helps Nigeria break into selling to a geographic region that has traditionally been dominated by Middle Eastern producers.

Also this week, Nigeria’s government approved a phased plan to refinance some $2.6 billion debt owed to electricity companies. The money is mostly owed to 27 power generation companies, and has put a damper on investment to help grow the industry.

Kenya looks to reestablish IMF program

Kenya has its sights set on getting a new funded IMF program, Reuters reports, after reported failures to meet the terms of a previous deal prompted the multilateral to prematurely scrap the program. The IMF canceled a final review of Kenya’s last support program in March, citing time limitations, and leaving $800 million of the country’s $3.6 billion Extended Fund Facility and Extended Credit Facility undisbursed.

Kenya has faced fiscal deficit and revenue collection challenges this year—two main areas it aims to focus on with the IMF. Planned tax increases this year were abandoned after they were met with fierce public protest.

Negotiating a new program with “realistic” goals gives Kenya the opportunity to set new targets and strategies, a Kenyan government spokesperson said when announcing the talks earlier this year. The government also said it was working on improving efficiency, with measures such as lowering the costs of public participation in development projects.

Egypt recruits Chinese firm to boost auto-sector manufacturing

Egypt this week announced a $1 billion deal with China’s Sailun Group to build a tire manufacturing facility in the Suez Canal Zone, Business Insider Africa reports. The plant, which is expected to produce 10 million tires annually, will be built in three phases, with the first completed by 2026.

Egypt’s government hopes the deal will support its aim to both localize production and fortify its regional manufacturing presence, as setting the country up to be a regional export hub for Africa, the Middle East, and Europe.

Earlier this year Japan’s Sumitomo opened a new $100 million automotive wiring harness facility in Egypt, which is expected to create some 10,000 jobs and function as a supply hub for European auto firms. In 2023, BWM began manufacturing cars in Egypt for the first time.

Asia

Moody’s upgrades Pakistan debt

Ratings firm Moody’s raised its credit rating for Pakistan to Caa1 on Wednesday, citing the country’s improved finances and progress under its arrangement with the IMF. The upgrade followed similar moves by Fitch and S&P earlier this year, although Pakistan remains deep in junk territory.

The ratings reflect growing investor confidence in the country, which has made efforts to cozy up to the US President Donald Trump. Earlier this year Pakistan nominated Trump for the Nobel Peace Prize and proposed cooperation with the US in areas such as digital assets and critical minerals. However, analysts are skeptical the charm offensive will yield results, the New York Times reports.

US Secretary of State Marco Rubio seems to disagree. In a statement celebrating Pakistan’s independence day on Wednesday, he said the US looked forward to “fostering dynamic business partnerships” with Pakistan, highlighting critical minerals and hydrocarbons as two new areas of economic cooperation.

Myanmar top general calls for increased security ahead of election

The head of Myanmar’s ruling military junta this week requested heightened protection for candidates in upcoming elections, state-run outlet Global New Light of Myanmar reports. Independent analysts expect the vote, scheduled for this winter, to deliver a stage-managed victory to military-backed parties.

- UN accuses Myanmar security forces of systematic torture (UN News)

- Myanmar signs deal with Washington lobbyists to rebuild US relations (Reuters)

Whether the military will be able to govern is another question. Large swaths of Myanmar are run by rebel groups, who increasingly control the country’s vast natural resources. Rare earth mining in particular has surged in rebel-controlled Shan and Kachin states, Al Jazeera reports.

Sales from mining largely go to China, which dominates rare earths processing. But China has supported Myanmar’s ruling junta, putting sales by rebel groups at risk. Beijing has recently flexed that leverage, issuing an ultimatum to rebels in Kachin that it will quit purchasing rare earths unless they stop fighting the country’s military, Nikkei reports.

Turkish firm signs $6.3bn in agreements to build hydro plants in Kyrgyzstan

A subsidiary of one of Turkey’s largest conglomerates has signed two deals to invest $6.3 billion in hydroelectric power plants in Kyrgyzstan, Daily Sabah reports. Additional investment could bring the total to $10 billion, according to the Times of Central Asia.

- Pakistani investors pour into Kyrgyzstan (Times of Central Asia)

The investment will be made by Orta Asya Yatırım Holding, whose parent firm Ihlas Holding controls a portfolio that spans from newspapers to construction companies. Under the arrangements with Kyrgyzstan, the subsidiary will build and finance six hydroelectric power plants with a total capacity of more than 2,200 MW, and operate them for 20 years.

Middle East

Saudi Arabia turning to renewables to reduce oil consumption

Saudi Arabia’s government is increasingly turning to renewable energy to reduce its reliance on oil and free-up production for exports, Bloomberg reports. The country hopes to bring on line 130 gigawatts of renewable power by 2030, effectively ending its dependence on oil-fired generators, which are currently responsible for between a quarter to a third of its energy generation.

Saudi Arabia’s leadership, which is concerned about falling revenues and rising debt levels, is hoping bringing down its domestic oil consumption will enable it to export more without having to invest in drilling new wells.

ACWA Power, the partly state-owned energy company, has since 2024 commenced operations at four solar facilities with total capacity of some 4.9 gigawatts, and is expected to double that by next year. Last month, ACWA signed deals to build an additional 15 GW of solar capacity by mid-2028.

Syria tightens links with regional partners

This week, Syria’s transitional government signed some $14 billion in investment deals with regional partners Saudi Arabia, Qatar and UAE, mostly centered on rebuilding and improving war-damaged transportation and trade infrastructure, and housing, AP reports.

The deals, which include a $4 billion commitment from Qatari UCC Holding to expand Damascus International Airport and a $2 billion agreement with the UAE’s National Investment Corporation for a new subway system in the capital, are the biggest since the US lifted sanctions in July.

Turkey, a longtime supporter of president Ahmed al-Sharaa since before the fall of the Assad regime, formalized a security cooperation accord with the new government this week, Reuters reports. The agreement will see Turkey support the reconstruction of the Syrian army by providing weapons and training, but falls short of an explicit commitment to guarantee Syria’s territorial integrity.

Europe

Slovakia power struggle threatens budget disruption

A bitter power struggle over the top job at Slovakia’s central bank is complicating efforts to close one of the eurozone’s largest budget deficits, Politico reports. Prime Minister Robert Fico is pushing to replace National Bank Governor Peter Kažimír with finance minister Ladislav Kamenický, but Kažimír, backed by President Peter Pellegrini and the ruling coalition partner Hlas, has refused to step down.

The standoff comes ahead of critical autumn talks on fiscal consolidation needed to avoid EU sanctions and reassure markets.

Kažimír, who is currently appealing a recent bribery conviction, has a legal mandate that allows him to remain in office until a successor is appointed, giving Hlas leverage to block Fico’s choice and insist on its own nominee.

Analysts say the deadlock could persist until after next year’s budget is approved, and without a deal to resolve it, it is likely to further damage the central bank’s reputation.

China cuts ties with Czech president

China has suspended all engagement with Czech President Petr Pavel after he attended a private meeting with the Dalai Lama in India, EuroNews reports. Pavel met the exiled Tibetan leader last month to mark his 90th birthday, a move Beijing said “seriously contravenes” prior agreements and prompted “serious protests” from the Chinese foreign ministry.

The Czech presidential office said Pavel attended in a personal capacity after a trip to Japan and was not accompanied by officials.

Relations between Beijing and Prague have soured in recent years, notably after Pavel’s 2023 phone call with Taiwan’s then-president Tsai Ing-wen. The largely ceremonial Czech presidency holds symbolic weight in foreign affairs, with former president Václav Havel known for his ties to the Dalai Lama. China views both Tibet and Taiwan as part of its territory and has long opposed foreign leaders’ contacts with either.

Latin America

Argentina’s FX reforms spur rise in defaults

Argentine President Javier Milei’s austerity program and currency reforms have steadied the country’s currency but are squeezing companies already under financial strain, Bloomberg reports. Spending cuts have dampened domestic demand, while a stronger peso has made exports less competitive.

At the same time, the removal of most currency controls has upended corporate financing, pushing borrowing costs sharply higher and contributing to the highest rate of corporate defaults since the pandemic. Over half a dozen firms, including utility Grupo Albanesi, have missed payments or entered restructuring talks this year.

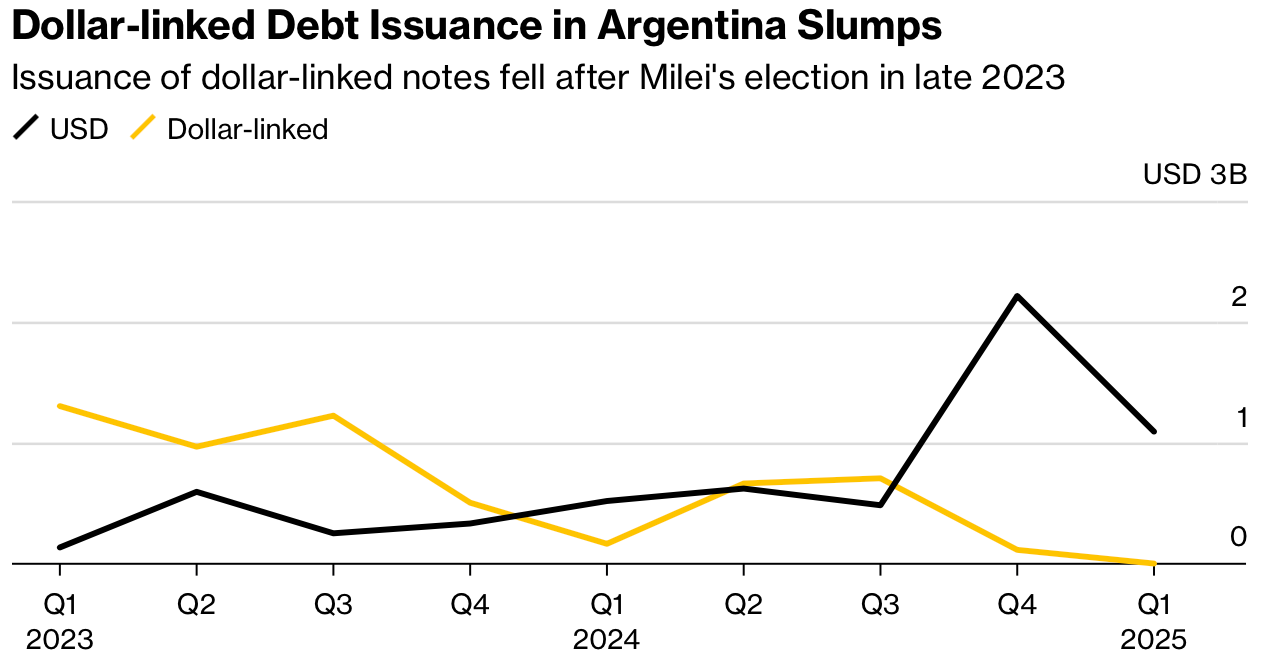

Before the reforms, many companies relied on “dollar-linked” bonds, which allowed them to borrow in local pesos but have repayments tied to the US dollar. This structure offered cheap funding because investors used it to hedge against inflation and currency depreciation. With exchange-rate volatility reduced, investor demand for these bonds has collapsed: Sales plunged to $2 million in the first quarter from $165 million a year earlier.

Ecuador’s IMF-inspired reform program crimps government revenues

Ecuador is pushing through fiscal reforms—including tax increases and cuts in subsidies—to meet IMF targets, but falling oil income, rising costs and expensive borrowing are squeezing public finances, FrontierView reports. The fiscal deficit could reach $5 billion this year, up from $3.4 billion in 2024, as temporary tax measures expire and oil production slows.

The finance ministry will present revised budgets in August and November, but with the country facing high borrowing costs and running up nearly $1 billion in arrears to suppliers there are increasing concerns over President Daniel Noboa’s ability to balance the books.

Analysts are concerned that a tighter government budget could delay payments, cut procurement and reduce infrastructure spending. Lower transfers to municipalities might also slow local tender issuance, adding uncertainty for suppliers.

Analysis

Lack of consensus on global economy raises risks

The global economy may be more exposed to a potential shock than at any point in recent years, not because of obvious weakness but because no one agrees on how resilient it is. Conflicting assessments from the institutions that set the tone for investors leave markets without a clear reference point.

The uncertainty could magnify the damage from a downturn—or it could fuel a faster-than-expected surge if fading fears of recession give way to renewed confidence.

Fitch Ratings last month downgraded its sovereign outlook for Asia-Pacific, Eastern Europe, and sub-Saharan Africa to “deteriorating,” citing fragile trade flows and the drag from new US tariffs. The IMF has moved in the opposite direction, lifting its 2025 global growth forecast to 3.0% on the back of a weaker dollar, smaller-than-feared tariff impacts, and front-loaded imports.

For investors, the gap between Fitch’s emphasis on vulnerability and the IMF’s focus on resilience leaves risk assessment unusually subjective.

Central banks are adding to the noise. ING analysts note that rate-cutting cycles have already begun in several emerging markets, even as the US Federal Reserve and other major advanced-economy central banks keep policy tight over inflation concerns. Trade bodies offer little to bridge the divide. The IMF has welcomed recent agreements but admits most lack the detail to ease short-term uncertainty, while the WTO warns that shifting tariffs and unresolved disputes could weigh on flows into 2026.

What We’re Reading

Bank of Ghana urges country’s banks to lean into private sector lending (Bloomberg)

Morocco banks on US investors for $26bn gas pipeline to Nigeria (The Africa Report)

TotalEnergies, Oando, Conoil hit as Nigeria’s Dangote dominates petrol market (The Africa Report)

Zimbabwe’s laboratories racing to keep up with surging gold exploration (Reuters)

Azule Energy seeks Angola’s untapped gas potential, adds second exploration project (Reuters)

African banks see artificial intelligence and cloud computing as top efficiency priority (African Banker)

Vietnamese farmers displaced to clear way for US president’s golf resort (Reuters)

Indonesia signs free-trade deal with Peru (Jakarta Post)

New Indonesia sovereign wealth fund to finance doubling of struggling state airline’s fleet (Nikkei)

Kazakhstan begins construction on first nuclear plant with help from Russian engineers (The Diplomat)

Pacific islands ice out US and China ahead of upcoming meeting (Reuters)

Oman picks Chinese firm for hydrogen plants (Semafor)

GCC offers Lebanon investment, grant support if Hezbollah disarms (Semafor)

Larijani’s Middle East tour reveals Iran’s struggle to maintain regional influence (Iranwire)

France, Germany and UK willing to reimpose sanctions on Iran over nuclear programme (BBC)

Saudi Arabia’s PIF makes $8bn writedown on value of flagship megaprojects (FT)

Iran and Russia stand to lose from US deal with Azerbaijan and Armenia (The Guardian)

Why Russia is building a $25bn nuclear power plant in Turkey (WSJ)

Romania seeks to expand Black Sea task force with Turkey and Bulgaria (Reuters)

Romanian premier vows deeper spending cuts to avoid default risk (Bloomberg)

Orbán’s rival accuses Russia of election meddling in Hungary (Bloomberg)

Serbia protests turn violent as president clings to power (FT)

Poland’s new president bumps Tusk from Trump call on Ukraine (Politico)

Costa Rica to start building massive El Salvador-inspired prison (Reuters)

Venezuela Rejects Start of Exxon Operations in Disputed Area (Bloomberg)

Border incidents escalate diplomatic crisis between Colombia and Peru (Mercopress)

Paraguay eyes Chinese parts assembly plan amid US tariff war with China, Brazil (South China Morning Post)

Razor-thin race will test Milei’s popularity in Argentina’s midterms (Reuters)

Global economic headwinds continue denting growth forecasts for major LatAm countries (FrontierView)

We are committed to providing FMN readers with a free weekly digest of politically unbiased, succinct and clear news and information from frontier and small emerging markets.

Please consider becoming a paid supporter to help cover some of our costs and support our continued development of sharp markets-focused coverage and new informational products. Paid subscribers will also gain exclusive access to our quarterly EM/FM report that aggregates EM insights from 25 major banks, international institutions and consultancies.